CA A-1-131 1980 free printable template

Show details

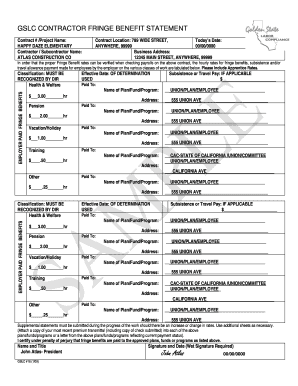

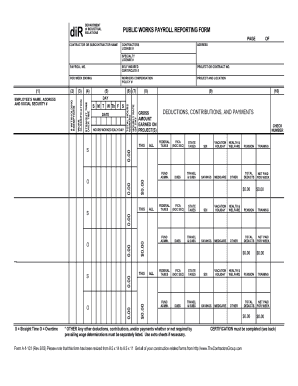

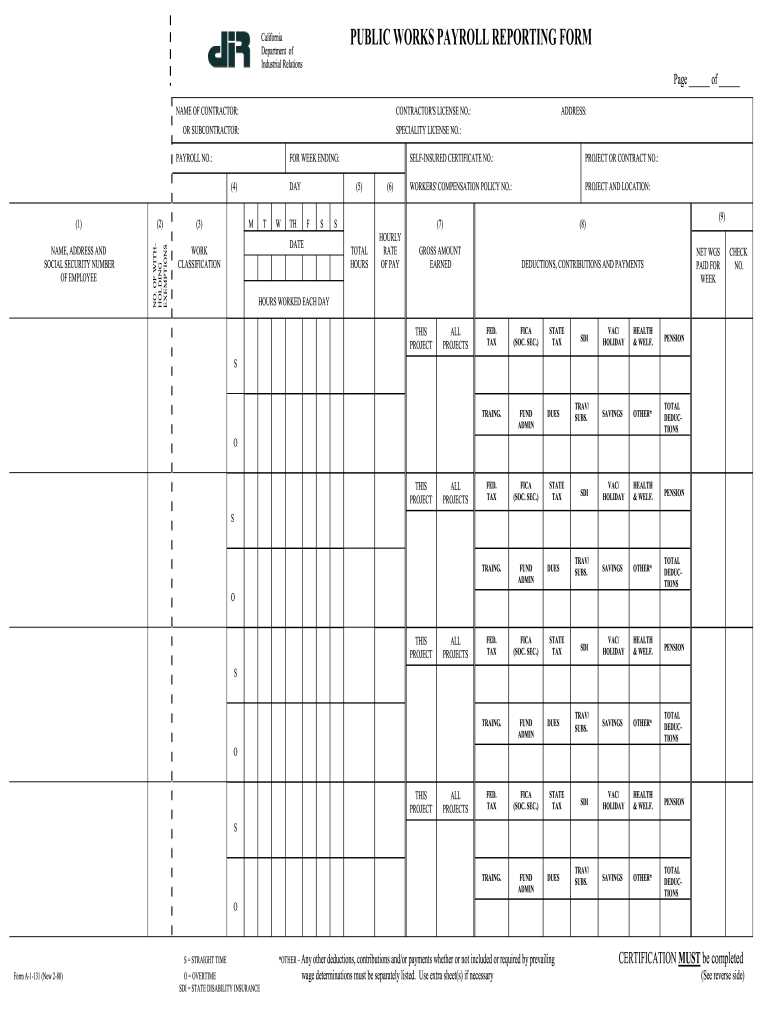

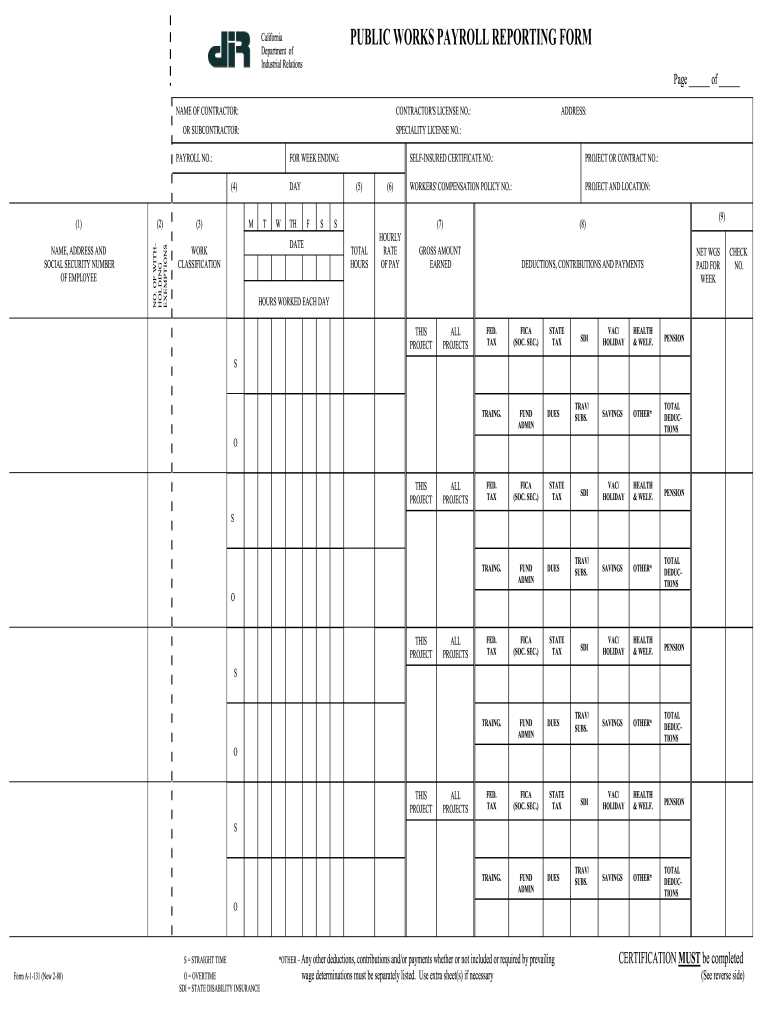

HOURS WORKED EACH DAY THIS PROJECT ALL FED. TAX FICA SOC. SEC. TRAING. FUND ADMIN STATE SDI VAC/ HOLIDAY HEALTH WELF. PENSION SAVINGS OTHER DEDUCTIONS DUES TRAV/ SUBS. O S STRAIGHT TIME Form A-1-131 New 2-80 O OVERTIME SDI STATE DISABILITY INSURANCE OTHER Any other deductions contributions and/or payments whether or not included or required by prevailing wage determinations must be separately listed. Use extra sheet s if necessary CERTIFICATION MUST be completed See reverse side NOTICE TO...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your california public works payroll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california public works payroll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit california public works payroll online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit california public works payroll. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

CA A-1-131 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out california public works payroll

How to fill out California public works payroll:

01

Gather all relevant employee information, including name, address, social security number, job classification, and pay rate.

02

Determine the correct prevailing wage rates for each job classification as mandated by the California Department of Industrial Relations.

03

Calculate the number of hours worked by each employee for each day of the pay period.

04

Multiply the hours worked by the respective prevailing wage rate for each employee to determine their gross wages.

05

Deduct any authorized payroll deductions, such as taxes, insurance premiums, or retirement contributions, from the gross wages to arrive at the net wages.

06

Complete the necessary payroll forms, such as the "Certified Payroll Report" or "Weekly Certified Payroll Record," accurately and legibly, including all required information.

07

Submit the completed payroll forms to the appropriate parties, such as the general contractor, government agency, or payroll company, as instructed by the project specifications or contract.

Who needs California public works payroll:

01

Contractors and subcontractors involved in public works projects funded by the state of California.

02

Government agencies or departments overseeing public works projects in California.

03

Workers employed on public works projects in California who are entitled to receive prevailing wages as specified by state law.

Fill form : Try Risk Free

