Get the free CITY OF JOSHUA TAX INCREMENT FINANCING TIF BOARD TUESDAY - cityofjoshuatx

Show details

CITY OF JOSHUA TAX INCREMENT FINANCING (TIF) BOARD TUESDAY, SEPTEMBER 29, 2009, SPECIAL SESSION 7:00 P.M. The Joshua Tax Increment Financing (TIF) Board will hold a Special Session at 7:00 p.m., at

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your city of joshua tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your city of joshua tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit city of joshua tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit city of joshua tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

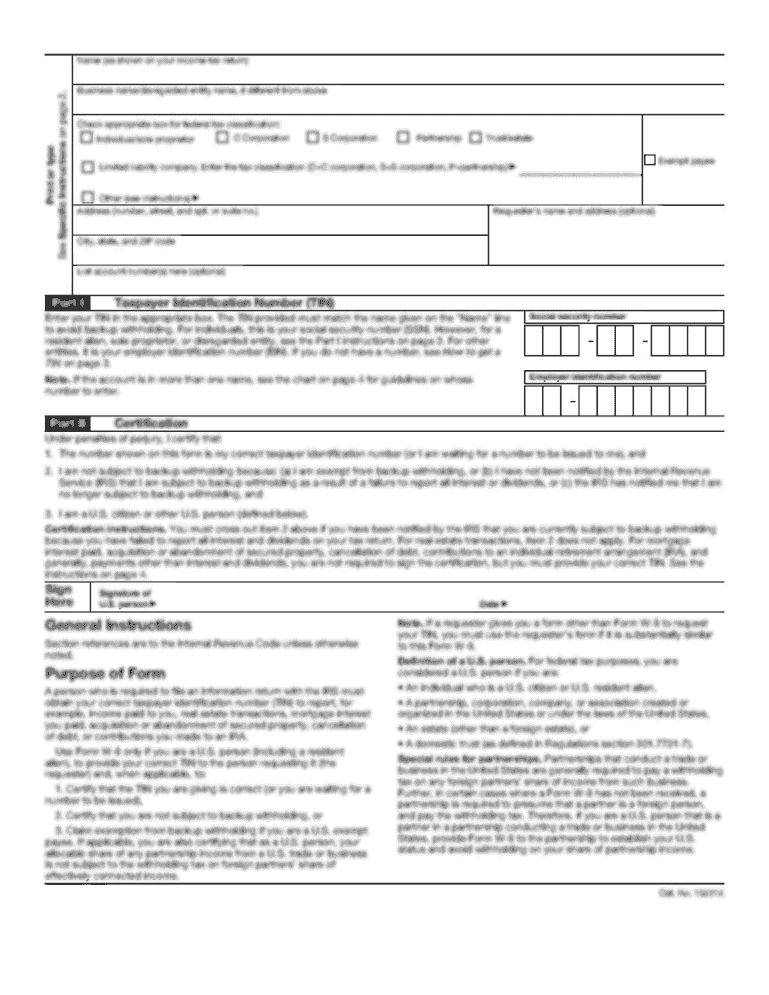

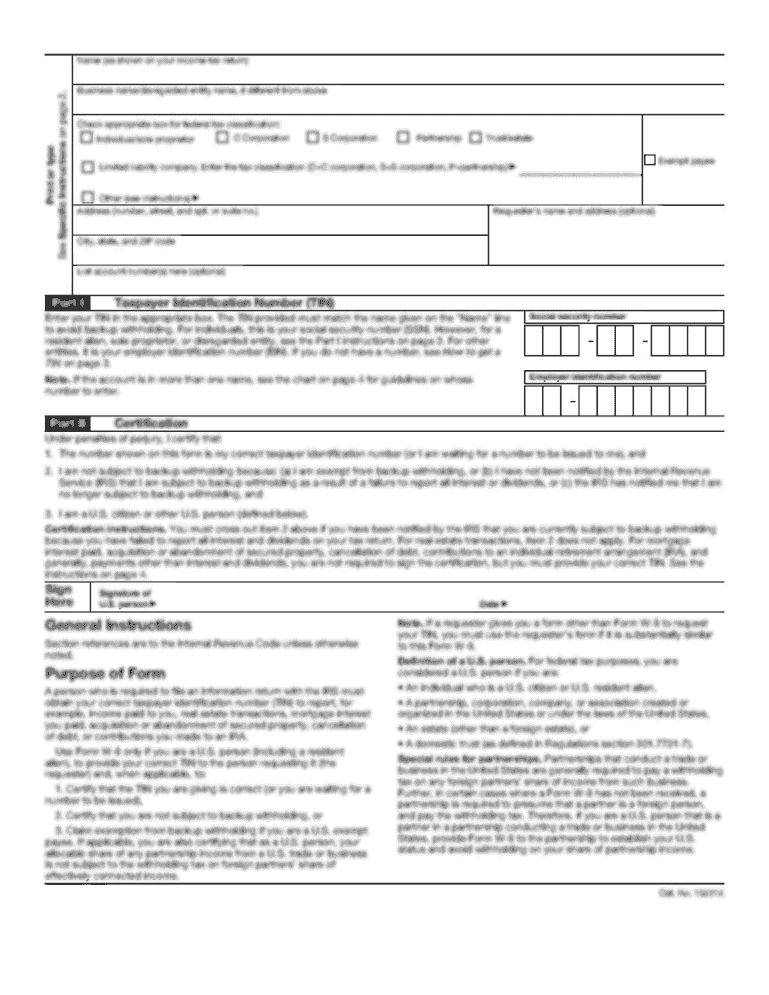

How to fill out city of joshua tax

How to fill out city of Joshua tax:

01

Gather necessary documents: Before filling out the city of Joshua tax forms, make sure you have all the necessary documents handy. This may include your W-2 forms, 1099 forms, receipts for deductible expenses, and any other relevant financial information.

02

Download the tax form: Visit the official website of the city of Joshua or the relevant tax authority to download the tax form. Make sure you have the correct form for the specific tax year you are filing for.

03

Fill in personal information: Begin filling in the tax form by providing your personal information such as your name, address, social security number, and any other details as required. Double-check the accuracy of these details to avoid any mistakes.

04

Provide income information: Enter your income details in the appropriate sections of the tax form. This may include your wages, salaries, tips, interest income, dividends, and any other sources of income. Be sure to include all income even if you did not receive a W-2 or 1099 form for it.

05

Deductions and credits: Determine if you are eligible for any deductions or credits that can help reduce your tax liability. Common deductions include mortgage interest, medical expenses, education expenses, and charitable contributions. Provide the necessary details and calculations for each deduction or credit you are claiming.

06

