Get the free Publication 1SP (Rev. August 2000 )

Show details

IRS Department of the Treasury Internal Revenue Service Searches Del Contribute En la primer part de ESTA publican n SE explicit albinos de Los searches m s import antes Que used Taine Como contribute.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your publication 1sp rev august form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your publication 1sp rev august form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit publication 1sp rev august online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit publication 1sp rev august. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

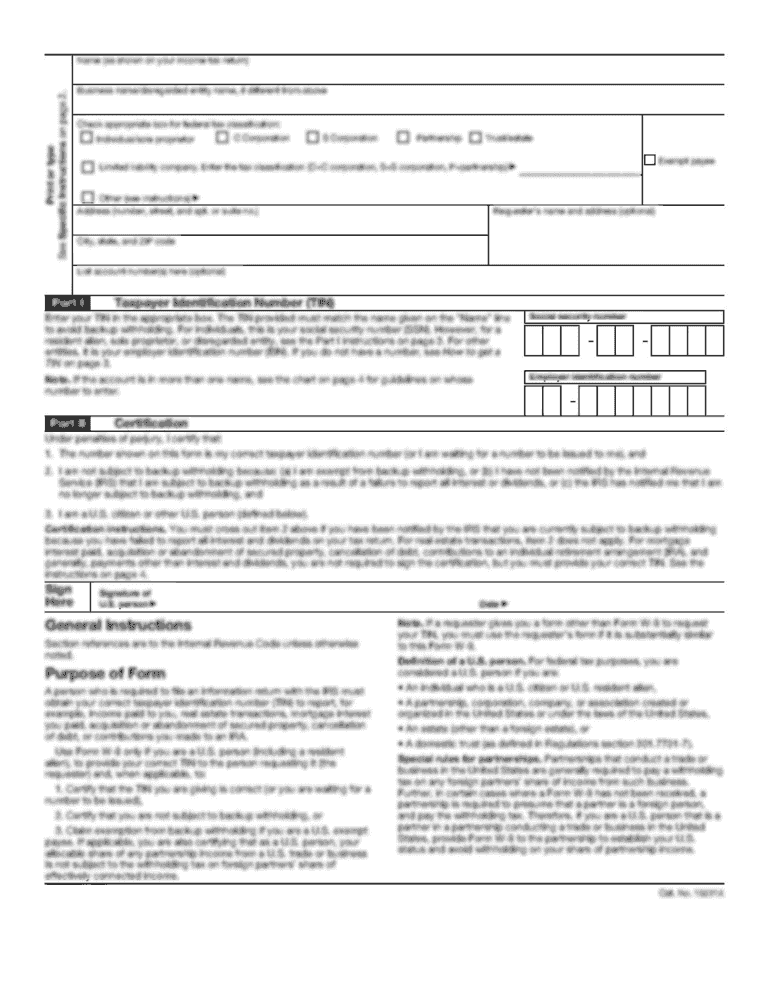

How to fill out publication 1sp rev august

01

To fill out publication 1sp rev august, you need to start by carefully reading through the instructions provided in the document.

02

Next, gather all the necessary information required to complete the publication. This may include personal details, dates, and any relevant supporting documents.

03

Make sure to follow the specified format and guidelines while entering the information into the appropriate fields or sections of the publication.

04

Review the completed publication to ensure accuracy and completeness before submitting it.

