Get the free California Schedule D (565)

Show details

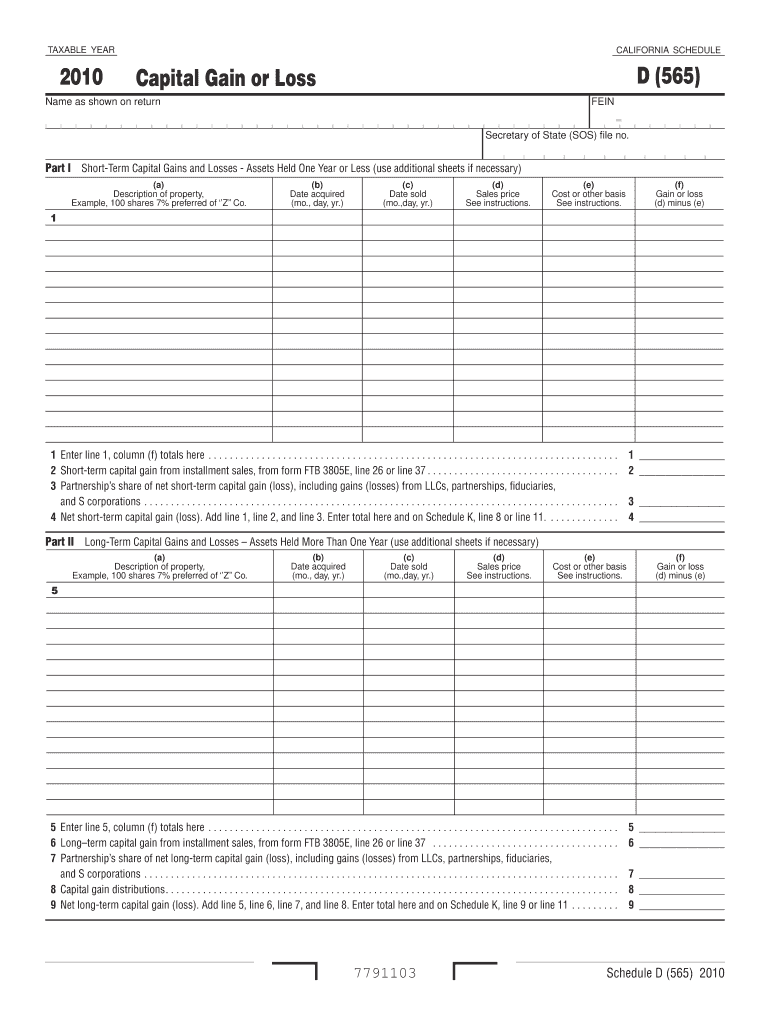

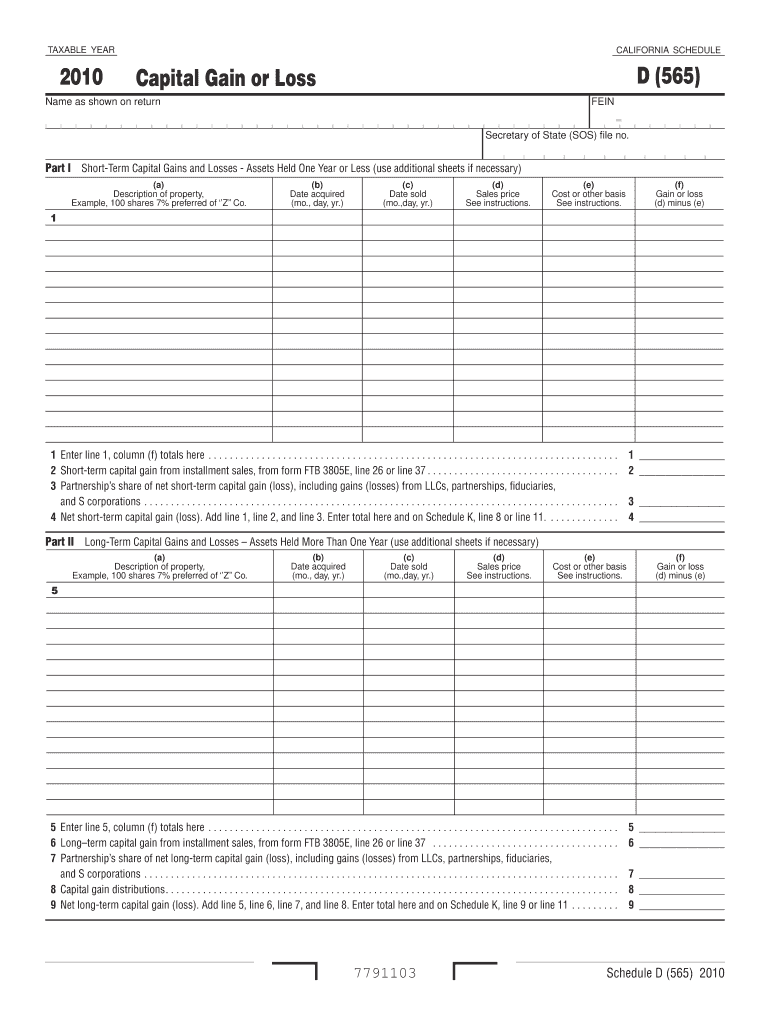

This document is used to report the sale or exchange of capital assets by the partnership, detailing both short-term and long-term capital gains and losses for the taxable year 2010.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign california schedule d 565

