Get the free Tax for Children Under Age 14 Who Have Investment Income of More Than $1,300 - irs

Show details

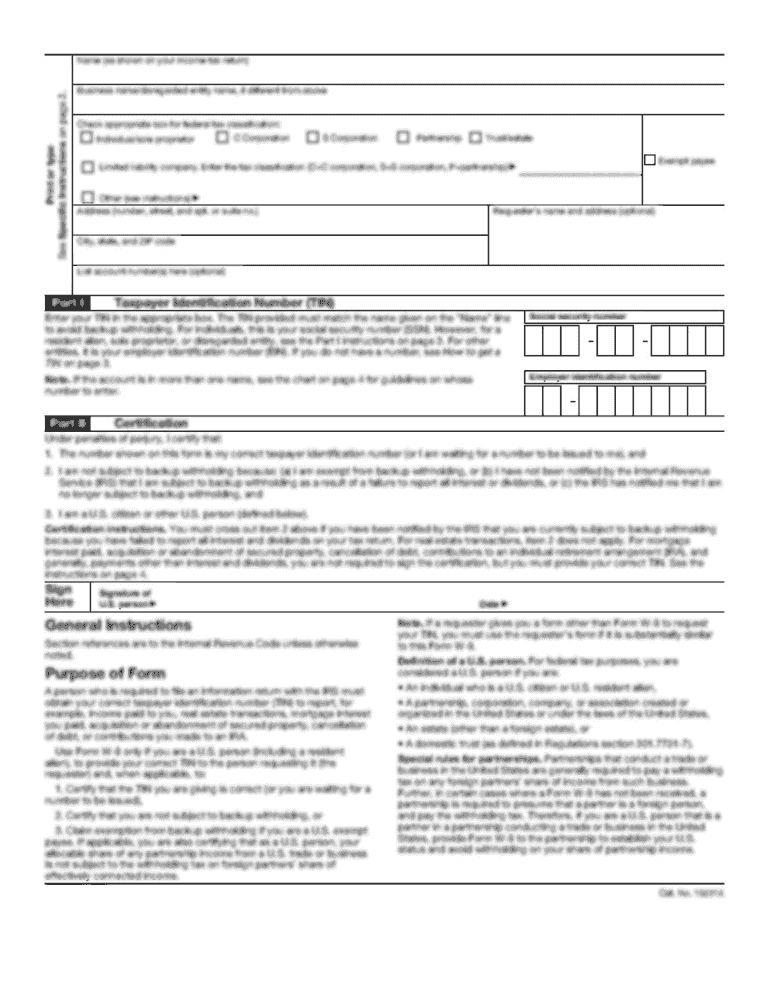

Form 8615 Tax for Children Under Age 14 Who Have Investment Income of More Than $1,300 Attach ONLY to the child's Form 1040, Form 1040A, Form 1040NR, or Form 1040-T. OMB No. 1545-0998 Department of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your tax for children under form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax for children under form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax for children under online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax for children under. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out tax for children under

How to fill out tax for children under?

01

First, gather all necessary documents such as your child's social security number, birth certificate, and any income statements they may have.

02

Determine if your child meets the qualifications for being claimed as a dependent on your tax return. This includes factors such as age, relationship to you, and the amount of financial support you provide for them.

03

If your child meets the qualifications, you will need to fill out the appropriate tax forms when filing your taxes. This typically includes completing the dependent information section on Form 1040 or Form 1040A.

04

Provide accurate information regarding your child's income, if any. This may include income from part-time jobs or investments. If their income exceeds a certain threshold, they may be required to file their own tax return.

05

Consider any tax credits or deductions that may apply to your situation, such as the Child Tax Credit or the Earned Income Tax Credit. These can help lower your overall tax liability.

06

Double-check all the information you have provided to ensure accuracy before submitting your tax return.

Who needs tax for children under?

01

Parents or legal guardians who have children under a certain age and meet the qualifications for claiming them as dependents on their tax returns.

02

Individuals who have children and incur expenses related to their care, such as childcare expenses or medical expenses that may be eligible for certain tax deductions or credits.

03

Anyone who has received income on behalf of a child, such as earnings from a child actor or model, may need to include that income on their tax return.

Overall, the need for tax filing for children under depends on the specific circumstances and qualifications outlined by the tax laws in your jurisdiction. It is recommended to consult with a tax professional or utilize tax preparation software to ensure compliance with the relevant tax regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax for children under?

Tax for children under refers to the tax obligations that apply to individuals under a certain age, typically minors. These children may still be required to report and pay taxes on their income, similar to adults.

Who is required to file tax for children under?

Parents or legal guardians are generally responsible for filing tax returns for children under a certain age. However, the specific requirements may vary depending on the child's income, type of income, and other factors. It is advisable to consult a tax professional or refer to the tax authority's guidelines to determine the exact filing requirements for children under.

How to fill out tax for children under?

Filling out tax forms for children under is similar to filling out tax forms for adults. The parent or legal guardian will need to gather all the necessary financial information, such as income earned by the child, deductions, and credits. They will then need to accurately complete the appropriate tax forms and report the child's income and other relevant information.

What is the purpose of tax for children under?

The purpose of tax for children under is to ensure that minors who have income are contributing their fair share to the government's revenue. This helps maintain the integrity of the tax system and ensures that everyone, regardless of age, is fulfilling their tax obligations.

What information must be reported on tax for children under?

The information that must be reported on tax for children under includes the child's income, such as wages, salary, tips, and investment income. Additionally, any deductions or credits applicable to the child's situation should be reported accurately. It is important to review the specific requirements of the tax authority and consult a tax professional if necessary to ensure compliance.

When is the deadline to file tax for children under in 2023?

The deadline to file tax for children under in 2023 may vary depending on the tax jurisdiction and the child's specific circumstances. It is advisable to check the tax authority's guidelines or consult a tax professional to determine the exact deadline for filing tax returns for children under in 2023.

What is the penalty for the late filing of tax for children under?

The penalty for the late filing of tax for children under may vary depending on the tax jurisdiction and the amount of tax owed. Generally, late filing penalties may include monetary fines or penalties based on a percentage of the tax owed. It is important to adhere to the designated deadlines to avoid incurring any penalties. It is advisable to check the tax authority's guidelines or consult a tax professional for the specific penalties associated with late filing of tax for children under.

How can I edit tax for children under from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including tax for children under, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in tax for children under?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your tax for children under to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I complete tax for children under on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your tax for children under. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your tax for children under online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.