In the event you are asked to provide documentation to support your claim for a refund of your tax refund in connection with the Taxpayer Relief Act of 1997 (ERA 1997) and you are a resident of the State of Hawaii, you should, as a condition to obtaining a refund, provide the following to the Department of Hawaiian Affairs:

(1) The name, mailing address, date of birth, social security number, and identifying number (PIN) (if any) of the taxpayer.

(2) The name, mailing address, date of birth, social security number, and identifying number (PIN) (if any) of the taxpayer's dependents.

(3) The name, mailing address, date of birth, social security number, and identifying number (PIN) of each spouse having a tax filing obligation for this tax year.

(4) The name, mailing address, date of birth, social security number, and identifying number (PIN) (if any) of each dependent of the taxpayer.

(5) Any other documentation required by the Department of Hawaiian Affairs.

NOTE: If you do not have a social security card and/or no identification number, you may submit a copy of a driver's license or other form of identification to the Department of Hawaiian Affairs along with the required documentation to establish your identity.

If you do not have a social security card and/or no identification number, you may submit a copy of a driver's license or other form of identification to the Department of Hawaiian Affairs along with the required documentation to establish your identity. 31. Make sure you file your return on time. (Sec. 6707(a), 6707(f).) NOTE: If you are requesting a refund for the 2017 tax year, check the box next to the “Apply for a Refund” button if you have filed your return on-time for the 2016 tax year. If you are not requesting a refund, check the box next to the “Apply for a Refund” button only if you are filing your return within 30 days of the due date.

32. (a) If your spouse filed an adjusted gross income tax return for the 2016 tax year, you must file a joint return. (Sec. 61 and Sec. 6091.1.)

If your spouse filed an adjusted gross income tax return for the 2016 tax year, you must file a joint return. (Sec. 61 and Sec.

