Get the free EFFECTIVE ENACTED COURTHOUSE 109 MARKET STREET ROOM - carolinemd

Show details

COUNTY COMMISSIONERS OF CAROLINE COUNTY, MARYLAND ORDINANCE #20143 PUBLIC HEARING: OCTOBER 28, 2014; BEGINNING AT 7:00 PM COURTHOUSE, 109 MARKET STREET, ROOM 106, DENTON, MARYLAND ENACTED: EFFECTIVE:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your effective enacted courthouse 109 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your effective enacted courthouse 109 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing effective enacted courthouse 109 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit effective enacted courthouse 109. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

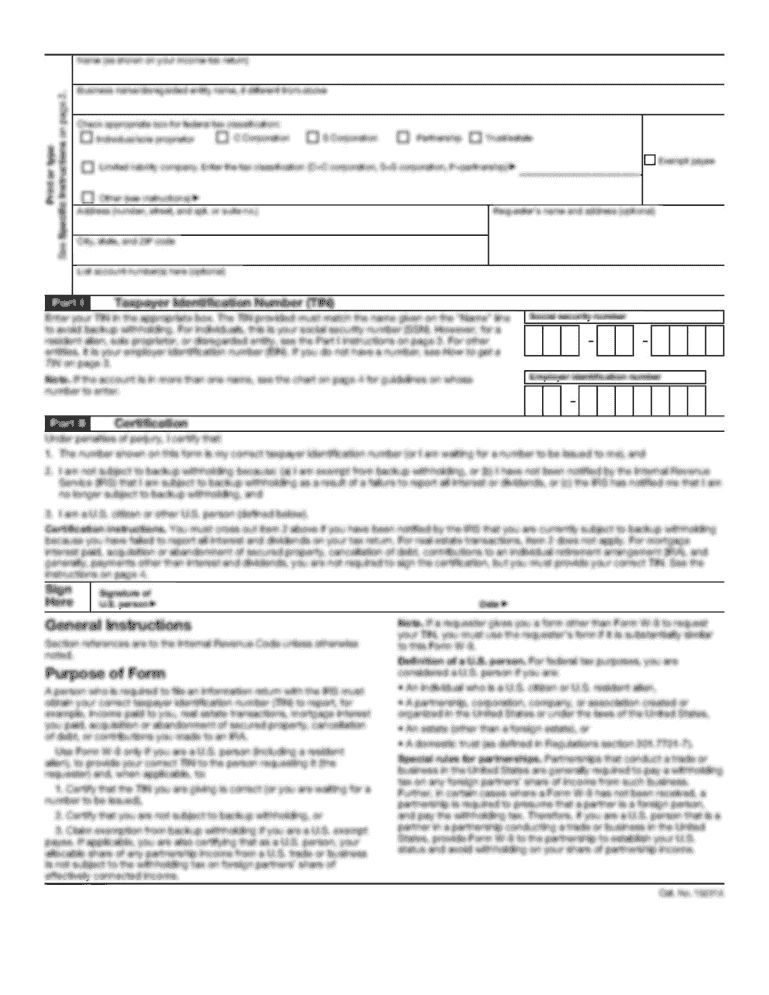

How to fill out effective enacted courthouse 109

How to fill out effective enacted courthouse 109:

01

Start by gathering all the necessary information and documents required for filling out the form, such as personal identification details and relevant financial records.

02

Carefully review the instructions provided with the form to ensure you understand the requirements and any specific guidelines for completing it.

03

Begin by accurately entering your personal information in the designated sections of the form, such as your name, address, and social security number.

04

Proceed to the financial sections of the form, providing details about your income, expenses, and any applicable deductions or exemptions.

05

Double-check all the information you have entered to ensure it is accurate and error-free. Mistakes or inconsistencies may result in delays or complications in processing your form.

06

If you have any questions or uncertainties while filling out the form, consider seeking assistance from a tax professional or consulting relevant resources for guidance.

Who needs effective enacted courthouse 109:

01

Individuals who have been mandated by a court to fill out the effective enacted courthouse 109 form as part of a legal process.

02

Legal professionals and court officials who deal with legal matters and require the form to document and record important information related to courthouse proceedings.

