Get the free non qualified annuity loss form

Show details

May / 2006 TAXATION OF NON-QUALIFIED ANNUITY CONTRACTS Inside this issue I. II. III. IV. V. VI. VII. VIII. IX. X. Introduction Types of Contracts Lifetime Distributions Premature Distributions Ownership

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your non qualified annuity loss form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non qualified annuity loss form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non qualified annuity loss online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit non qualified annuity loss. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

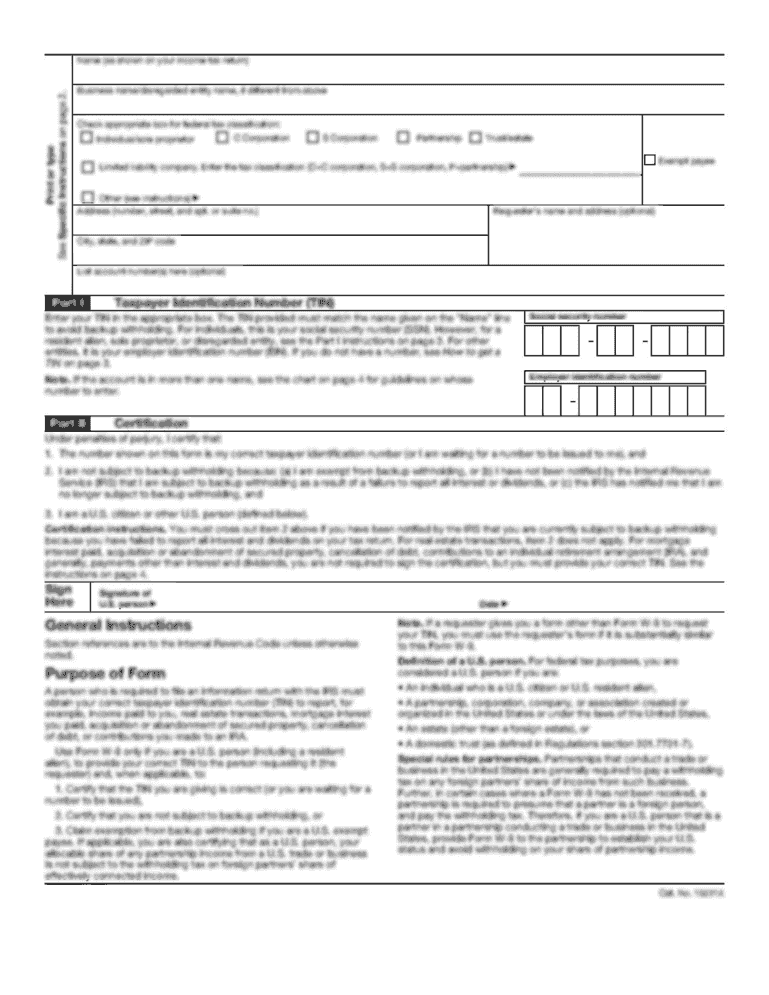

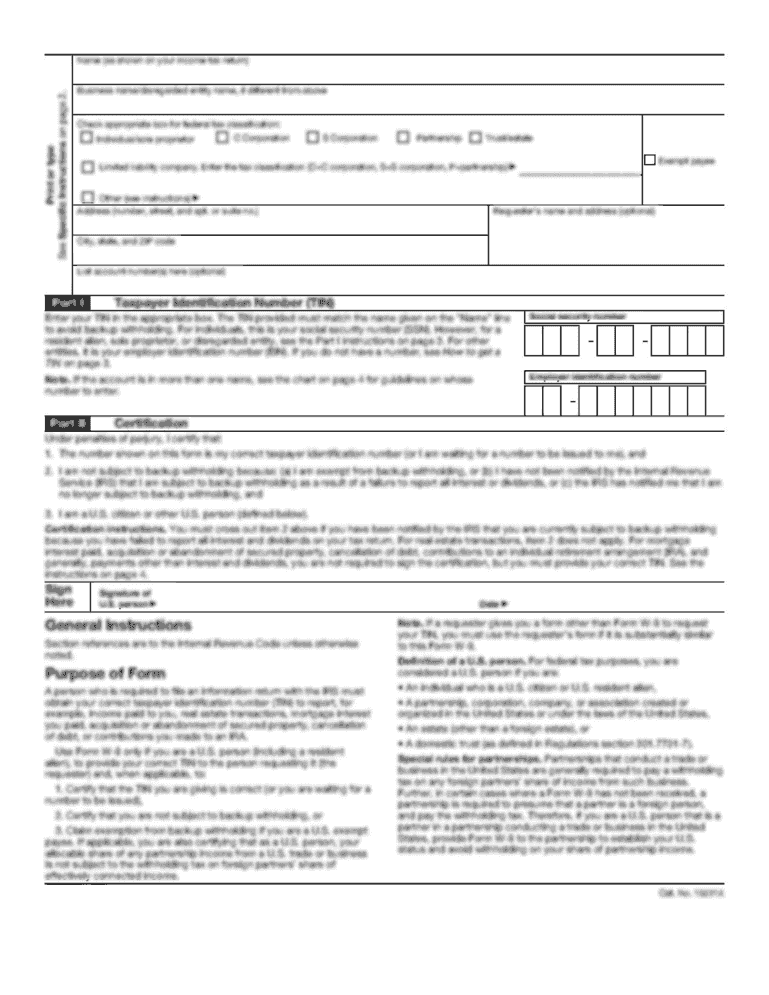

How to fill out non qualified annuity loss

How to fill out non qualified annuity loss:

01

Gather all necessary documentation: Collect all relevant information such as original annuity contract, policy statements, and any other supporting documents.

02

Identify the losses: Determine the specific losses incurred and their corresponding monetary value. This may include factors such as decline in account value, surrender charges, or penalties.

03

Calculate the adjusted cost basis: Determine the adjusted cost basis of the annuity, which is the original investment less any distributions or withdrawals.

04

Determine the taxable amount: Calculate the taxable amount of the non qualified annuity loss by subtracting the adjusted cost basis from the current account value.

05

Fill out the appropriate forms: Use the relevant IRS forms to report the non qualified annuity loss, such as Form 1040 Schedule D for capital gains and losses, or Form 4684 for casualties and thefts.

06

Submit the forms: Ensure all forms are completed accurately and submitted to the appropriate tax authority within the specified deadline.

Who needs non qualified annuity loss:

01

Individuals with non qualified annuities: Non qualified annuity loss is relevant for individuals who hold annuities that do not meet the requirements for tax-deferred treatment, such as those purchased with after-tax dollars.

02

Taxpayers looking to offset capital gains: Non qualified annuity losses can be used to offset capital gains, reducing the overall taxable income and potentially lowering the tax liability.

03

Individuals experiencing a decline in annuity value: Those who have suffered a decline in the value of their non qualified annuity may need to report the loss for tax purposes and potentially claim a deduction or credit.

04

Taxpayers seeking to optimize their tax situation: Understanding how to fill out non qualified annuity loss can help taxpayers navigate the complexities of the tax system and optimize their tax situation by properly reporting losses.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is non qualified annuity loss?