Edit your california schedule d 565 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california schedule d 565 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit california schedule d 565 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit california schedule d 565. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out california schedule d 565

How to fill out California Schedule D (565)

01

Gather your financial information including capital gains and losses from sales of assets.

02

Obtain the California Schedule D (565) form from the California Franchise Tax Board website or your tax preparer.

03

Fill out your personal information at the top of the form, including your name, social security number, and filing status.

04

Report your short-term capital gains and losses on Part I of the form, following the instructions for each column carefully.

05

Report your long-term capital gains and losses on Part II of the form, ensuring you categorize them correctly.

06

Total your short-term and long-term capital gains and losses at the bottom of their respective sections.

07

Calculate your net capital gain or loss and enter it in the designated area on the form.

08

Transfer your net capital gain or loss to your California Form 540 or other applicable tax return forms.

09

Review the completed Schedule D (565) for accuracy before submission.

10

Attach the Schedule D (565) to your California tax return when filing.

Who needs California Schedule D (565)?

01

Individual taxpayers in California who have capital gains or losses to report from the sale of assets such as stocks, bonds, real estate, or other investments.

02

Trusts or estates that have capital gains or losses from the sale of property and need to report these on their California tax returns.

03

Partnerships or multi-member LLCs that require Schedule D (565) to report capital gains and losses on behalf of the entity.

Fill

form

: Try Risk Free

People Also Ask about

How do I avoid capital gains tax on my property in California?

You do not have to report the sale of your home if all of the following apply: Your gain from the sale was less than $250,000. You have not used the exclusion in the last 2 years. You owned and occupied the home for at least 2 years.

How much of a capital loss can I deduct in California?

Depending on the character of the gain as either short term or long term, it will offset those unused losses first. If your losses exceed your current year capital gain, you may also deduct up to $3,000 of your unused losses against your ordinary income.

What is the $3000 capital loss rule?

The capital loss tax deduction allows taxpayers to offset investment losses against their gains, reducing their taxable income. If capital losses exceed gains, individuals can use up to $3,000 per year to offset other income, with any remaining losses carried forward to future years.

What is the maximum capital loss carryover in California?

Should you have more than $3,000 in such capital losses, you may be able to carry the losses forward. You can continue to carry forward these losses until such time that future realized gains exhaust them. Under current law, the ability to carry these losses forward is lost only on death.

What is the maximum write off for capital losses?

There is no limit on using capital losses to offset capital gains. There are, however, limits when deducting a net capital loss from taxable income. This loss deduction is capped at $3,000 per year or $1,500 per year for married filing separately.

Is it worth claiming capital losses?

Yes, capital losses are tax deductible up to a limit. After netting out short- and long-term capital gains and losses for a possible net loss, the loss can offset any income, up to $3,000.

How much is capital gains tax in California on real estate?

In California, capital gains from the sale of a house are taxed by both the state and federal governments. The state tax rate varies from 1% to 13.3% based on your tax bracket. The federal tax rate depends on whether the gains are short-term (taxed as ordinary income) or long-term (based on the tax bracket).

Who is required to file CA form 565?

You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is California Schedule D (565)?

California Schedule D (565) is a form used by partnerships, limited liability companies (LLCs), and certain other entities to report capital gains and losses for state tax purposes.

Who is required to file California Schedule D (565)?

Entities such as partnerships, LLCs, and corporations that have capital gains or losses to report must file California Schedule D (565) along with their California tax return.

How to fill out California Schedule D (565)?

To fill out California Schedule D (565), you must provide information about capital gains and losses, including details of each asset sold, the date of acquisition and sale, the amount gained or lost, and any applicable adjustments.

What is the purpose of California Schedule D (565)?

The purpose of California Schedule D (565) is to allow the California Franchise Tax Board to assess and track capital gains and losses for taxation purposes, ensuring compliance with state tax laws.

What information must be reported on California Schedule D (565)?

California Schedule D (565) requires the reporting of each capital asset sold, including the asset description, acquisition date, sale date, sale proceeds, cost or other basis, and any capital loss carryover or adjustments.

Fill out your california schedule d 565 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Schedule D 565 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.