Get the free LOTTERY AND GAMING CREDIT APPLICATION FOR - co kenosha wi

Show details

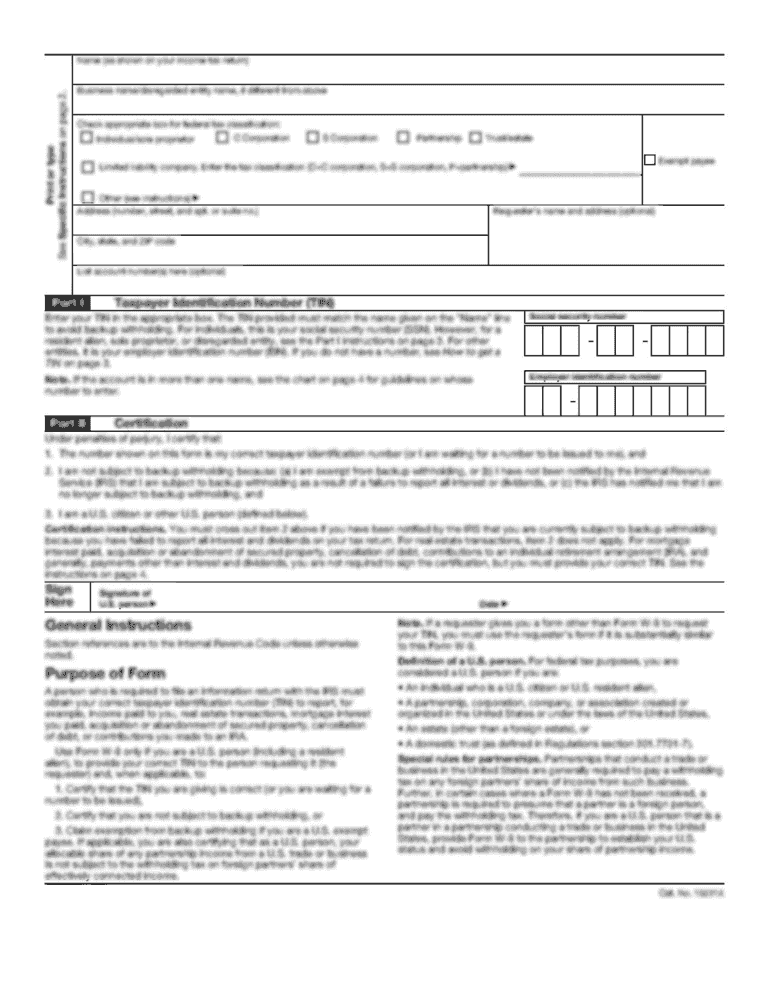

LOTTERY AND GAMING CREDIT APPLICATION FOR 2014 PROPERTY TAXES PAYABLE IN 2015 This application is to be used to claim a lottery and gaming credit on the December 2014 property tax bill for the property

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your lottery and gaming credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lottery and gaming credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lottery and gaming credit online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit lottery and gaming credit. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out lottery and gaming credit

How to fill out lottery and gaming credit:

01

Start by obtaining a lottery and gaming credit application form. This can usually be found on the official website of your local lottery or gaming authority.

02

Carefully read the instructions provided on the application form to ensure that you understand the eligibility criteria and requirements for obtaining the credit.

03

Gather all the necessary documents and information that may be required to complete the application. This may include proof of identification, proof of address, and any other supporting documents as specified on the application form.

04

Fill out the application form accurately and legibly. Be sure to provide all the required information, such as your full name, contact details, and any other personal information requested on the form.

05

Pay attention to any specific sections or questions related to your eligibility for the credit. For example, there may be questions regarding your annual income, age, or any previous gambling-related issues.

06

Double-check your application form for any errors or missing information before submitting it. This will help avoid delays or any issues with your application.

07

Gather any supporting documents that need to be submitted along with your application. This may include copies of your identification documents, proof of address, and any other required paperwork.

08

Submit your completed application form and supporting documents through the designated channel mentioned on the form. This can be via mail, online submission, or in-person at a specific office or branch.

09

Wait for a confirmation or acknowledgment of your application. This may include a reference number or a notification stating that your application is being processed.

10

Keep copies of the application form, supporting documents, and any communication related to your lottery and gaming credit application for future reference.

Who needs lottery and gaming credit?

01

Individuals who frequently engage in gambling activities, such as playing the lottery, online gambling, or visiting casinos, may consider applying for lottery and gaming credit.

02

This credit can be especially beneficial for individuals who experience financial constraints but still wish to partake in gambling activities responsibly.

03

Lottery and gaming credit can provide financial assistance in the form of credits or vouchers that can be used to purchase lottery tickets or place bets, allowing individuals to enjoy these activities without straining their personal finances.

04

It may also be helpful for individuals who want to establish a gambling budget and ensure they do not overspend or go beyond their predetermined limits.

05

Eligibility criteria for lottery and gaming credit may vary depending on the jurisdiction and authority issuing the credit. Therefore, individuals interested in obtaining such credit should review the specific requirements to determine their eligibility.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is lottery and gaming credit?

Lottery and gaming credit is a tax credit that can be claimed on Illinois income tax returns by individuals who have purchased Illinois Lottery tickets or invested in certain gaming activities.

Who is required to file lottery and gaming credit?

Individuals who have purchased Illinois Lottery tickets or invested in certain gaming activities are required to file for lottery and gaming credit if they meet the eligibility requirements.

How to fill out lottery and gaming credit?

To fill out lottery and gaming credit, individuals must complete Schedule IL-WIT, Illinois Lottery and Gaming Credit, and include it with their Illinois income tax return.

What is the purpose of lottery and gaming credit?

The purpose of lottery and gaming credit is to provide tax relief to individuals who participate in Illinois Lottery games or certain gaming activities.

What information must be reported on lottery and gaming credit?

Information such as the amount spent on Illinois Lottery tickets or gaming activities, the winnings received, and other relevant details must be reported on the lottery and gaming credit form.

When is the deadline to file lottery and gaming credit in 2023?

The deadline to file lottery and gaming credit in 2023 is April 15, 2024.

What is the penalty for the late filing of lottery and gaming credit?

The penalty for the late filing of lottery and gaming credit is a 5% penalty for each month that the credit is filed late, up to a maximum of 25% of the credit amount.

How do I edit lottery and gaming credit in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing lottery and gaming credit and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How can I edit lottery and gaming credit on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing lottery and gaming credit right away.

How do I edit lottery and gaming credit on an Android device?

You can make any changes to PDF files, such as lottery and gaming credit, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your lottery and gaming credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.