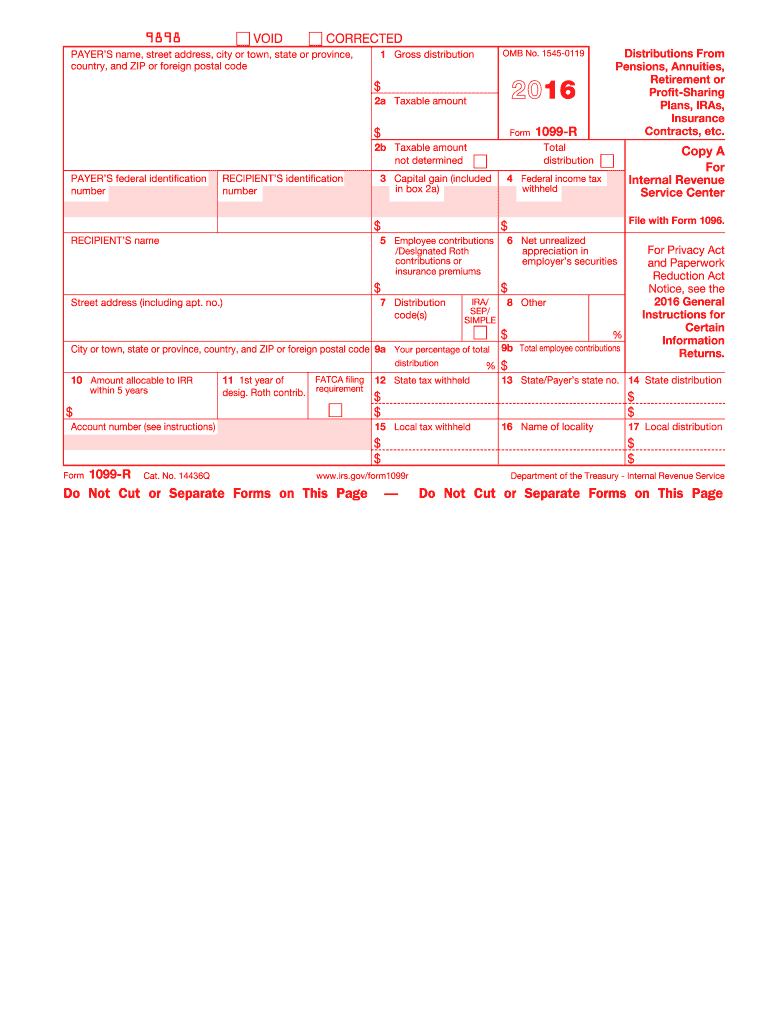

Who needs form 1099 — R?

In the USA, form 1099 — R or Distributions from Pensions, Annuities, or Profit-Sharing plans is sent to everyone who has been paid more than $10 from their retirement plan. In some cases, form 1099 — R is issued to the disabled employees or the ones who have work-related injuries.

What is form 1099 — R for?

The main aim of the form 1099 — R is to inform the individual about the payments he has received from a retirement fund. Additionally, the form is used to report such distributions:

-

Money transferred from the standard retirement plan to the individual retirement arrangement, that usually does not bear taxes

-

Money moved from retirement savings to another account

-

Cancellation of money transfer to another account or individual retirement arrangement

Every transaction reported in form 1099 -R is thoroughly checked to define whether it falls under taxation or is subject to a penalty.

Is form 1099 — R accompanied by other forms?

Form 1099-R is sent to the recipient in one copy. The recipient may sometimes be required to attach a tax return to the form 1099 — R.

When is form 1099 — R due?

According to the rules, form 1099 — R must be sent to the individual by February, 1, 2016. If it is not available by this time, the individual should turn to the IRS for help. The latter will contact the employer to request the missing form.

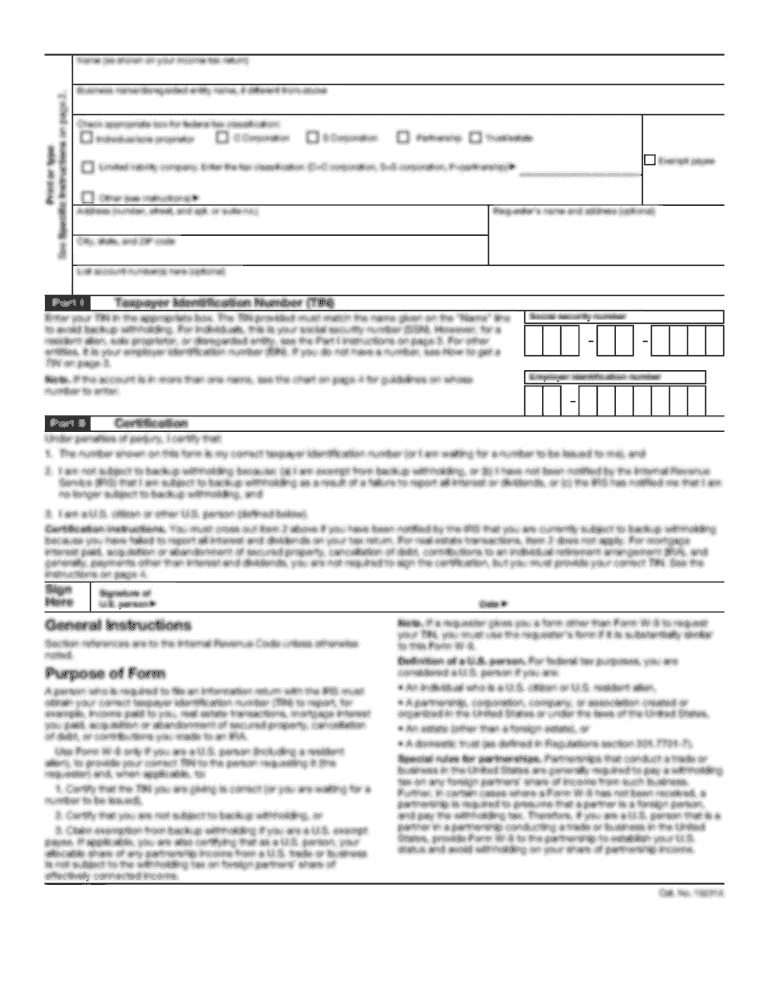

How do I fill out form 1099 — R?

Form 1099 — R consists of 17 boxes preceded by information about the payer and recipient. On the left you'll see the payer's name, contact information and identification number. Next there will be given the recipient's info including name and address.

The part on the right is filled out with the data about the payments and taxes withheld from them. All the boxes are of great importance. The detailed instructions on how to fill them out are provided on IRS official site. Here are some of the fields:

-

Field 1 — total amount of distribution before tax deduction

-

Field 2a — total amount of tax withheld

-

Field 2b — the tax amount unknown due to the insufficient data

-

Field 3 — any payments taxable as a capital gain

-

Field 4 — tax deducted from federal payments

-

Field 5 — tax-free payments that an employee may get

-

Field 9 — the percentage of the person whose name written on form 1099 — r

Etc.

Where do I send form 1099 — R?

Form 1099 — R is sent to the IRS and the recipients by the set date.