03

Individuals or entities involved in legal disputes or cases that require them to provide detailed information or disclosure related to courthouse procedures.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is effective enacted courthouse 109?

Effective enacted courthouse 109 is a form used to report certain financial transactions to the IRS.

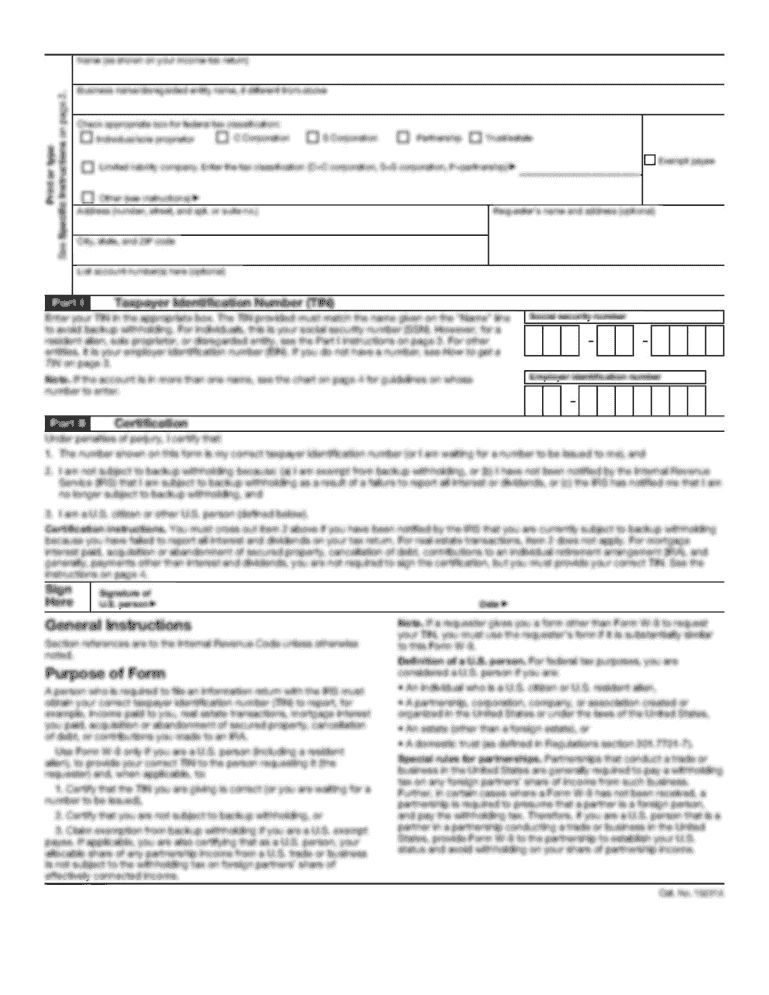

Who is required to file effective enacted courthouse 109?

Any individual or entity who has engaged in reportable financial transactions must file effective enacted courthouse 109.

How to fill out effective enacted courthouse 109?

You can fill out effective enacted courthouse 109 by providing the required information about the financial transactions you have engaged in.

What is the purpose of effective enacted courthouse 109?

The purpose of effective enacted courthouse 109 is to report specific financial transactions to the IRS for tax enforcement purposes.

What information must be reported on effective enacted courthouse 109?

Effective enacted courthouse 109 requires information such as the nature of the transaction, date of the transaction, and the amount involved.

When is the deadline to file effective enacted courthouse 109 in 2023?

The deadline to file effective enacted courthouse 109 in 2023 is April 15th.

What is the penalty for the late filing of effective enacted courthouse 109?

The penalty for the late filing of effective enacted courthouse 109 is $50 per form if filed within 30 days of the deadline, and $100 per form if filed more than 30 days after the deadline.

How can I manage my effective enacted courthouse 109 directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your effective enacted courthouse 109 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I execute effective enacted courthouse 109 online?

With pdfFiller, you may easily complete and sign effective enacted courthouse 109 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I sign the effective enacted courthouse 109 electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your effective enacted courthouse 109 and you'll be done in minutes.

Fill out your effective enacted courthouse 109 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.