Get the free Continuing Guarantee - housing usc

Show details

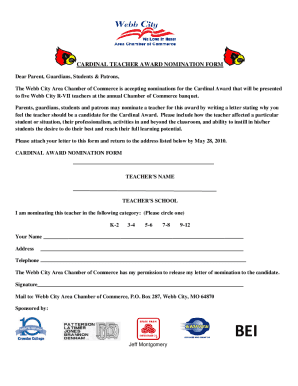

This document serves as a guarantee by the Guarantor for the payment of rent and damages by the Renter to the Owner in relation to a lease agreement.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign continuing guarantee - housing

Edit your continuing guarantee - housing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your continuing guarantee - housing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing continuing guarantee - housing online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit continuing guarantee - housing. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out continuing guarantee - housing

How to fill out Continuing Guarantee

01

Begin by obtaining the Continuing Guarantee form from your lender or financial institution.

02

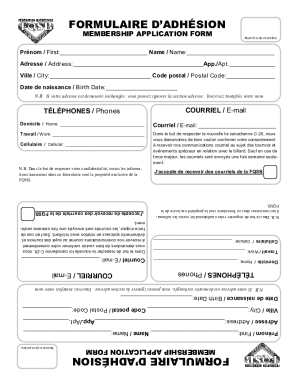

Fill in your personal details, including name, address, and contact information at the top of the form.

03

Clearly state the name of the borrower for whom you are providing the guarantee.

04

Specify the details of the loan or credit for which the guarantee is being provided, including amount and terms.

05

Review the obligations you are undertaking as a guarantor, ensuring you understand the risk involved.

06

Include any necessary supporting documentation as required by the lender, such as proof of income or credit history.

07

Sign the document where indicated, confirming your agreement to the terms of the guarantee.

08

Provide the completed form to the lender, keeping a copy for your records.

Who needs Continuing Guarantee?

01

Individuals or businesses looking to secure a loan or credit facility may require a Continuing Guarantee.

02

Lenders often require a Continuing Guarantee from someone with a good credit history to decrease their risk.

03

This guarantee is useful for borrowers who may not have sufficient creditworthiness on their own.

Fill

form

: Try Risk Free

People Also Ask about

What are the three types of warranties?

Generally, there are three warranty types relating to product liability claims: express warranties, implied warranty of fitness for particular purpose, and implied warranty of merchantability. These are specific legal terms that are unfamiliar to most.

What are the three types of guarantees?

Traditionally, a distinction is made between: Real guarantees relating to assets having an intrinsic value. Personal guarantees involving a debt obligation for one or more people. Moral guarantees that do not provide the lender with any real legal security.

What does continuing guaranty mean?

A continuing guaranty is a promise made by someone to pay a debt or perform a duty if another person fails to do so. This type of guaranty applies to a series of transactions or an ongoing relationship, rather than just one specific instance.

How many kinds of guarantees are there?

Summary Table Type of GuaranteeDescription Specific Guarantee For a single transaction or obligation. Continuing Guarantee Covers a series of transactions or obligations. Personal Guarantee Individual assumes liability for the debtor's default. Corporate Guarantee Company assumes liability for another entity's debt.11 more rows

What are the three types of bank guarantees?

Bank guarantees are mostly seen in international business transactions, although they may also individuals may need a guarantee to rent property in some countries. Different types of guarantees include a performance bond guarantee, an advance payment guarantee, a warrantee bond guarantee, and a rental guarantee.

What is a continuing guarantor?

A continuing guarantee provides lasting security for creditors by ensuring that a guarantor remains responsible for a borrower's obligations over time.

What are the three guarantees?

After the proclamation of independence he continued with the creation of "Imperial Mexico." His army was called that of the Three Guarantees: Catholicism, Independence, and Union (of the opposed parties after the war).

What is a continuing guarantee?

It means the surety promises to be responsible not just for one specific transaction but for multiple transactions that may happen in the future between the principal debtor and the creditor. For example, if A agrees to be liable for any rent collected by C on behalf of B up to ₹5,000, it is a continuing guarantee.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Continuing Guarantee?

A Continuing Guarantee is a contractual agreement where one party agrees to be responsible for the obligations or debts of another party on an ongoing basis, covering multiple transactions over time.

Who is required to file Continuing Guarantee?

Typically, businesses or individuals who extend credit or enter into a contractual relationship that involves ongoing financial obligations may be required to file a Continuing Guarantee.

How to fill out Continuing Guarantee?

To fill out a Continuing Guarantee, one should provide the parties' names, specify the nature of the obligations guaranteed, outline the limits of liability, sign the document, and date it appropriately.

What is the purpose of Continuing Guarantee?

The purpose of a Continuing Guarantee is to provide security to the creditor by ensuring that the guarantor backs the debtor's future obligations, facilitating trust and financial transactions.

What information must be reported on Continuing Guarantee?

The Continuing Guarantee must include the name and address of the guarantor and the guaranteed party, the description of the obligations covered, the duration of the guarantee, and any specific terms or limits of the guarantee.

Fill out your continuing guarantee - housing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Continuing Guarantee - Housing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.