FL DoR DR-405 1997 free printable template

Show details

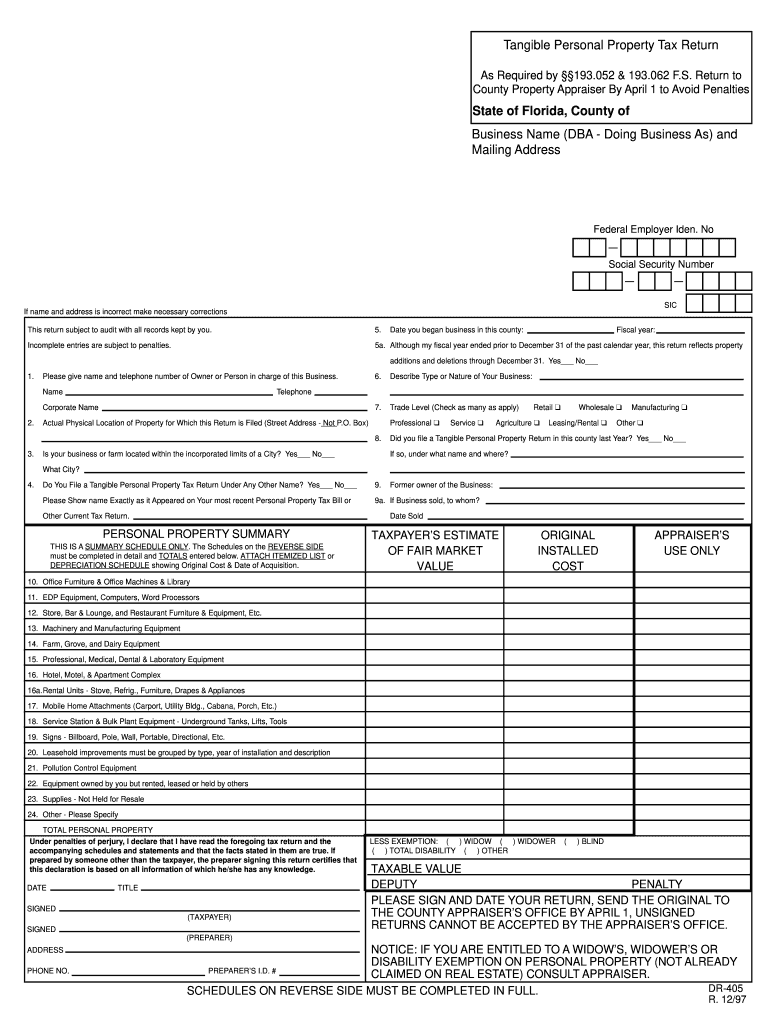

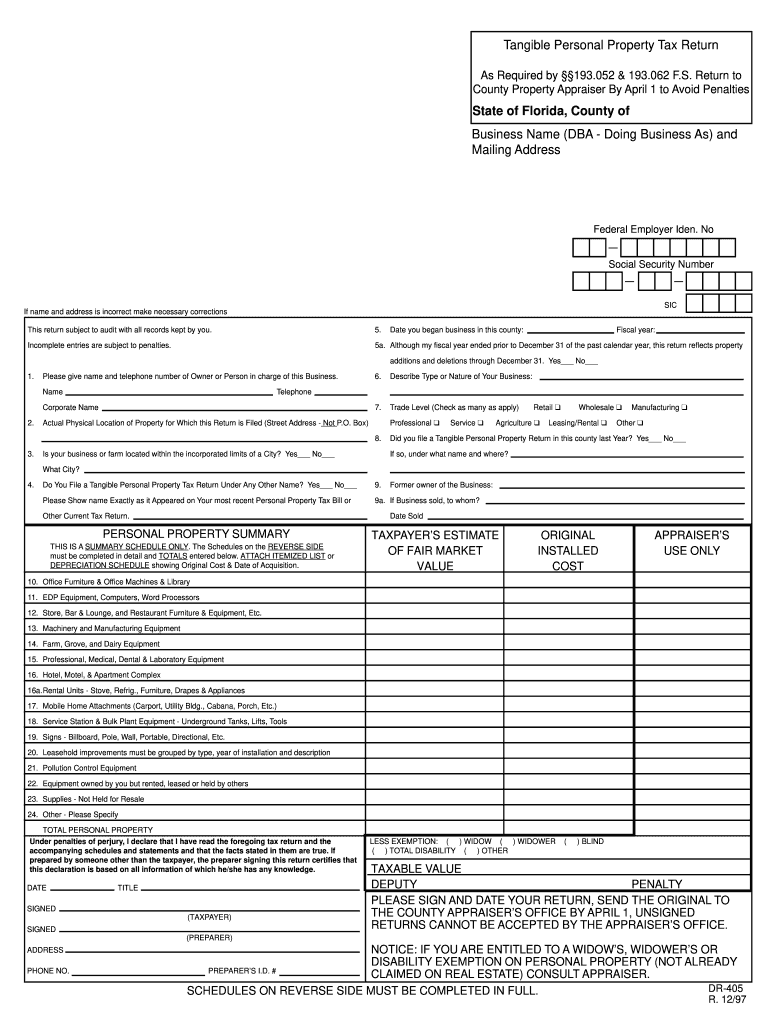

Tangible Personal Property Tax Return Confidential 193.074 F.S. As Required by 193.052 & 193.062 F.S. Return to County Property Appraiser By April 1 to Avoid Penalties State of Florida, County of

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your tangible personal property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tangible personal property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tangible personal property tax online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tangible personal property tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

FL DoR DR-405 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tangible personal property tax

How to fill out tangible personal property tax?

01

Gather all necessary documents: Before starting the process, make sure you have all the required documents such as inventory listings, asset details, and depreciation schedules for the taxable personal property.

02

Determine the tax jurisdiction: Identify the specific tax jurisdiction, such as county or municipality, where you are required to file the tangible personal property tax. Different jurisdictions may have different requirements and due dates.

03

Complete the tax form: Obtain the tangible personal property tax form from the appropriate tax authority. This form will typically include sections to report property details, assess its value, and calculate the corresponding tax liability. Fill out the form accurately and provide all the requested information.

04

Determine property value: Assess the value of your tangible personal property based on guidance provided by the tax authority. This may involve determining the fair market value of each item and considering factors such as age, condition, and depreciation.

05

Report property details: Provide descriptions and relevant information for each asset on the tax form. This may include item names, quantities, serial numbers, and other identifying details.

06

Calculate tax liability: Use the provided instructions on the tax form to calculate the tax liability for your tangible personal property. This may involve applying tax rates, exemptions, and deductions based on the tax jurisdiction's regulations.

07

Submit the form: Once you have completed the tax form and calculated the tax liability, submit it to the appropriate tax authority by the specified deadline. Ensure that you include any required supporting documents and payment if applicable.

Who needs tangible personal property tax?

01

Business entities: Most commonly, tangible personal property tax applies to businesses that own or use taxable personal property for their operations. This includes assets such as furniture, equipment, vehicles, and machinery.

02

Individuals with substantial assets: In some jurisdictions, individuals who own significant tangible personal property may also be required to pay tangible personal property tax. This can apply to high-value items like boats, aircraft, or expensive collections.