People Also Ask about california public works payroll

What is a statement of non performance?

What is the current prevailing wage in California?

What are the 4 versions of wage determination?

What is the penalty for prevailing wage in California?

What is certified payroll California?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is california public works payroll?

California public works payroll refers to the wages and salaries paid to workers who are employed on public works projects in California. Public works projects are construction, maintenance, alteration, or repair projects that are funded, in whole or in part, by public money. These projects can be state-funded or funded by local government entities such as counties, cities, or school districts.

Under California law, public agencies are required to pay prevailing wages and benefits to workers employed on public works projects. Prevailing wages are the minimum hourly rates and benefits established by the California Department of Industrial Relations (DIR) for the specific craft or classification of work in a particular geographic area. The purpose of prevailing wage laws is to ensure that workers on public works projects are paid fair wages and benefits that are consistent with the local labor market.

Public agencies are responsible for calculating and tracking the payroll for workers on public works projects. The payroll includes various components such as base wages, fringe benefits, and overtime payments. It is the responsibility of public agencies to ensure compliance with prevailing wage laws and to submit certified payroll records to the DIR on a regular basis.

Additionally, the California Department of Industrial Relations maintains a database called the Electronic Certified Payroll Reporting System (eCPR) to collect and store certified payroll records submitted by public agencies and contractors. This database allows public agencies, workers, and the public to access and verify the payroll data for public works projects in California.

Who is required to file california public works payroll?

The contractor or subcontractor working on a public works project in California is required to file the California public works payroll.

How to fill out california public works payroll?

To fill out California public works payroll, follow these steps:

1. Gather the necessary information: Collect all the relevant details required for completing the payroll. This includes the names and contact information of employees, their employment classification (e.g., laborer, carpenter, electrician), hours worked, and applicable prevailing wage rates for each classification.

