ID Affidavit Regarding Residence in Trust 2003 free printable template

Show details

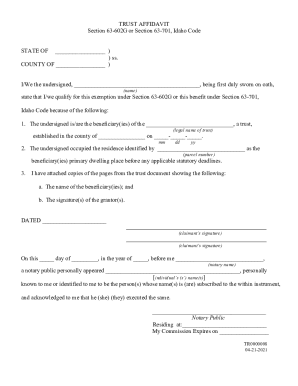

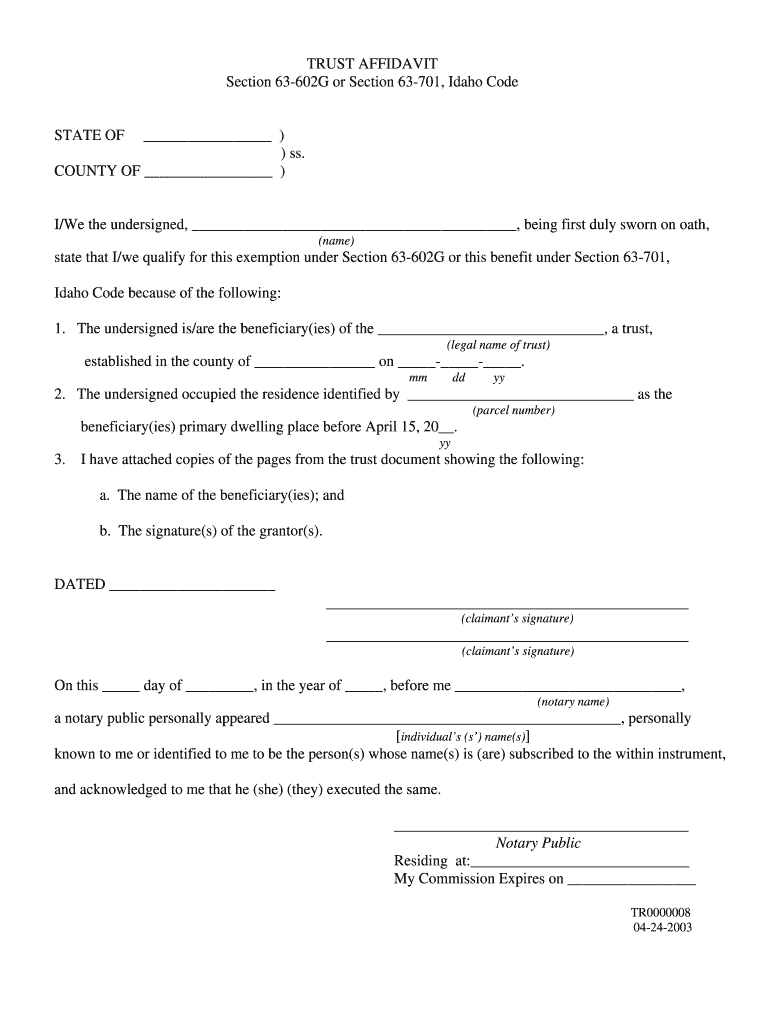

TRUST AFFIDAVIT Section 63-602G or Section 63-701, Idaho Code STATE OF)) SS. COUNTY OF) I/We the undersigned, being first duly sworn on oath, (name) state that I/we qualify for this exemption under

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ID Affidavit Regarding Residence in Trust

Edit your ID Affidavit Regarding Residence in Trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ID Affidavit Regarding Residence in Trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ID Affidavit Regarding Residence in Trust online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ID Affidavit Regarding Residence in Trust. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ID Affidavit Regarding Residence in Trust Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ID Affidavit Regarding Residence in Trust

How to fill out ID Affidavit Regarding Residence in Trust

01

Obtain a copy of the ID Affidavit Regarding Residence in Trust form from the appropriate authority or website.

02

Read the instructions carefully to understand the requirements and information needed.

03

Fill out your legal name and address in the designated fields.

04

Provide details about the trust, including its name and the trustee's information.

05

Specify the duration of your residence at the address provided.

06

Include any supporting documentation that may be required, such as proof of residence or identification.

07

Review the completed affidavit for accuracy and completeness.

08

Sign and date the affidavit in the presence of a notary public, if required.

09

Make copies of the signed affidavit for your records before submitting it to the relevant authority.

Who needs ID Affidavit Regarding Residence in Trust?

01

Individuals who are establishing a trust and need to confirm their residence for legal purposes.

02

Trustees or beneficiaries who need to verify their residency in relation to the trust.

03

Persons involved in estate planning who require documentation of residence associated with a trust.

Fill

form

: Try Risk Free

People Also Ask about

What is the homeowners exemption in Idaho?

Each owner-occupied primary residence (house or manufactured home) and up to one-acre of land is eligible for a Homestead Exemption. This exemption allows the value of your residence and land up to one-acre be exempted at 50% of the assessed value up to a maximum of $125,000; whichever is less.

What is the Idaho property tax exemption?

The homeowner's exemption will exempt 50% of the value of your home and up to one acre of land (maximum: $100,000) from property tax.

What is the Canyon County tax exemption?

A homestead exemption protects the owner's equity in their property. Every property owner in the state of Idaho that occupies their home as their primary residence is automatically protected up to the first $100,000 in equity regardless of size per Idaho Code 55-1003.

At what age do seniors stop paying property taxes in Idaho?

You were 65 or older, blind, widowed, disabled, a former POW or hostage, or a motherless or fatherless child under 18 years old.

What is the homeowners exemption in Boise?

The homeowner's exemption will exempt 50% of the value of your home and up to one acre of land (maximum: $100,000) from property tax.

At what age do you stop paying property taxes in Idaho?

You were 65 or older, blind, widowed, disabled, a former POW or hostage, or a motherless or fatherless child under 18 years old.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ID Affidavit Regarding Residence in Trust online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your ID Affidavit Regarding Residence in Trust to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the ID Affidavit Regarding Residence in Trust electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your ID Affidavit Regarding Residence in Trust in minutes.

How do I edit ID Affidavit Regarding Residence in Trust on an Android device?

With the pdfFiller Android app, you can edit, sign, and share ID Affidavit Regarding Residence in Trust on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is ID Affidavit Regarding Residence in Trust?

The ID Affidavit Regarding Residence in Trust is a legal document used to verify the residential address of a trust and its beneficiaries. It helps establish the residency of the trust for legal or taxation purposes.

Who is required to file ID Affidavit Regarding Residence in Trust?

Typically, the trustee or the individual managing the trust is required to file the ID Affidavit Regarding Residence in Trust, especially if the trust is involved in legal, tax, or administrative proceedings.

How to fill out ID Affidavit Regarding Residence in Trust?

To fill out the ID Affidavit Regarding Residence in Trust, provide accurate information about the trust, including its name, the trust's address, the names of beneficiaries, and signatures of the trustee or authorized representatives.

What is the purpose of ID Affidavit Regarding Residence in Trust?

The purpose of the ID Affidavit Regarding Residence in Trust is to confirm the residency of the trust for legal documentation, tax obligations, and to ensure compliance with state laws governing trusts.

What information must be reported on ID Affidavit Regarding Residence in Trust?

The information that must be reported includes the trust's name, address, the names and addresses of the beneficiaries, the relationship of the beneficiaries to the trust, and any other relevant details as required by local laws.

Fill out your ID Affidavit Regarding Residence in Trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ID Affidavit Regarding Residence In Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.