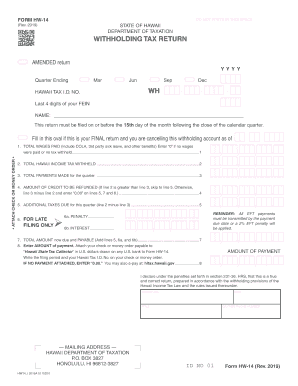

HI DoT HW-14 2010 free printable template

Show details

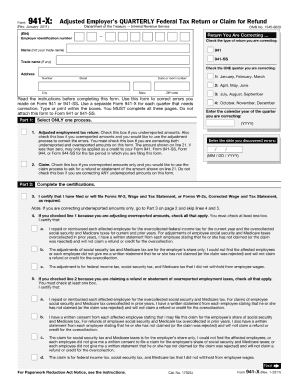

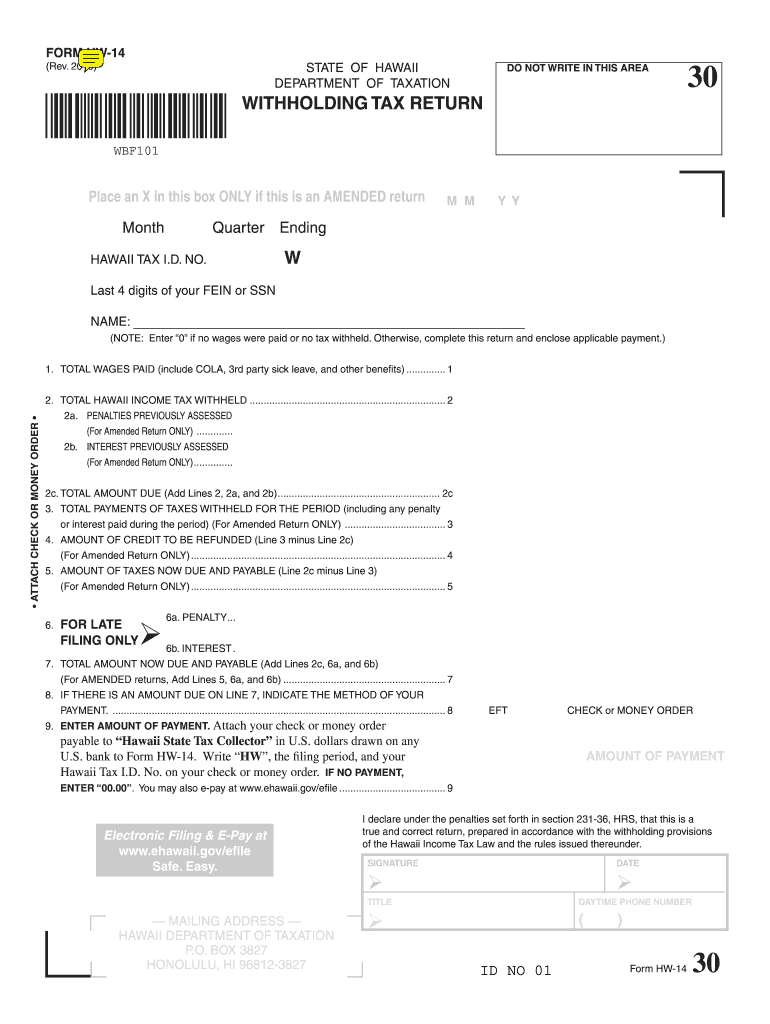

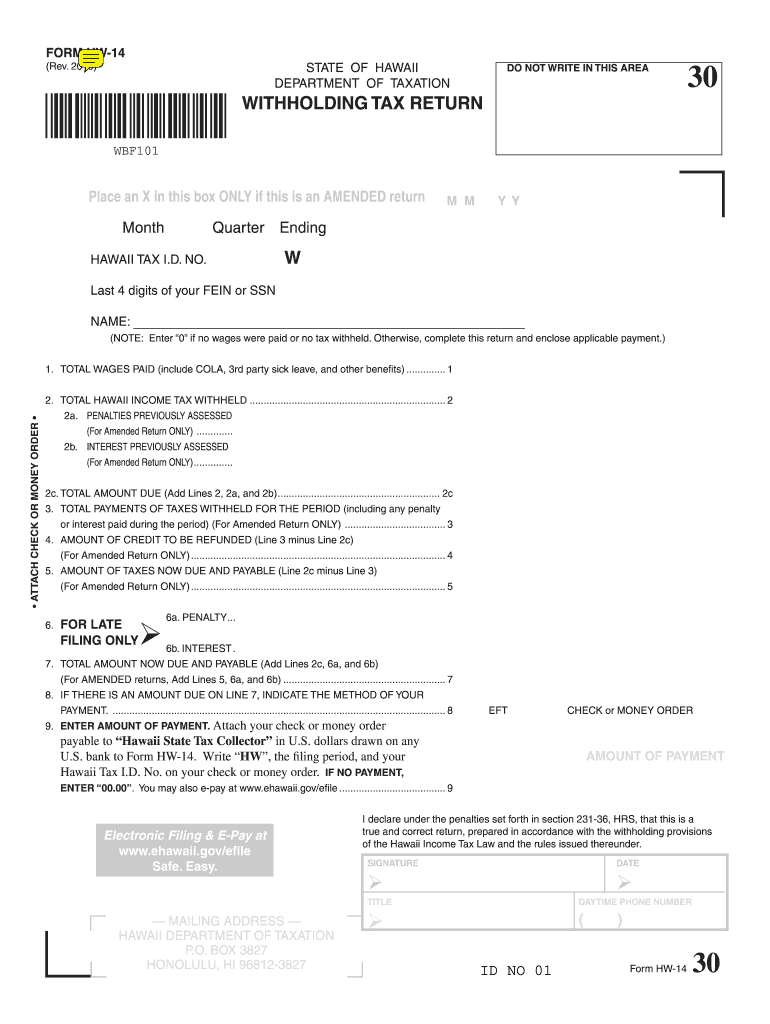

Attach your check or money order payable to Hawaii State Tax Collector in U.S. dollars drawn on any U.S. bank to Form HW-14. SIGNATURE DATE TITLE MAILING ADDRESS HAWAII DEPARTMENT OF TAXATION P. O. BOX 3827 HONOLULU HI 96812-3827 DAYTIME PHONE NUMBER ID NO 01 Form HW-14. 0 or higher with this form. FORM HW-14 Rev. 2010 DO NOT WRITE IN THIS AREA STATE OF HAWAII DEPARTMENT OF TAXATION WITHHOLDING TAX RETURN Clear Form WBF101 Place an X in this box ONLY if this is an AMENDED return M M Y Y...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form hw 14 2010 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form hw 14 2010 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

HI DoT HW-14 Form Versions

Version

Form Popularity

Fillable & printabley

Fill form : Try Risk Free

Fill out your form hw 14 2010 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.