Get the free CHARITABLE ANNUITIES REQUIREMENTS AND REPORTING - insurance arkansas

Show details

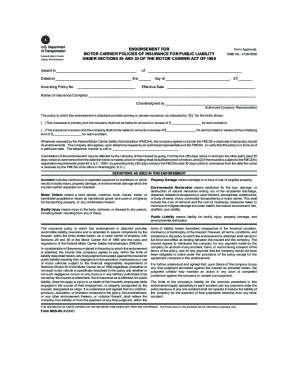

This document establishes requirements and standards for organizations and Arkansas municipalities to obtain permits for offering charitable annuities, clarifying procedures and standards for both

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable annuities requirements and

Edit your charitable annuities requirements and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable annuities requirements and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing charitable annuities requirements and online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit charitable annuities requirements and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable annuities requirements and

How to fill out CHARITABLE ANNUITIES REQUIREMENTS AND REPORTING

01

Gather the necessary documentation related to the charitable annuity, including donor information and details of the annuity agreement.

02

Complete the required forms as specified by the governing tax authority or relevant filing agency.

03

Ensure the accurate calculation of the annuity's present value using IRS tables for determining the charitable deduction.

04

Review the reporting requirements for both the charity and the donor, as they may differ, and prepare to fulfill both.

05

Submit the completed forms to the appropriate tax authority by the specified deadlines.

06

Maintain records of all submitted documents and communications related to the charitable annuity for future reference and compliance.

Who needs CHARITABLE ANNUITIES REQUIREMENTS AND REPORTING?

01

Non-profit organizations that offer charitable annuities as part of their fundraising efforts.

02

Donors who contribute to charitable annuities and have tax reporting obligations.

03

Financial and tax advisors who assist charities and donors in managing charitable annuities.

Fill

form

: Try Risk Free

People Also Ask about

How is a gifted annuity taxed?

If you are 70½ or older, you can make a one-time election of up to $54,000 to fund a gift annuity. While your gift does not qualify for an income tax deduction, it does escape income tax liability on the transfer and count toward all or part of your required minimum distributions.

What is the difference between a charitable gift annuity and a charitable trust?

While a charitable remainder trust enables you to rest easy that your funds are under your control, a charitable gift annuity requires that you have faith in the charity you donate to. If the charity becomes insoluble and cannot make the payments to you, then there is no recourse to take.

How is income from a charitable gift annuity taxed?

Each payment is partially tax-free for a number of years, a period measured by the donor's life expectancy. After that period, the entire payment will be treated as ordinary income to the donor.

How do I report a charitable gift annuity?

The charity that issues the annuity will send a Form 1099-R to the annuitant. This form will specify how the payments should be reported for income tax purposes.

Is income from a charitable gift annuity taxable?

Each payment is partially tax-free for a number of years, a period measured by the donor's life expectancy. After that period, the entire payment will be treated as ordinary income to the donor.

What is required for a charitable gift annuity?

To qualify, applying charities must have been in continuous operation for 10 years and must maintain a segregated reserve fund in trust for California annuitants only that is both legally and physically separated from the charity's other accounts and assets.

How to report a charitable gift annuity on a tax return?

Taxation of CGA payments. The charity that issues the annuity will send a Form 1099-R to the annuitant. This form will specify how the payments should be reported for income tax purposes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CHARITABLE ANNUITIES REQUIREMENTS AND REPORTING?

CHARITABLE ANNUITIES REQUIREMENTS AND REPORTING refers to the legal and regulatory framework that governs the issuance, management, and reporting of charitable annuities by organizations. This includes the requirements for compliance with state laws regarding the establishment and administration of charitable gift annuities.

Who is required to file CHARITABLE ANNUITIES REQUIREMENTS AND REPORTING?

Organizations that issue charitable annuities, typically nonprofit entities such as charities and foundations, are required to file CHARITABLE ANNUITIES REQUIREMENTS AND REPORTING. This also includes any financial institutions or entities that manage such annuity contracts.

How to fill out CHARITABLE ANNUITIES REQUIREMENTS AND REPORTING?

To fill out CHARITABLE ANNUITIES REQUIREMENTS AND REPORTING, organizations must provide accurate information regarding the annuity contracts they issue, including details on the beneficiary, payout terms, and total contributions. It often requires careful documentation and adherence to both federal and state guidelines.

What is the purpose of CHARITABLE ANNUITIES REQUIREMENTS AND REPORTING?

The purpose of CHARITABLE ANNUITIES REQUIREMENTS AND REPORTING is to ensure transparency, protect the interests of annuity holders, and provide regulatory oversight for charitable organizations. It helps maintain compliance with legal obligations and promotes trust in charitable giving.

What information must be reported on CHARITABLE ANNUITIES REQUIREMENTS AND REPORTING?

The information that must be reported typically includes the names and contact information of the annuity holders, the terms of the annuity, the amount contributed, the expected payout schedule, and any other relevant financial details that demonstrate compliance with state regulations.

Fill out your charitable annuities requirements and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Annuities Requirements And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.