Get the free 2007 Form 4684 (Fill-In Capable)

Show details

Form 4684 Department of the Treasury Internal Revenue Service OMB No. 1545-0177 Casualties and Thefts 1998 See separate instructions. Attach to your tax return. Use a separate Form 4684 for each different

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2007 form 4684 fill-in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2007 form 4684 fill-in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2007 form 4684 fill-in online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2007 form 4684 fill-in. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

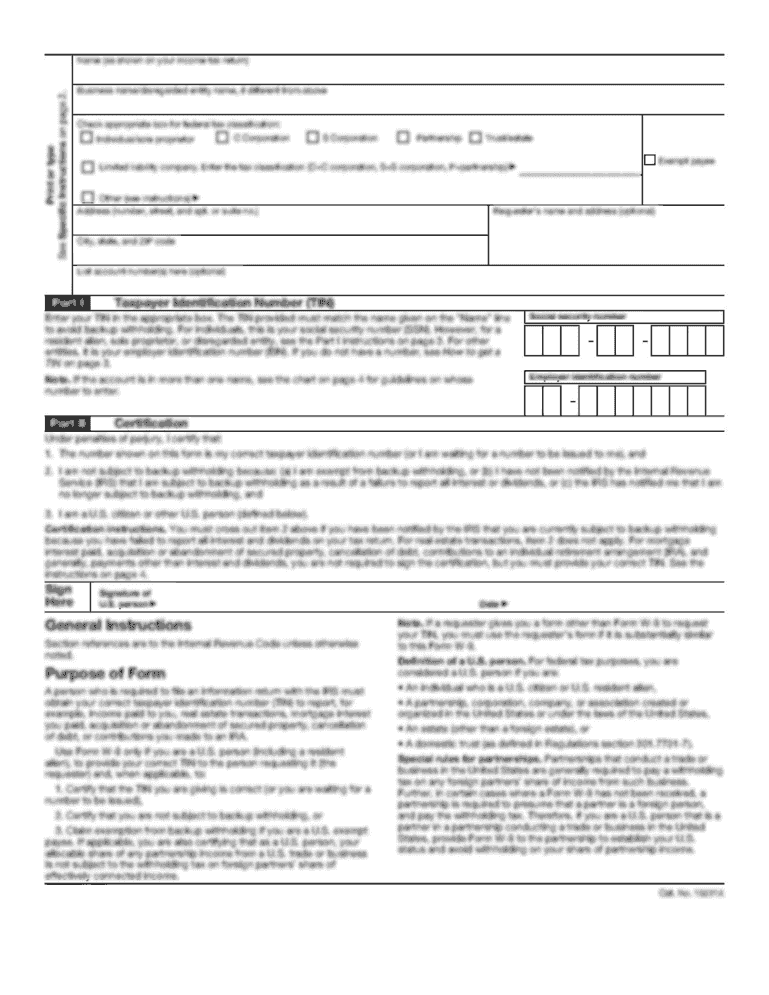

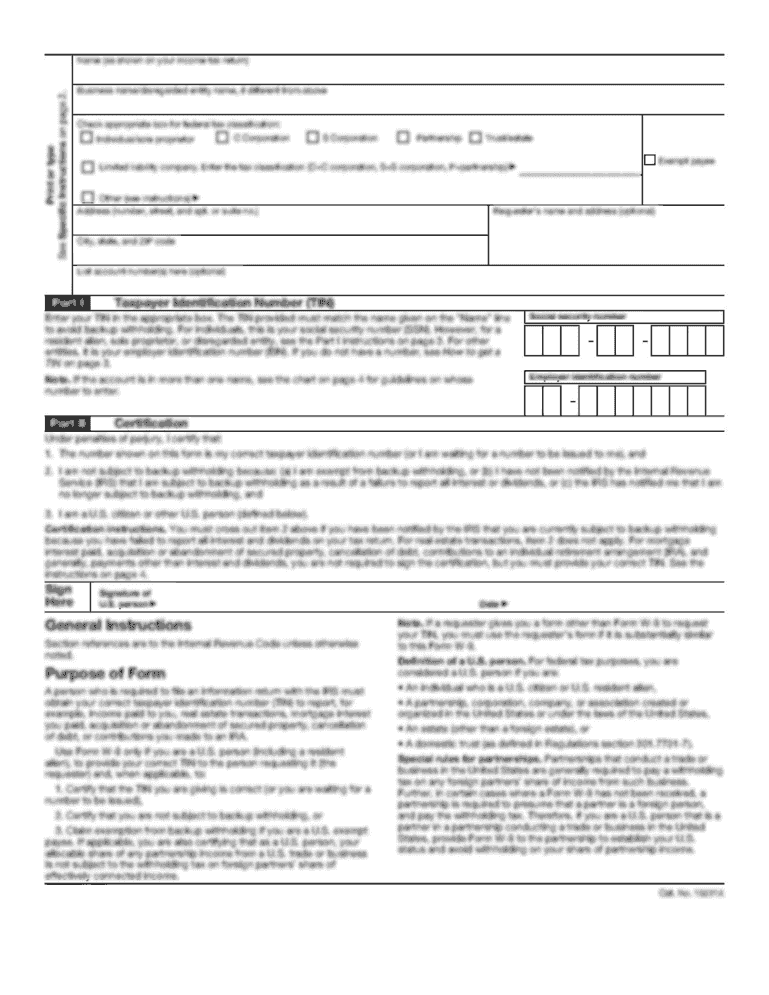

How to fill out 2007 form 4684 fill-in

How to fill out 2007 form 4684 fill-in?

01

First, obtain a copy of the 2007 form 4684 fill-in from the Internal Revenue Service (IRS) website or your local IRS office.

02

Read the instructions provided with the form carefully to familiarize yourself with the requirements and guidelines for filling out the form.

03

Start by entering your personal information in the top section of the form, including your name, address, and social security number.

04

Proceed to the income section and report any income related to the casualty or theft event that you are claiming on the form.

05

In the next section, provide a detailed description of the casualty or theft event, including the type of property involved, the date of the event, and any other pertinent information.

06

If you have insurance coverage for the loss, report the amount of reimbursement received in the appropriate section.

07

Calculate your casualty or theft loss by subtracting any insurance reimbursement from the total loss amount. Enter this result in the designated line of the form.

08

Complete the remaining sections of the form, such as the computation of the gain or loss, if applicable, and any additional information required.

09

Double-check all the information entered on the form for accuracy and make sure you have attached any necessary supporting documents.

10

Sign and date the form, and mail it to the IRS address provided in the instructions.

Who needs 2007 form 4684 fill-in?

01

Individuals who have experienced a casualty or theft event in the year 2007 and want to claim a deduction for the resulting loss on their federal income tax return.

02

Taxpayers who need to report details of the casualty or theft event, including the type of property involved, the amount of loss, and any insurance reimbursements received.

03

