Get the free Unconsolidated Condensed Interim Balance Sheet

Show details

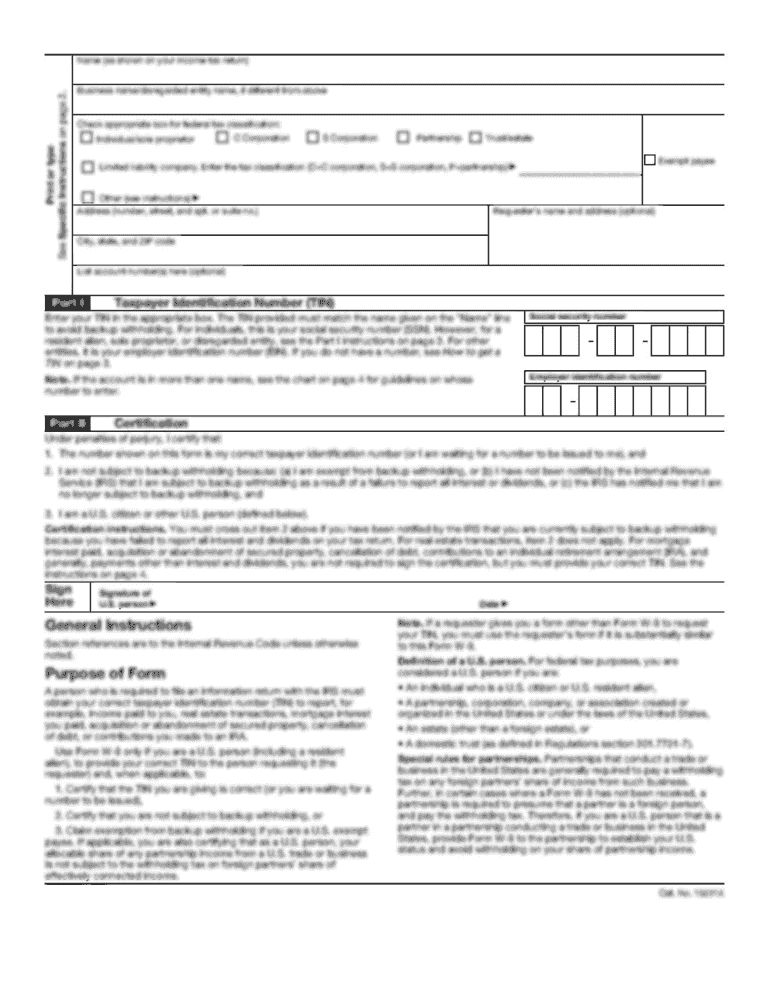

MCB Bank Limited Unconsolidated Condensed Interim Balance Sheet As at June 30, 2007, Note Audited Unaudited December 31, June 30, 2006 2007 (Rupees '000) Assets Cash and balances with treasury banks

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your unconsolidated condensed interim balance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unconsolidated condensed interim balance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing unconsolidated condensed interim balance online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit unconsolidated condensed interim balance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out unconsolidated condensed interim balance

How to fill out unconsolidated condensed interim balance?

01

Gather the necessary financial information: Begin by collecting all relevant financial data, including income statements, balance sheets, and cash flow statements, for the specific reporting period.

02

Review the accounting standards: Familiarize yourself with the applicable accounting standards and regulations that govern the preparation of unconsolidated condensed interim balance sheets. Ensure compliance with all reporting requirements.

03

Calculate the net income: Determine the net income for the reporting period by subtracting total expenses from total revenues. This figure represents the company's profitability during the specified time frame.

04

Determine assets and liabilities: Identify all assets owned by the company as of the reporting date. This may include cash, accounts receivable, inventory, property, and equipment. Similarly, assess the liabilities such as accounts payable, loans, and accrued expenses.

05

Prepare unconsolidated condensed balance sheet: Utilize the gathered information to prepare a condensed balance sheet that provides a snapshot of the company's financial position at the reporting date. Organize the assets, liabilities, and shareholders' equity sections accordingly.

06

Present the data in a clear format: Ensure that the unconsolidated condensed interim balance sheet is presented in a clear and concise manner, allowing easy comprehension and analysis by its intended users.

Who needs unconsolidated condensed interim balance?

01

Companies preparing financial reports: Businesses that are required to provide regular financial statements to internal and external stakeholders, such as shareholders, management, and regulatory bodies, need unconsolidated condensed interim balance sheets. These statements provide an overview of the company's financial performance and position during a specific time period.

02

Investors and shareholders: Investors and shareholders, who have a vested interest in the company's financial health, often rely on unconsolidated condensed interim balance sheets to assess profitability, liquidity, and solvency. This information aids in making informed investment decisions.

03

Financial analysts and professionals: Financial analysts and professionals use unconsolidated condensed interim balance sheets to evaluate the financial performance of a company and conduct various analyses, such as ratio analysis, to measure its financial strength and stability.

04

Regulatory bodies and auditors: Regulatory bodies overseeing financial reporting, such as the Securities and Exchange Commission (SEC) in the United States, may require companies to submit unconsolidated condensed interim balance sheets for compliance purposes. Auditors also rely on these statements to ensure accuracy and validity of the reported financial data.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is unconsolidated condensed interim balance?

Unconsolidated condensed interim balance is a financial statement that provides a snapshot of a company's financial position at a specific point in time.

Who is required to file unconsolidated condensed interim balance?

Companies with publicly traded securities are typically required by regulatory authorities to file unconsolidated condensed interim balance.

How to fill out unconsolidated condensed interim balance?

To fill out unconsolidated condensed interim balance, companies need to compile financial information such as assets, liabilities, and equity, for a specific period.

What is the purpose of unconsolidated condensed interim balance?

The purpose of unconsolidated condensed interim balance is to provide stakeholders with insight into the company's financial health and performance.

What information must be reported on unconsolidated condensed interim balance?

Information such as cash balances, accounts receivable, accounts payable, and inventory must be reported on unconsolidated condensed interim balance.

When is the deadline to file unconsolidated condensed interim balance in 2023?

The deadline to file unconsolidated condensed interim balance in 2023 will vary depending on the reporting requirements of the regulatory authorities.

What is the penalty for the late filing of unconsolidated condensed interim balance?

Penalties for the late filing of unconsolidated condensed interim balance may include monetary fines or sanctions imposed by regulatory authorities.

How do I complete unconsolidated condensed interim balance online?

pdfFiller has made it easy to fill out and sign unconsolidated condensed interim balance. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit unconsolidated condensed interim balance online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your unconsolidated condensed interim balance and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an eSignature for the unconsolidated condensed interim balance in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your unconsolidated condensed interim balance and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your unconsolidated condensed interim balance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.