Get the free CPA CERTIFICATE BY RECIPROCITY - nbpa ne

Show details

This document outlines the requirements and processes for obtaining a CPA certificate by reciprocity in Nebraska, including eligibility criteria and application procedures.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cpa certificate by reciprocity

Edit your cpa certificate by reciprocity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cpa certificate by reciprocity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cpa certificate by reciprocity online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit cpa certificate by reciprocity. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

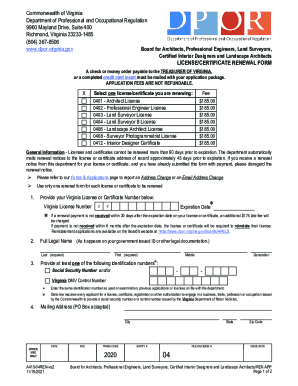

How to fill out cpa certificate by reciprocity

How to fill out CPA CERTIFICATE BY RECIPROCITY

01

Obtain the application form for the CPA Certificate by Reciprocity from your state board of accountancy.

02

Review the eligibility requirements outlined by your state for reciprocity.

03

Gather all necessary documents, including your original CPA license, transcripts, and proof of work experience.

04

Complete the application form carefully, ensuring all information is accurate and complete.

05

Prepare any required fees and payment methods as outlined in the application instructions.

06

Submit the completed application, supporting documents, and payment to your state board of accountancy through the designated submission method.

07

Wait for confirmation of receipt from the board and any further instructions or additional steps.

Who needs CPA CERTIFICATE BY RECIPROCITY?

01

Individuals who are licensed CPAs in one state and wish to obtain a CPA license in another state without undergoing the examination process again.

02

CPAs looking to expand their practice into a new jurisdiction where they need a reciprocal license.

03

Licensed accountants who have moved to a new state for personal or professional reasons and wish to continue their CPA practice.

Fill

form

: Try Risk Free

People Also Ask about

Does California have CPA reciprocity?

A: Currently, California does not recognize reciprocity. An out-of-state CPA wanting to be licensed in California must submit an application and meet California's education and licensing requirements (including passing the required ethics exam).

Can CPAs work internationally?

One of the many perks of obtaining your CPA license is not only job security, but actually being in high demand. And not just in the United States, but all over the globe.

Can I take the CPA exam outside of the US?

Residents from many nations in Africa, Asia, Europe and South America may be eligible to take the CPA Exam. In addition to testing locations in the United States, international CPA testing locations are located in the following countries: Bahrain. Brazil.

Can you take the CPA Exam outside the US?

The Exam application process is basically the same for U.S. and international candidates. In order to qualify to take the Exam outside the U.S., you will have to establish your eligibility through a jurisdiction participating in the international administration of the Exam.

Which country is best for doing CPA?

1. UK – Average CA salary: £38,787 per year. The United Kingdom remains the best country for chartered accountants and related professionals in the world. The British finance sector is thriving, with plenty of major accounting firms setting their headquarters in the country.

What is the easiest state to pass the CPA exam?

What State Is Best for the CPA License? If you want to take the CPA exam as early as possible with fewer requirements, Alaska is a good state to get your CPA license in because it allows candidates to sit while completing an undergraduate degree if within 18 hours of meeting bachelor's degree requirements.

What is the international equivalent of the CPA exam?

To put it simply, the “ACCA” credential and the “CPA” credential denote a similar skill set, but the CPA is localized (by state in the U.S.) while the ACCA is a global credential. Both credentials are highly respected and can open doors to a rewarding career in accounting.

What is the hardest CPA Exam in the world?

How hard is the FAR CPA exam? The FAR section of the CPA Exam is hard because it's the most comprehensive of the 4 exam sections, and it has a lot of math questions that are mentally taxing to get through. It has the lowest pass rate of all 4 exam sections and is considered the hardest CPA Exam section.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CPA CERTIFICATE BY RECIPROCITY?

The CPA Certificate by Reciprocity is a credential that allows a certified public accountant licensed in one jurisdiction to obtain a CPA license in another jurisdiction without having to retake the examination, provided that the applicant meets specific eligibility requirements.

Who is required to file CPA CERTIFICATE BY RECIPROCITY?

Individuals who are already licensed CPAs in one state or jurisdiction and wish to obtain licensure in another state or jurisdiction are required to file a CPA Certificate by Reciprocity.

How to fill out CPA CERTIFICATE BY RECIPROCITY?

To fill out the CPA Certificate by Reciprocity, applicants typically need to complete an application form provided by the state board of accountancy, include proof of their existing CPA license, submit verification of education and experience, and pay the required fees.

What is the purpose of CPA CERTIFICATE BY RECIPROCITY?

The purpose of the CPA Certificate by Reciprocity is to streamline the process for licensed CPAs to practice in multiple jurisdictions, thereby recognizing the qualifications and standards of CPAs already licensed elsewhere.

What information must be reported on CPA CERTIFICATE BY RECIPROCITY?

Information that must be reported includes the applicant's current CPA license details, education history, professional experience, any disciplinary actions, and personal identification information such as proof of residency and social security number.

Fill out your cpa certificate by reciprocity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cpa Certificate By Reciprocity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.