05

It is important to note that the specific individuals or organizations who need publication 1sp rev august may vary depending on the nature of the publication and its intended purpose. It could be individuals seeking to file official documentation, organizations dealing with legal or administrative procedures, or anyone else who requires the information provided in the publication.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

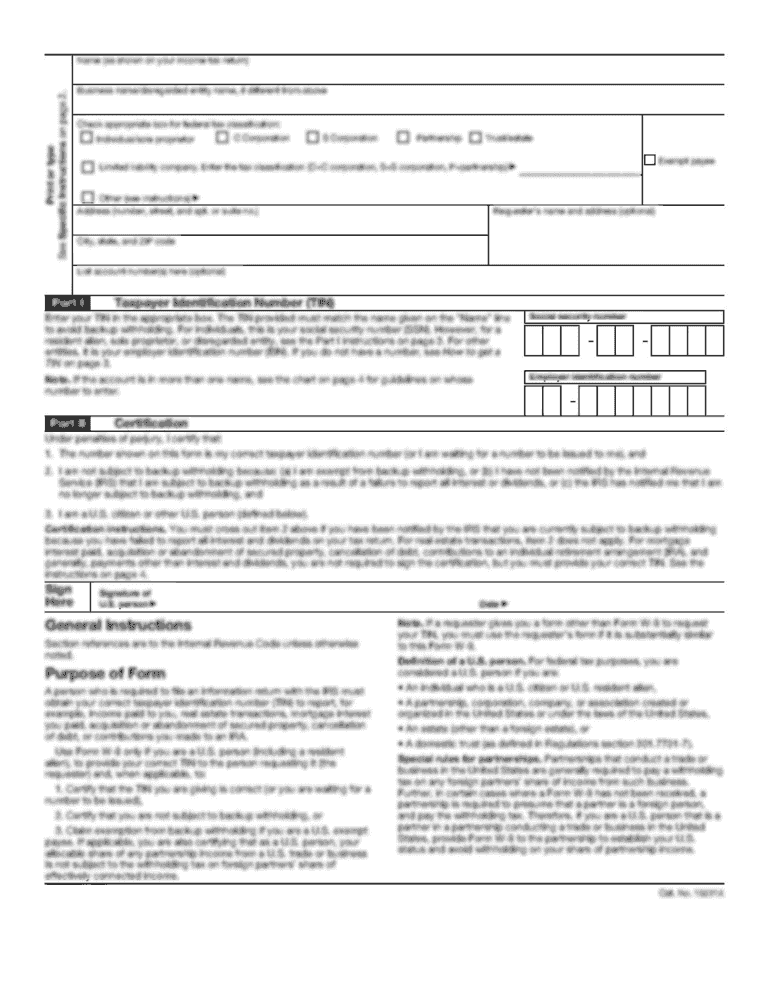

What is publication 1sp rev august?

Publication 1sp rev august is a form issued by the Internal Revenue Service (IRS) that provides instructions and guidance for individuals who are taxpayers with specific filing requirements.

Who is required to file publication 1sp rev august?

Publication 1sp rev august is specifically for individuals who have to file a tax return and have certain special filing considerations, such as being in a specific tax situation.

How to fill out publication 1sp rev august?

Filling out publication 1sp rev august involves following the instructions provided by the IRS. The form will require you to provide detailed information about your income, deductions, and any other relevant tax information.

What is the purpose of publication 1sp rev august?

The purpose of publication 1sp rev august is to help taxpayers who have special filing considerations to understand their filing requirements and to ensure they fill out their tax return accurately and correctly.

What information must be reported on publication 1sp rev august?

Publication 1sp rev august will require you to report your income, deductions, credits, and any other relevant tax information that applies to your specific tax situation.

When is the deadline to file publication 1sp rev august in 2023?

The specific deadline for filing publication 1sp rev august in 2023 will be determined by the IRS and can vary. It is important to check the IRS website or consult a tax professional to get the most accurate and up-to-date deadline information.

What is the penalty for the late filing of publication 1sp rev august?

The penalty for late filing of publication 1sp rev august can vary depending on the specific circumstances. It is best to consult the IRS website or speak with a tax professional to understand the penalties that may apply to your situation.

How can I send publication 1sp rev august for eSignature?

When you're ready to share your publication 1sp rev august, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit publication 1sp rev august straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing publication 1sp rev august, you need to install and log in to the app.

How do I fill out publication 1sp rev august on an Android device?

Complete publication 1sp rev august and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your publication 1sp rev august online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.