Get the free 401(k) Retirement Plan Interest Checking

Show details

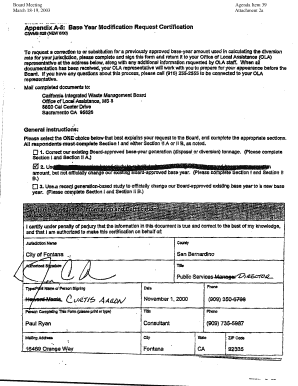

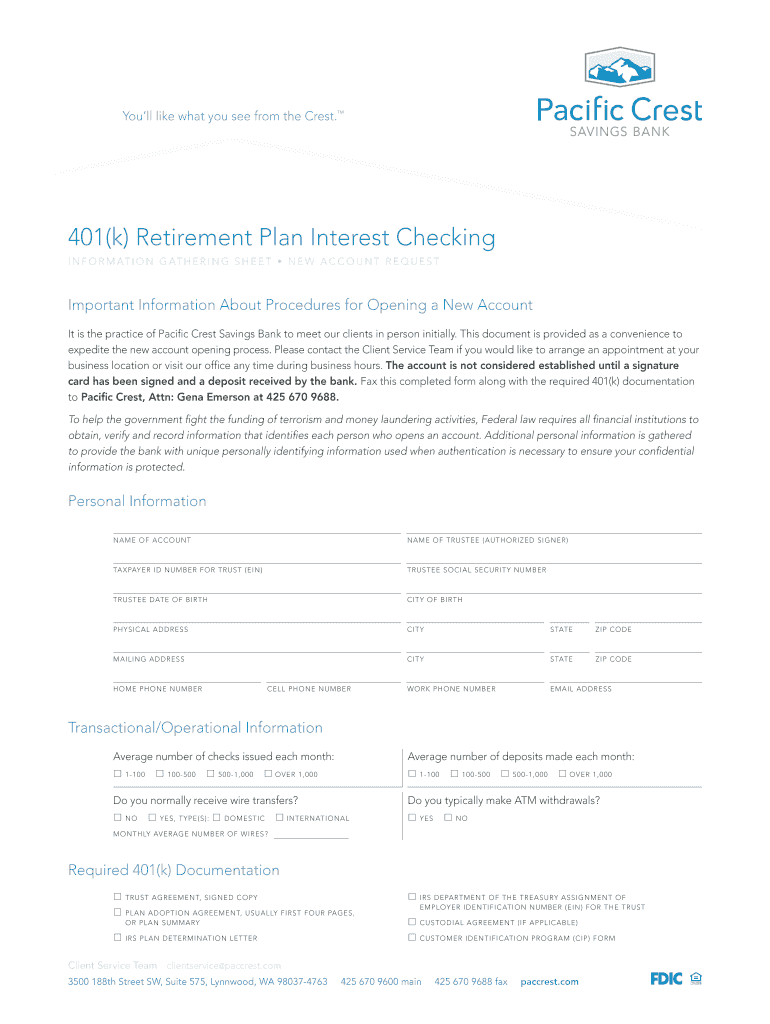

You'll like what you see from the Crest. 401(k) Retirement Plan Interest Checking I N F O R M AT I O N G AT H E R I N G S H E E T N E W A C C O U N T R E Q U E S T Important Information About Procedures

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 401k retirement plan interest

Edit your 401k retirement plan interest form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 401k retirement plan interest form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 401k retirement plan interest online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 401k retirement plan interest. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 401k retirement plan interest

How to fill out 401k retirement plan interest:

01

Obtain the necessary forms: To fill out your 401k retirement plan interest, start by obtaining the required forms from your employer or retirement plan provider. These forms typically include a beneficiary designation form, investment allocation form, and possibly a withdrawal request form.

02

Understand your options: Take the time to understand the various options available within your 401k retirement plan. This may include choosing between different investment funds, deciding on a contribution amount, and selecting any employer matching options. Educate yourself on the different investment risks and potential returns associated with each option.

03

Provide accurate personal information: Fill out the forms with accurate personal information, including your full name, social security number, and contact details. Double-check all information for accuracy to avoid any potential issues or delays in processing.

04

Designate beneficiaries: Determine who you want to receive your 401k funds in the event of your passing by filling out the beneficiary designation form. You can designate one or multiple beneficiaries, specifying the percentage or portion of the account they should receive.

05

Allocate your investments: Decide how you want your contributions to be allocated among the available investment options. You may choose to diversify your investments across different funds or focus on specific ones based on your risk tolerance and investment goals. Complete the investment allocation form accordingly.

06

Review and submit: Carefully review all the filled-out forms to ensure accuracy and completeness. If everything looks correct, submit the forms to your employer or retirement plan provider. Retain copies for your records.

Who needs 401k retirement plan interest?

01

Employees: 401k retirement plans are primarily designed for employees who want to save for their retirement. If you are currently employed and your employer offers a 401k plan, you may benefit from participating in it. It allows you to contribute a portion of your salary to the plan on a pre-tax basis, helping you save for retirement while potentially reducing your taxable income.

02

Self-employed individuals: Even if you are self-employed, you can still establish and contribute to a solo 401k plan. This retirement account option is suitable for sole proprietors, freelancers, and small business owners with no employees, or those with only a spouse working in the business.

03

Individuals seeking tax advantages: 401k retirement plans offer attractive tax advantages. Contributions made to a traditional 401k are tax-deferred, meaning you contribute pre-tax dollars, reducing your taxable income for the year. Additionally, any investment gains within the plan are tax-deferred until withdrawal.

04

Those looking for employer match: Many employers offer a matching contribution as a benefit of participating in a 401k plan. This means that for every dollar you contribute to your retirement plan, your employer may match a certain percentage, increasing your overall savings. Taking advantage of this employer match can significantly boost your retirement savings over time.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 401k retirement plan interest in Gmail?

401k retirement plan interest and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get 401k retirement plan interest?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific 401k retirement plan interest and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete 401k retirement plan interest online?

Completing and signing 401k retirement plan interest online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

What is 401k retirement plan interest?

401k retirement plan interest refers to the earnings or returns generated from investments held within a 401k retirement account.

Who is required to file 401k retirement plan interest?

Individuals who have a 401k retirement account are required to report the interest earned on their account.

How to fill out 401k retirement plan interest?

When filing taxes, individuals can usually find the 401k retirement plan interest information on their year-end statement provided by their financial institution.

What is the purpose of 401k retirement plan interest?

The purpose of 401k retirement plan interest is to help individuals save and invest for their retirement years.

What information must be reported on 401k retirement plan interest?

The interest earned on investments within the 401k retirement account must be reported when filing taxes.

Fill out your 401k retirement plan interest online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

401k Retirement Plan Interest is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.