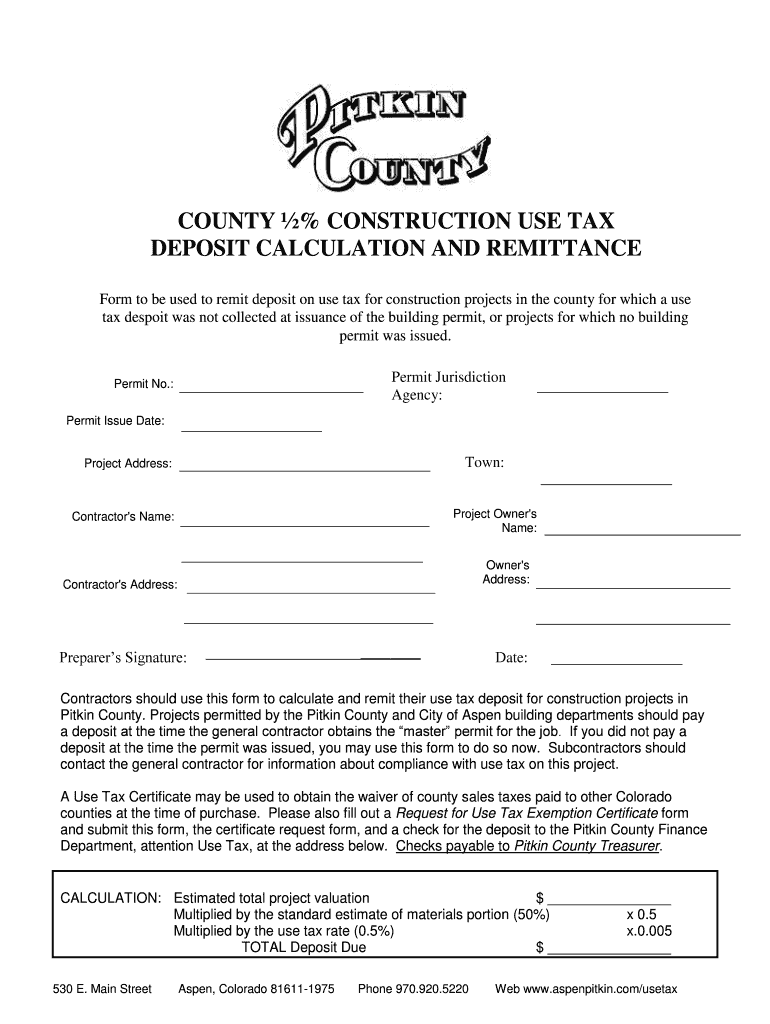

Get the free COUNTY ½% CONSTRUCTION USE TAX DEPOSIT CALCULATION AND REMITTANCE

Show details

Form to be used to remit deposit on use tax for construction projects in Pitkin County for which a use tax deposit was not collected at the issuance of the building permit or for projects without

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign county construction use tax

Edit your county construction use tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your county construction use tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing county construction use tax online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit county construction use tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out county construction use tax

How to fill out COUNTY ½% CONSTRUCTION USE TAX DEPOSIT CALCULATION AND REMITTANCE

01

Obtain the COUNTY ½% CONSTRUCTION USE TAX DEPOSIT CALCULATION AND REMITTANCE form from your local tax authority website or office.

02

Fill out the date field at the top of the form to indicate when you are submitting the calculation.

03

Enter your business name and address in the designated fields to identify the taxpayer.

04

Input the project information, including location and type of construction, in the specified sections.

05

Calculate the total cost of construction to determine the taxable amount.

06

Apply the ½% tax rate to the taxable amount to calculate the total tax due.

07

Enter this total tax due in the appropriate field on the form.

08

Sign and date the form to certify that the information provided is accurate.

09

Submit the completed form along with any payment required to your local tax authority by the deadline.

Who needs COUNTY ½% CONSTRUCTION USE TAX DEPOSIT CALCULATION AND REMITTANCE?

01

Contractors engaged in construction projects in the county.

02

Property owners who are undertaking construction, renovation, or demolition activities.

03

Businesses involved in the sale of tangible goods that are subject to use tax in the county.

Fill

form

: Try Risk Free

People Also Ask about

Is construction labor taxable in Wisconsin?

Is labor taxed in Wisconsin? General contractors charge sales tax to the end customer on materials and labor charges, unless the customer issues an exemption certificate. It's important to note that labor is taxable in Wisconsin for certain types of construction activities and services.

Is sales and use tax the same as property tax?

Property tax is a direct tax, for which the owner of the property is obligated to pay the taxes. Sales tax is an indirect tax, for which a company collects tax from a customer on behalf of the government. Property owners are responsible for paying taxes on their property every year.

Why is use tax important?

The purpose of the use tax is supposed to protect in-state retailers against unfair competition from out-of-state sellers that aren't required to collect tax. It also ensures that all of a state's residents help fund state and local programs and services, regardless of where they shop.

Who must pay California use tax?

Finally, use tax in California is generally required to be paid by individuals and businesses that make taxable purchases from out-of-state sellers and do not pay sales tax at the time of purchase.

What is an example of a use tax?

Example of Use Tax Let's say that a Californian bought clothing from an online retailer in Oregon. Under Oregon law, the retailer does not collect sales tax on the goods but the retail buyer must still pay a use tax on that clothing purchase to the California tax authority called the Board of Equalization.

How to calculate local tax rate?

Local Tax Amount = Price x (Local Tax Percentage / 100) Total = Price + State Tax Amount + Use Tax Amount + Local Tax Amount.

What is use tax in construction?

There's no such thing as a “construction sales tax,” technically. But in many states, sales and use tax apply to the sale or use of certain construction services and/or materials. Sales tax on construction work is governed by sales and use tax laws, rules, and regulations.

What is the sales tax for contractors in Massachusetts?

State sales tax is 6.25% on taxable products sold. If you offered services as an independent contractor and did not sell products, you don't need to file and pay sales taxes because services are generally exempt from sales taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is COUNTY ½% CONSTRUCTION USE TAX DEPOSIT CALCULATION AND REMITTANCE?

The COUNTY ½% CONSTRUCTION USE TAX DEPOSIT CALCULATION AND REMITTANCE is a form used to calculate and remit the 0.5% construction use tax imposed by the county on construction projects. This tax applies to the purchase price of taxable materials and labor used in construction.

Who is required to file COUNTY ½% CONSTRUCTION USE TAX DEPOSIT CALCULATION AND REMITTANCE?

Individuals or businesses engaged in construction activities within the county that are subject to the ½% construction use tax are required to file this calculation and remittance.

How to fill out COUNTY ½% CONSTRUCTION USE TAX DEPOSIT CALCULATION AND REMITTANCE?

To fill out the form, enter the total cost of construction materials, calculate 0.5% of that total, and report the amount due as well as any payments made or outstanding balances in the designated fields on the form.

What is the purpose of COUNTY ½% CONSTRUCTION USE TAX DEPOSIT CALCULATION AND REMITTANCE?

The purpose of this calculation and remittance is to ensure accurate reporting and payment of the construction use tax, which funds local public services and infrastructure projects.

What information must be reported on COUNTY ½% CONSTRUCTION USE TAX DEPOSIT CALCULATION AND REMITTANCE?

Information to be reported includes the total cost of construction materials, the calculated tax amount due, any previous payments made, and the taxpayer's identifying information, including name, address, and tax identification number.

Fill out your county construction use tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

County Construction Use Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.