Get the free Form 5309 - IRS - irs

Show details

Attach Form 5309 to Form 5300 or 5303 whichever applies. The plan you establish must be designed to invest primarily in employer securities. Signature For Paperwork Reduction Act Notice see back of form. Title Date Cat. No. 11835F Rev. 1-94 Form 5309 Rev. 1-94 Paperwork Reduction Act Notice. What To File To receive a determination on whether a plan initially or as a result of a plan amendment meets the requirements of section 409 or 4975 e 7 subm...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 5309 - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 5309 - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 5309 - irs online

To use the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 5309 - irs. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

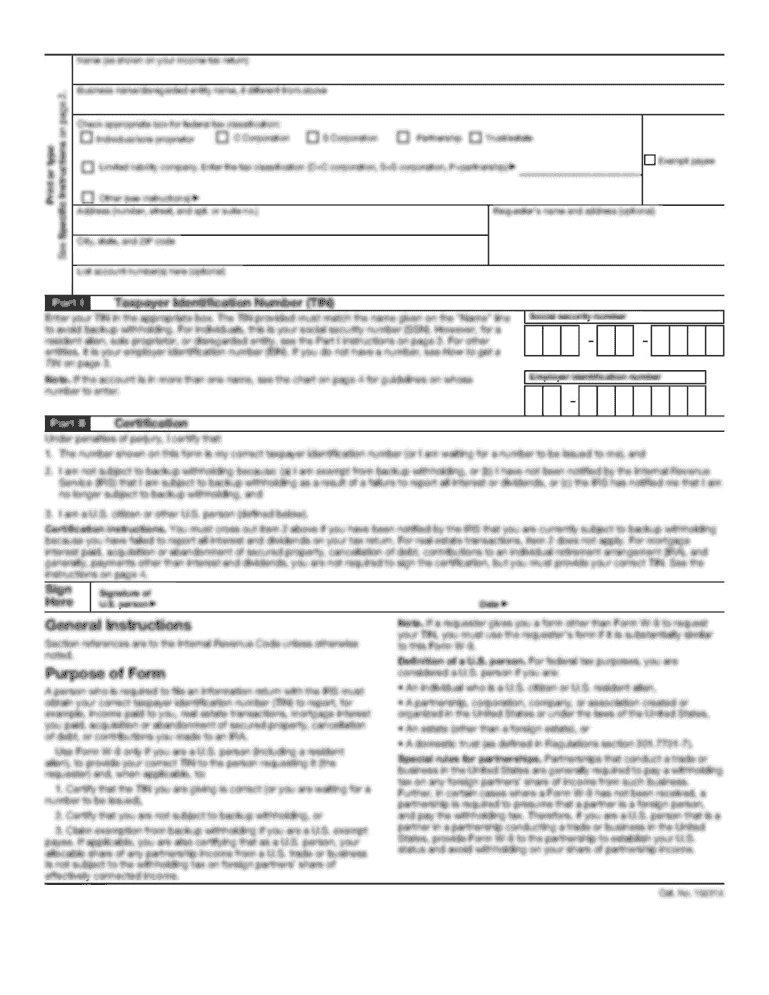

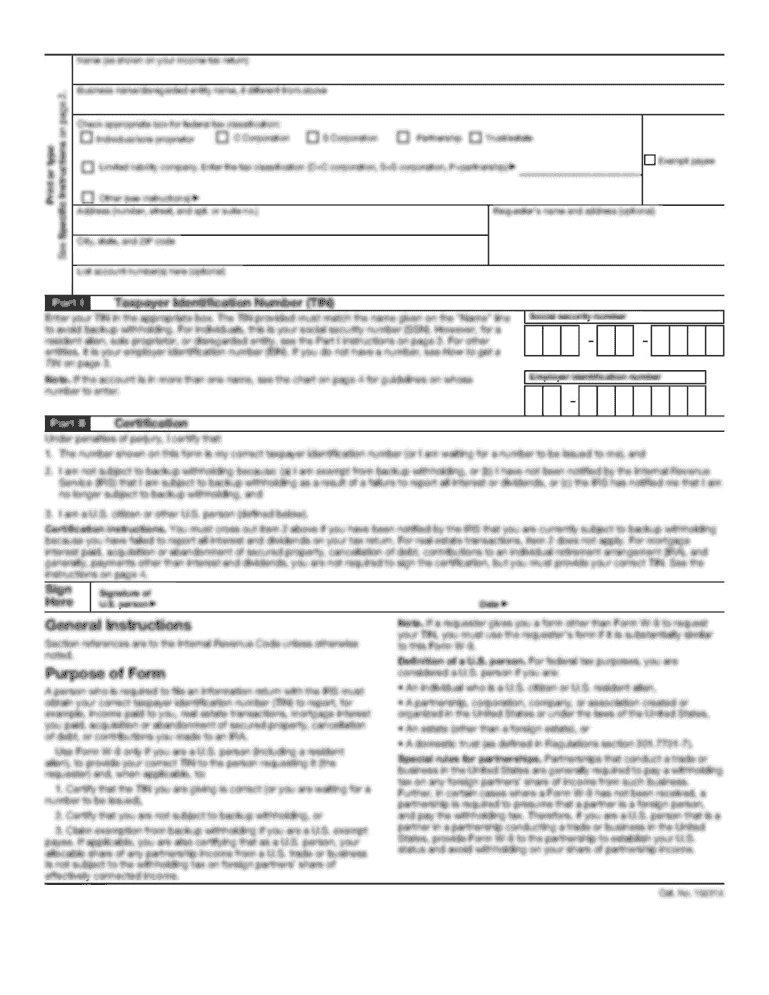

How to fill out form 5309 - irs

How to fill out form 5309 - irs:

01

Gather all necessary information and documents, such as your personal identification details, income information, and relevant financial records.

02

Review the instructions provided by the IRS for form 5309 to familiarize yourself with the requirements and guidelines.

03

Begin by filling out the top section of the form with your personal information, including your name, address, and social security number.

04

Follow the instructions on the form to accurately complete each section, providing all requested information and double-checking for any errors or missing details.

05

Ensure you attach any required supporting documents, such as proof of income or deductions, as specified in the instructions.

06

Review the completed form, making sure all entries are accurate and legible.

07

Sign and date the form, certifying the information provided is true and accurate to the best of your knowledge.

08

Make a copy of the completed form and all attached documents for your records.

09

Mail the original form and attachments to the appropriate IRS address as indicated in the instructions.

Who needs form 5309 - irs:

01

Individuals or businesses who have made contributions to individual retirement arrangements (IRAs) need form 5309 - irs.

02

This form is required for anyone who wants to request a waiver of the 60-day rollover requirement for IRA distributions.

03

