Get the free 2001 Instructions for Form 1099, 1098, 5498, and W-2G

Show details

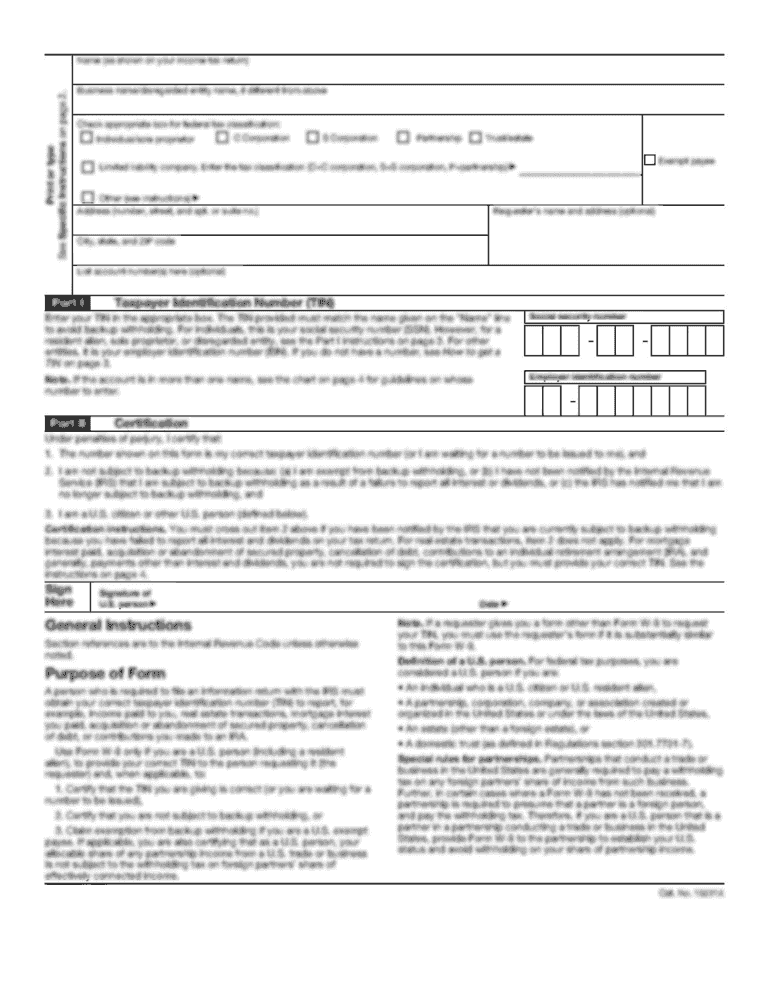

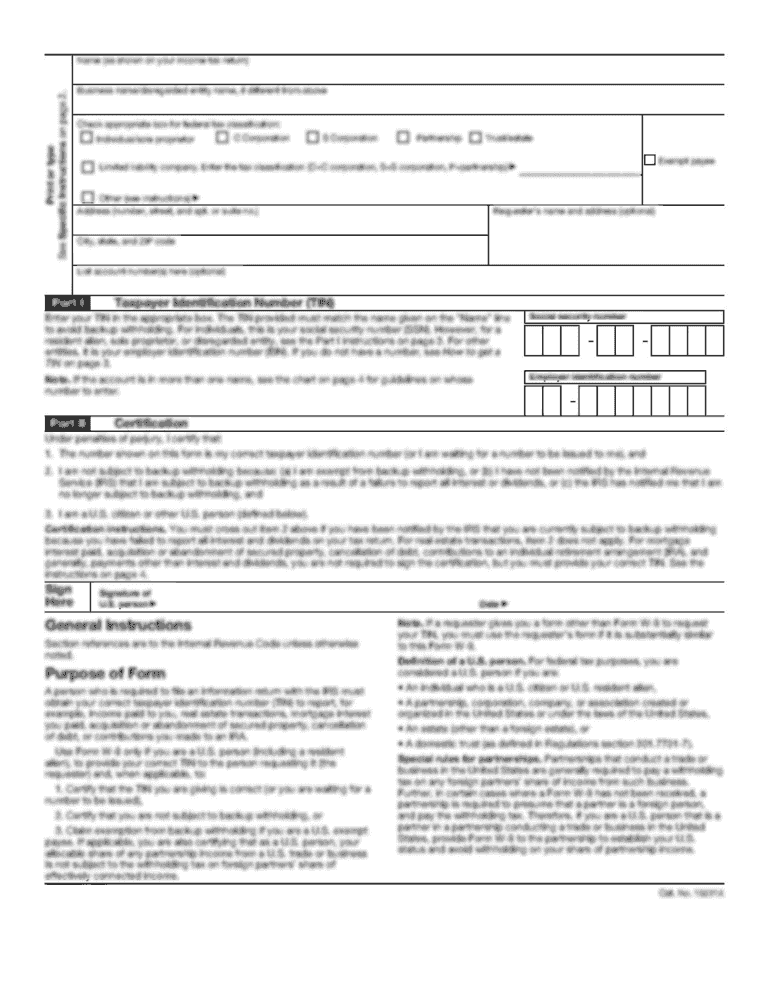

2001 General Instructions for Forms 1099, 1098, 5498, and W-2G Section references are to the Internal Revenue Code. Department of the Treasury Internal Revenue Service What's New for 2001? Forms 1098-E

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2001 instructions for form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2001 instructions for form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2001 instructions for form online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2001 instructions for form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

How to fill out 2001 instructions for form

How to fill out 2001 instructions for form:

01

Start by carefully reading the instructions provided. It is important to understand the requirements and guidelines before proceeding.

02

Gather all the necessary information and documents that are required to fill out the form. This may include personal identification, financial records, or any other relevant information.

03

Begin filling out the form by following the given sections and fields. Ensure that you provide accurate and up-to-date information.

04

Pay close attention to any specific instructions or special requirements mentioned in the form instructions. This may include providing additional supporting documents or signatures.

05

Double-check your entries to ensure that there are no errors or mistakes. It is recommended to review your form before submitting it.

06

If you are unsure about any section or have any questions, reach out to the appropriate authority or consult the provided contact information for clarification.

07

Once you have completed all the required fields and reviewed your form, submit it according to the instructions provided. This can be done by mail, online submission, or any other specified method.

Who needs 2001 instructions for form:

01

Individuals who are required to fill out the specific form outlined in the 2001 instructions. This may include taxpayers, job applicants, students, or any other individuals who fall under the relevant category.

02

Professionals or organizations that assist others in filling out forms, such as accountants, lawyers, or consultants, may refer to the 2001 instructions to provide accurate guidance to their clients.

03

