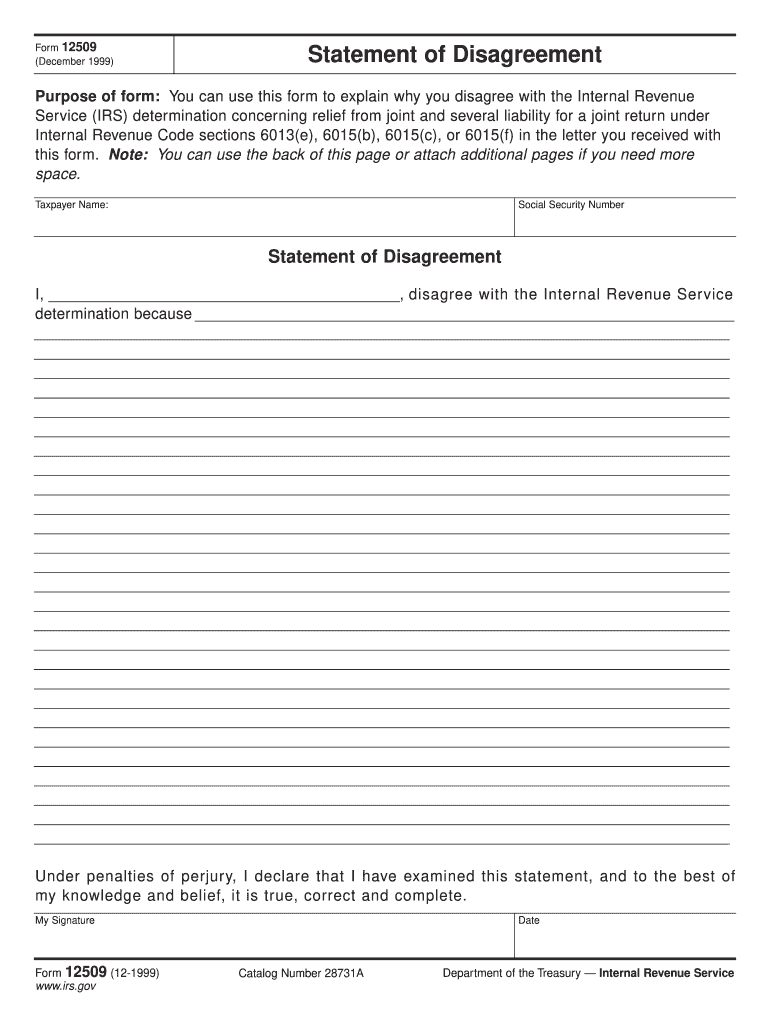

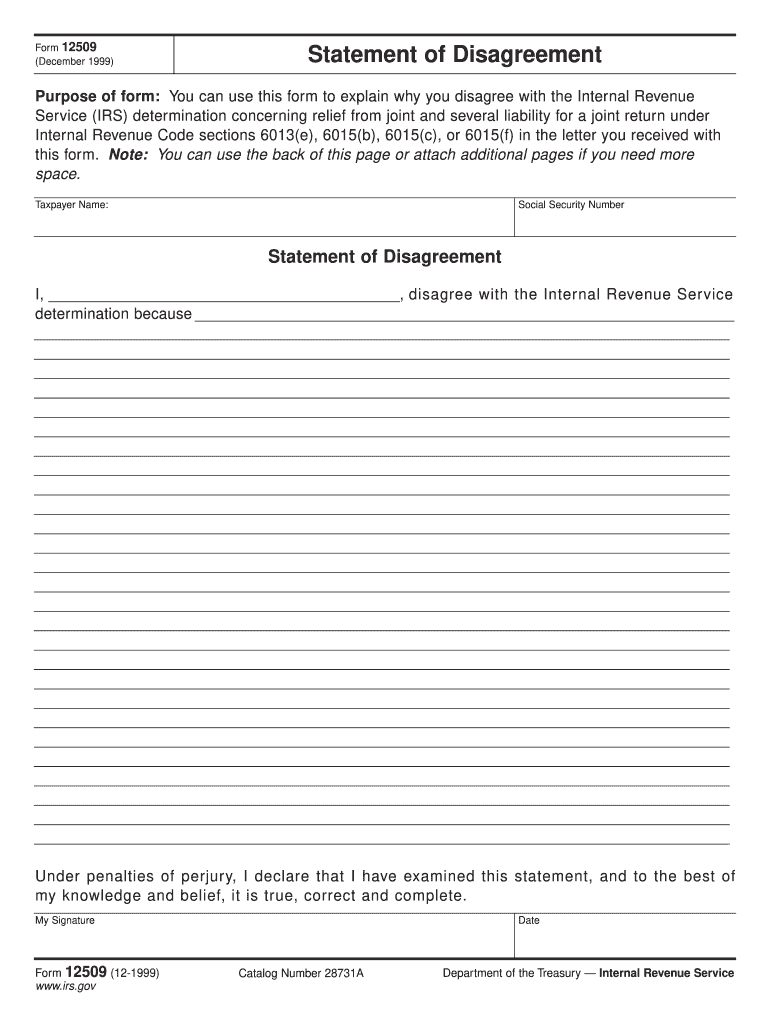

IRS 12509 1999 free printable template

Get, Create, Make and Sign

Editing irs form 12509 1999 online

IRS 12509 Form Versions

How to fill out irs form 12509 1999

How to fill out IRS Form 12509 1999:

Who needs IRS Form 12509 1999:

Instructions and Help about irs form 12509 1999

Hi guys its Michelle knight from little miss bookkeeping, and today I wanted to run through a form you might already be familiar with and that is how to complete your super form or your standard choice uh superannuation standard choice form, so it looks something like this it's something that you complete when you start a new job and as an accountant I do see these get completed incorrectly, so I thought it would be a good idea to just quickly run through um some details so if you're interested in learning more please keep watching [Applause] okay, so typically you will complete your uh super form when you commence um a new job, and you will generally be given this at the same time as your ten declaration, so I've created another video going through this um little baby um but an in your employer will give you these forms together, so you'll complete these both at the same time the reason why you will complete this form is so your employer can pay super into the right super fund now there are all different types of super funds different industry funds self-management for...

Fill form : Try Risk Free

People Also Ask about irs form 12509 1999

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your irs form 12509 1999 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.