Non qualified annuity loss refers to the loss incurred by an individual or business from the sale or surrender of a non qualified annuity. It is the amount by which the individual or business's investment in the annuity exceeds the proceeds received upon surrender or sale.

Who is required to file non qualified annuity loss?

Individuals or businesses who have incurred a loss from the sale or surrender of a non qualified annuity are required to file non qualified annuity loss.

How to fill out non qualified annuity loss?

To fill out non qualified annuity loss, individuals or businesses need to report the loss on Schedule D of their tax return. They should provide details of the annuity, including the purchase price, surrender or sale price, and any related expenses.

What is the purpose of non qualified annuity loss?

The purpose of reporting non qualified annuity loss is to allow individuals or businesses to deduct the loss from their taxable income, thereby reducing their overall tax liability.

What information must be reported on non qualified annuity loss?

The information that must be reported on non qualified annuity loss includes the purchase price of the annuity, the surrender or sale price, any related expenses (such as commissions or fees), and the resulting loss.

When is the deadline to file non qualified annuity loss in 2023?

The deadline to file non qualified annuity loss in 2023 is typically April 15th. However, it is advisable to consult the latest tax regulations or consult with a tax professional for the most accurate and up-to-date deadline information.

What is the penalty for the late filing of non qualified annuity loss?

The penalty for the late filing of non qualified annuity loss can vary depending on the specific circumstances and tax regulations. It is advisable to consult the latest tax regulations or seek guidance from a tax professional to determine the exact penalty amount.

How do I complete non qualified annuity loss online?

Completing and signing non qualified annuity loss online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit non qualified annuity loss in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing non qualified annuity loss and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I complete non qualified annuity loss on an Android device?

On an Android device, use the pdfFiller mobile app to finish your non qualified annuity loss. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your non qualified annuity loss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.