Government agencies or departments that manage the form or require the information provided in the form may use the 2001 instructions as a reference for processing and evaluating the submitted forms.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is instructions for form 1099?

Instructions for form 1099 provide guidance on how to fill out and file the form accurately.

Who is required to file instructions for form 1099?

Any person or entity who made certain types of payments during the tax year is required to file instructions for form 1099. This includes businesses, employers, and financial institutions.

How to fill out instructions for form 1099?

To fill out instructions for form 1099, you will need to provide information about the payer, recipient, payment amounts, and payment type. The specific instructions can be found in the IRS guidelines for form 1099.

What is the purpose of instructions for form 1099?

The purpose of instructions for form 1099 is to ensure that payments made by businesses and other entities are properly reported to the IRS and recipients. This helps the IRS track income and ensure compliance with tax laws.

What information must be reported on instructions for form 1099?

Instructions for form 1099 require reporting of information such as the payer's name, address, and taxpayer identification number, the recipient's name, address, and taxpayer identification number, the amount paid, and the type of income or payment.

When is the deadline to file instructions for form 1099 in 2023?

The deadline to file instructions for form 1099 in 2023 is January 31st, 2024.

What is the penalty for the late filing of instructions for form 1099?

The penalty for the late filing of instructions for form 1099 varies depending on the delay. The penalty ranges from $50 to $280 per form, depending on how late the form is filed.

How can I modify 2001 instructions for form without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including 2001 instructions for form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I execute 2001 instructions for form online?

Easy online 2001 instructions for form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make edits in 2001 instructions for form without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit 2001 instructions for form and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Fill out your 2001 instructions for form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.