Get the free Government Money Market Fund Wilmington Tax-Exempt Money Market Fund (each a "

Show details

WT MUTUAL FUND Wilmington Prime Money Market Fund Wilmington U.S. Government Money Market Fund Wilmington Tax-Exempt Money Market Fund (each a Fund and collectively, the Funds) Supplement dated October

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your government money market fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

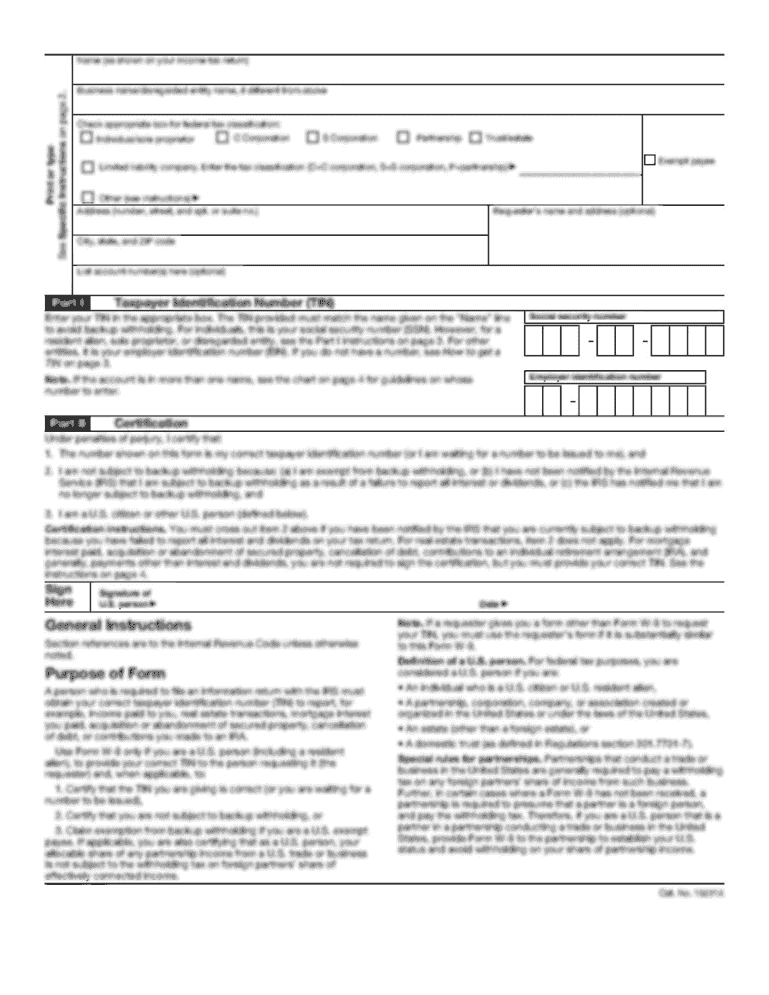

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your government money market fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit government money market fund online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit government money market fund. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

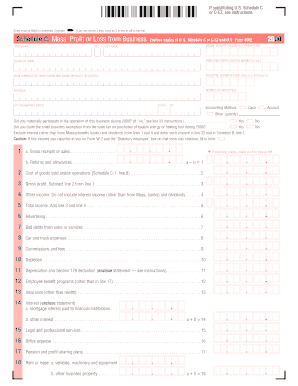

How to fill out government money market fund

How to fill out government money market fund:

01

Gather the necessary documents and information, such as your identification, social security number, and financial statements.

02

Research different government money market fund options and compare their features, rates, and fees.

03

Choose the government money market fund that aligns with your investment goals and risk tolerance.

04

Contact the financial institution or brokerage firm offering the fund and request an application form.

05

Fill out the application form accurately and completely, providing all necessary personal and financial information.

06

Review the terms and conditions of the fund carefully before signing the application form.

07

Submit the completed application form along with any required supporting documents, such as proof of address or income.

08

Wait for the fund provider to process your application and open your government money market fund account.

09

Once your account is set up, deposit funds into the account according to the minimum investment requirement or your desired investment amount.

10

Monitor your government money market fund regularly, keep track of any changes in interest rates, and evaluate its performance periodically.

Who needs government money market fund:

01

Individuals who prioritize liquidity and safety in their investments.

02

Investors looking for low-risk options with relatively stable returns.

03

Those who want to park their cash temporarily and earn some interest before deciding on other investment opportunities.

04

Individuals who want to diversify their investment portfolio and include a safe and conservative option.

05

Businesses and organizations that require a short-term investment vehicle for their cash reserves.

06

Individuals or entities seeking a government-backed investment option that provides a higher yield than traditional savings accounts.

07

Investors who prefer fixed income investments over equity-based investments.

08

Those who want to minimize the impact of interest rate fluctuations on their investment returns.

09

Investors with a short investment horizon or those who need quick access to their funds.

10

Individuals who want the peace of mind of investing in a fund that is regulated and overseen by government agencies.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is government money market fund?

Government money market funds are mutual funds that invest in short-term, low-risk securities issued by the government, such as Treasury bills, notes, and bonds. They are considered to be one of the safest forms of investment.

Who is required to file government money market fund?

Individuals or entities who invest in government money market funds are not required to file them. However, the fund manager or the financial institution managing the fund may be required to file certain regulatory reports as per the relevant regulatory authority's guidelines.

How to fill out government money market fund?

As an investor, there is usually no need to fill out any specific form for a government money market fund. You can invest in these funds through a brokerage account or directly with a fund company by following their account opening and investment process.

What is the purpose of government money market fund?

The purpose of a government money market fund is to provide investors with a relatively safe and liquid investment option that aims to preserve the value of their investment while generating a modest level of income.

What information must be reported on government money market fund?

The specific information that must be reported on a government money market fund depends on the regulatory requirements set by the relevant authority. Typically, these funds are required to disclose their holdings, investment strategies, performance, expenses, and other key details in their prospectus or periodic reports.

When is the deadline to file government money market fund in 2023?

There is usually no specific filing deadline for individual investors of government money market funds. However, the fund manager or the financial institution managing the fund may have their own reporting deadlines as per the relevant regulatory guidelines.

What is the penalty for the late filing of government money market fund?

The penalty for the late filing of a government money market fund usually depends on the specific regulatory authority and the nature of the violation. It is best to consult the relevant regulatory guidelines or seek professional advice for specific penalty information.

How can I manage my government money market fund directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your government money market fund and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I create an electronic signature for signing my government money market fund in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your government money market fund and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit government money market fund on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as government money market fund. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your government money market fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.