2. Determine the pay period: Decide on the pay period for which you are processing the payroll. This could be weekly, bi-weekly, or semi-monthly.

3. Calculate the gross wages: Determine the total number of hours worked by each employee during the pay period and multiply it by the prevailing wage rate for their respective job classification. Ensure you are using the correct wage rates as per the published prevailing wage schedule.

4. Deduct taxes and withholdings: Subtract applicable federal, state, and local taxes from the gross wages of each employee. Additionally, deduct any authorized withholdings such as social security, Medicare, health insurance, or retirement contributions.

5. Determine overtime wages: If any employee has worked more than the standard hours defined by California labor laws (usually 8 hours per day or 40 hours per week), calculate the overtime wages. Overtime rates are typically 1.5 times the regular hourly wage.

6. Calculate fringe benefits: If required by the applicable prevailing wage determination, calculate and include any fringe benefit payments. These can include health and welfare benefits, pension contributions, or vacation and sick pay accruals.

7. Calculate total labor costs: Add up the gross wages, overtime wages, and fringe benefits to arrive at the total labor costs for each employee.

8. Complete the payroll forms: Using the above calculations, fill out the required payroll forms. Typical forms for California public works include a certified payroll report (Form DIR- Certified Payroll Records), Statement of Compliance (Form PW-10), and any other forms specific to your project or agency.

9. Submit the payroll report: File the completed payroll report with the appropriate agency or governing body responsible for monitoring public works projects, such as the California Department of Industrial Relations (DIR) or the contracting agency.

10. Maintain records: Keep all payroll records, including timesheets, pay stubs, and payroll reports, for a minimum of three years as mandated by California law. These records may be subject to audit or inspection by governing bodies or agencies.

It is important to note that certain details and requirements may vary depending on the specific project, funding source, or agency. Therefore, consult the relevant prevailing wage determinations, contract documents, or seek professional advice to ensure compliance with all applicable regulations.

What is the purpose of california public works payroll?

The purpose of California public works payroll is to ensure that workers on public works projects are paid fair wages and benefits according to prevailing wage laws. These laws aim to prevent the underpayment and exploitation of workers by requiring contractors and subcontractors on public projects to pay employees the prevailing wage rates determined by the Director of the Department of Industrial Relations. The public works payroll system helps monitor and enforce compliance with these laws, ensuring that workers receive reasonable compensation for their labor.

What information must be reported on california public works payroll?

Under California law, the following information must be reported on public works payroll:

1. Employee Information: The name, address, social security number, classification of work, and hourly/daily rate of each employee who worked on the public works project.

2. Hours Worked: The number of hours worked by each employee in each classification of work, including overtime hours worked.

3. Rate of Pay: The prevailing rate of per diem wages paid, the amount of employer payments for health and welfare, pension, vacation, and other benefits paid or furnished, and any cash equivalent of those benefits.

4. Deductions: The amount and purpose of any and all deductions made from the employee's wages.

5. Benefits: Information regarding any employer payments made to a third party for the purpose of providing benefits to the employees (e.g., union trust funds).

6. Certified Payroll Records: The certified payroll records must be submitted on a weekly basis to the awarding body or the contractor's payroll service company.

It is important to note that the specific reporting requirements may vary depending on the public works project and the applicable prevailing wage rates. It is recommended to consult the California Labor Code and relevant regulations for the most accurate and up-to-date information.

When is the deadline to file california public works payroll in 2023?

The deadline to file California public works payroll for 2023 is typically within the first 10 days of the month following the reporting period. However, the exact deadline may vary depending on the specific reporting requirements set by the California Department of Industrial Relations. It is always advisable to check their official website or consult with a professional for the most accurate and up-to-date information regarding specific deadlines.

What is the penalty for the late filing of california public works payroll?

The penalty for the late filing of California public works payroll varies depending on the specific circumstances. However, according to California Labor Code Section 1775, in general, contractors and subcontractors who fail to submit certified payroll records within the required timeframes may be subject to civil penalties.

The penalty amount may range from $25 to $100 for each calendar day of noncompliance, or as determined by the Director of the Department of Industrial Relations. The Director may also consider other factors such as the size of the project and the willfulness of the violation when imposing penalties.

It is important to note that the specific penalty amount may vary and should be confirmed with the California Department of Industrial Relations for accurate and up-to-date information.

How do I edit california public works payroll straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing california public works payroll, you need to install and log in to the app.

Can I edit california public works payroll on an Android device?

The pdfFiller app for Android allows you to edit PDF files like california public works payroll. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I complete california public works payroll on an Android device?

On an Android device, use the pdfFiller mobile app to finish your california public works payroll. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your california public works payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.