Individuals who meet the specific eligibility criteria outlined by the IRS for claiming casualty and theft losses on their tax returns for the year 2007.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 4684 fill-in capable?

Form 4684 fill-in capable is an IRS form used to report gains and losses from casualties and thefts that are not covered by insurance or other reimbursement.

Who is required to file form 4684 fill-in capable?

Individuals, partnerships, corporations, and trusts that have experienced casualties or thefts resulting in a gain or loss and meet certain criteria are required to file form 4684 fill-in capable.

How to fill out form 4684 fill-in capable?

To fill out form 4684 fill-in capable, you need to provide your personal information, details about the casualty or theft, the amount of loss, and any other relevant information as per the instructions provided by the IRS.

What is the purpose of form 4684 fill-in capable?

The purpose of form 4684 fill-in capable is to report and calculate the amount of gain or loss from casualties and thefts that are not covered by insurance or other reimbursement.

What information must be reported on form 4684 fill-in capable?

Information that must be reported on form 4684 fill-in capable includes personal information, details about the casualty or theft, the amount of loss, and any other relevant information as per the instructions provided by the IRS.

When is the deadline to file form 4684 fill-in capable in 2023?

The deadline to file form 4684 fill-in capable in 2023 is usually April 17th, 2023. However, it is always recommended to refer to the official IRS website or consult a tax professional for the most up-to-date information.

What is the penalty for the late filing of form 4684 fill-in capable?

The penalty for the late filing of form 4684 fill-in capable depends on various factors and can vary. It is best to refer to the official IRS guidelines or consult a tax professional to understand the specific penalty for late filing.

How can I get 2007 form 4684 fill-in?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific 2007 form 4684 fill-in and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit 2007 form 4684 fill-in on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as 2007 form 4684 fill-in. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I fill out 2007 form 4684 fill-in on an Android device?

Complete 2007 form 4684 fill-in and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your 2007 form 4684 fill-in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.