Calculate tax owed or refund: Once you have provided all the necessary information, calculate the amount of tax you owe or the refund you are entitled to. This can be done using the tax tables provided in the instructions or by utilizing online tax calculators.

07

Review and sign: Before submitting your tax form, thoroughly review all the information you have provided. Look for any errors or discrepancies that may need correction. Once satisfied, sign and date the form. If filing jointly with a spouse, ensure they also sign the form.

08

Submit the form: After completing the form and ensuring its accuracy, submit it to the city of Joshua tax department. Depending on the regulations, you may be required to mail it or submit it electronically through an online portal.

Who needs city of Joshua tax:

01

Residents of the city of Joshua: If you are a resident of the city of Joshua, you will typically be required to file and pay city taxes. This is applicable if you live within the city's jurisdiction boundaries.

02

Individuals earning income within the city: Even if you do not reside in the city of Joshua, you may still be required to pay city taxes if you earn income within the city's limits. This can include individuals who work within the city, own rental properties, or conduct business activities there.

03

Self-employed individuals: Self-employed individuals, including freelancers or independent contractors, who have a business presence or generate income within the city of Joshua may also need to file and pay city taxes.

It is important to note that tax requirements can vary, and it is always advisable to consult the official guidelines provided by the city of Joshua or seek professional tax advice to ensure compliance with all applicable tax laws.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get city of joshua tax?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the city of joshua tax in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit city of joshua tax online?

The editing procedure is simple with pdfFiller. Open your city of joshua tax in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out city of joshua tax on an Android device?

On Android, use the pdfFiller mobile app to finish your city of joshua tax. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your city of joshua tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.