It is important for individuals who wish to avoid early withdrawal penalties or tax obligations on IRA distributions to properly utilize form 5309 - irs to request a waiver.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 5309 - irs?

Form 5309 - IRS is a document used by tax-exempt organizations to request a determination letter from the Internal Revenue Service (IRS) regarding their tax-exempt status.

Who is required to file form 5309 - irs?

Tax-exempt organizations that want to verify or update their tax-exempt status with the IRS are required to file form 5309.

How to fill out form 5309 - irs?

To fill out form 5309 - IRS, you need to provide information about your tax-exempt organization, including its name, address, employer identification number (EIN), and details about its activities and purpose.

What is the purpose of form 5309 - irs?

The purpose of form 5309 - IRS is to request a determination letter from the IRS, which confirms or updates the tax-exempt status of the organization.

What information must be reported on form 5309 - irs?

Form 5309 requires information such as the organization's name, EIN, address, contact details, a description of its purpose and activities, details of any significant changes since the last application, and the signature of an authorized individual.

When is the deadline to file form 5309 - irs in 2023?

The deadline to file form 5309 - IRS in 2023 is typically based on the organization's tax year. It is recommended to consult the IRS website or a tax professional for the specific deadline.

What is the penalty for the late filing of form 5309 - irs?

The penalty for the late filing of form 5309 - IRS can vary depending on the specific circumstances. It is advisable to consult the IRS guidelines or seek professional advice to determine the applicable penalties.

How do I modify my form 5309 - irs in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your form 5309 - irs as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I fill out form 5309 - irs on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your form 5309 - irs, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I fill out form 5309 - irs on an Android device?

Use the pdfFiller app for Android to finish your form 5309 - irs. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your form 5309 - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.