Get the free W IN O O S K I S C H O O L - wsdschools

Show details

W IN O S K I S C H O O L district news! December 2011 Ch u g C h o o C h o celebrating Our Achievements! C Music Matters ! G an o C h an u g VOLUME 9, ISSUE 3 By Cathy ManderAdams 18th Annual Benefit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your w in o o form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w in o o form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing w in o o online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit w in o o. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

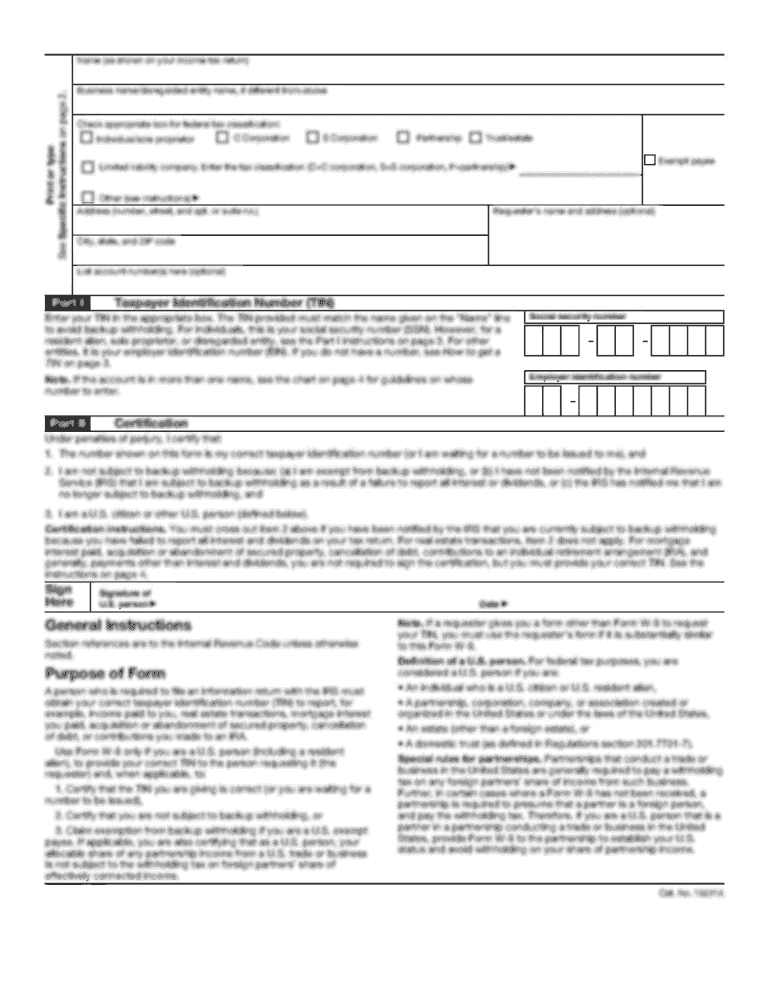

How to fill out w in o o

How to fill out w in o o?

01

Start by gathering all necessary information and documents. This includes personal details, such as your name, address, and contact information, as well as any relevant identification numbers or social security numbers.

02

Carefully read the instructions or guidelines provided with the form. This will help you understand the purpose of the form and any specific requirements for filling it out.

03

Begin by entering your personal information in the designated fields on the form. Make sure to double-check the accuracy of the information before moving on to the next step.

04

If there are any sections or questions that you are unsure about, consult the instructions or seek assistance from a professional. It is important to provide accurate and complete information on the form.

05

Review the completed form to ensure all information is correct and legible. If necessary, make any necessary corrections or additions.

06

Sign and date the form where indicated. This signature verifies that the information provided is true and accurate to the best of your knowledge.

07

Make a copy of the completed form for your records before submitting it.

08

Follow the specific submission instructions provided with the form. This may include mailing it to a specific address, submitting it online, or delivering it in person.

09

Keep a record of when and how you submitted the form, as well as any confirmation or receipt numbers provided.

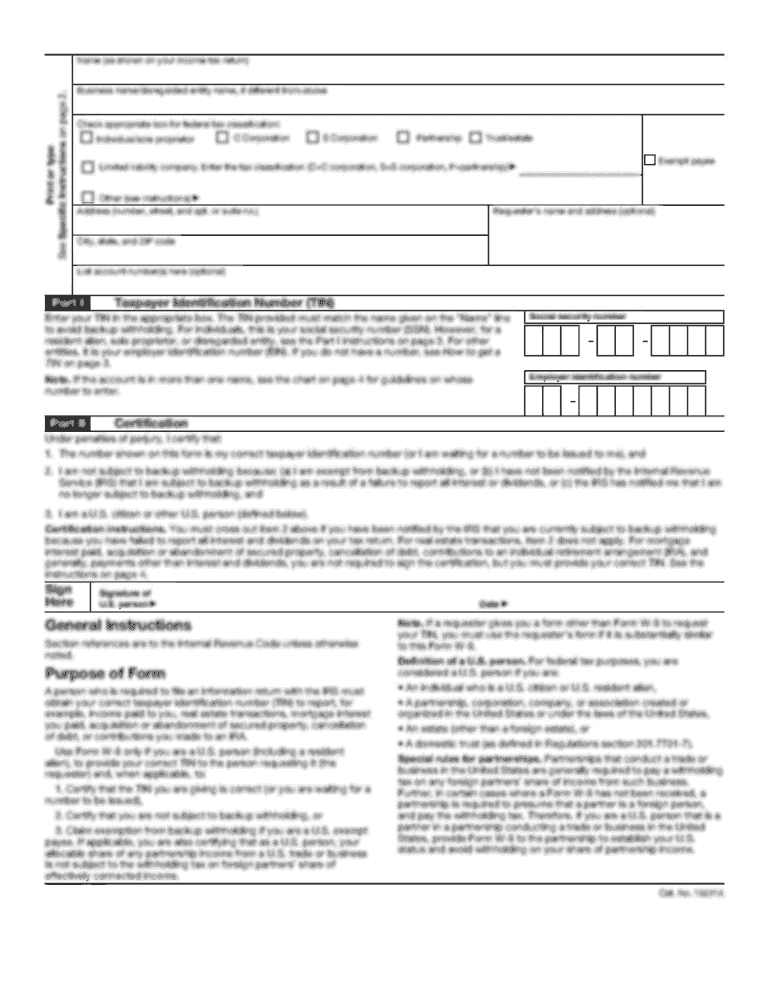

Who needs w in o o?

01

Individuals who are required to report certain information to a government agency or entity.

02

Employers who need to furnish employee wage and tax statements to both the employee and the Internal Revenue Service (IRS).

03

Individuals who receive various forms of income, such as self-employed individuals, independent contractors, or those who earn income from investments or rental properties. These individuals may need to report their income and expenses using the W-2 or W-3 forms.

04

Employers who pay wages to employees and are responsible for withholding income taxes, social security taxes, and Medicare taxes from employees' paychecks. These employers must issue W-2 forms to their employees and submit copies to the IRS.

05

Businesses or organizations that are required to file informational returns, such as 1099 forms, for non-employee compensation or other types of income paid to individuals or entities.

Overall, anyone who has tax or employment-related responsibilities may need to fill out the appropriate W form or form in the "o o" format. It is essential to understand the specific requirements and ensure accurate and timely reporting.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit w in o o online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your w in o o to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out w in o o using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign w in o o and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete w in o o on an Android device?

Use the pdfFiller mobile app and complete your w in o o and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your w in o o online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.