03

Property owners in specific locations: Certain locations may impose tangible personal property tax on property owners, regardless of whether they are businesses or individuals. This tax helps fund local government services and infrastructure.

Note: The specific requirements and exemptions for tangible personal property tax may vary depending on the jurisdiction. It is essential to consult the relevant tax authority or a professional tax advisor for accurate and up-to-date information.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tangible personal property tax?

Tangible personal property tax is a tax on physical assets that are used for business purposes, such as machinery, equipment, furniture, and inventory.

Who is required to file tangible personal property tax?

Businesses or individuals who own tangible personal property used for business purposes are required to file tangible personal property tax.

How to fill out tangible personal property tax?

To fill out tangible personal property tax, you need to gather information about your business assets, calculate their value, and complete the required forms provided by the tax authority.

What is the purpose of tangible personal property tax?

The purpose of tangible personal property tax is to generate revenue for local governments based on the value of physical assets used for business purposes.

What information must be reported on tangible personal property tax?

The information that must be reported on tangible personal property tax includes a detailed inventory of business assets, their value, and any applicable depreciation or exemptions.

When is the deadline to file tangible personal property tax in 2023?

The deadline to file tangible personal property tax in 2023 may vary depending on the jurisdiction. It is recommended to check with the local tax authority for the specific deadline.

What is the penalty for the late filing of tangible personal property tax?

The penalty for the late filing of tangible personal property tax may vary depending on the jurisdiction. Typically, it can include late filing fees, interest charges, and potential legal consequences. It is advised to check with the local tax authority for specific penalty information.

How do I complete tangible personal property tax online?

Completing and signing tangible personal property tax online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out the tangible personal property tax form on my smartphone?

Use the pdfFiller mobile app to complete and sign tangible personal property tax on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How can I fill out tangible personal property tax on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your tangible personal property tax, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your tangible personal property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.