Get the free Lodging Tax City of Petersburg Pamela C - petersburg-va

Show details

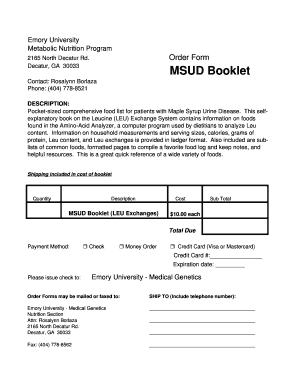

Lodging Tax City of Petersburg Pamela C. Hairs ton LT Lodging Tax Checks Payable To: City Treasurer Business Name Mailing Address Registration No. For Month of. Gross Receipts. 6 % Tax... Penalty

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your lodging tax city of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lodging tax city of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lodging tax city of online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit lodging tax city of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out lodging tax city of

How to fill out lodging tax city of?

01

Obtain the necessary forms from the city's tax department or website.

02

Fill in your personal information including your name, address, and contact details.

03

Provide details about your lodging business such as the business name, address, and type of lodging facility.

04

Fill in the dates and amount of income earned from lodging within the city.

05

Calculate the applicable tax rate based on the city's regulations and multiply it by the income earned.

06

Determine any deductions or exemptions that may apply to your situation and subtract them from the calculated tax amount.

07

Provide any supporting documents requested, such as copies of receipts or invoices.

08

Double-check all the information provided and make sure it is accurate and complete.

09

Sign and date the form, and submit it to the city's tax department along with any required payment.

Who needs lodging tax city of?

01

Property owners or operators who offer lodging services within the city are generally required to pay lodging tax.

02

This includes hotels, motels, bed and breakfasts, vacation rentals, and any other accommodations that charge guests for overnight stays.

03

Individuals or businesses that generate income from providing lodging services in the city may be liable for lodging tax.

04

It is important to check the specific regulations and requirements of the city you operate in, as they may vary.

Note: The information provided here is of a general nature and may not be applicable to all situations. It is recommended to consult with a tax professional or the city's tax department for specific guidance on lodging tax requirements in your city.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is lodging tax city of?

The lodging tax for the city of refers to a tax imposed on accommodations such as hotels, motels, and bed and breakfast establishments within the city boundaries.

Who is required to file lodging tax city of?

All operators of lodging establishments within the city boundaries are required to file lodging tax with the city.

How to fill out lodging tax city of?

Operators can fill out lodging tax forms online through the city's website or in person at the city's finance department.

What is the purpose of lodging tax city of?

The purpose of lodging tax for the city of is to generate revenue for the city by taxing accommodations provided to visitors.

What information must be reported on lodging tax city of?

Operators must report the total amount of revenue earned from lodging accommodations within the city, as well as any applicable deductions or exemptions.

When is the deadline to file lodging tax city of in 2023?

The deadline to file lodging tax for the city of in 2023 is typically on April 15th of each year.

What is the penalty for the late filing of lodging tax city of?

The penalty for late filing of lodging tax for the city of is typically a percentage of the total tax owed, calculated based on the number of days past the deadline.

How do I make edits in lodging tax city of without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your lodging tax city of, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I sign the lodging tax city of electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your lodging tax city of in minutes.

How do I fill out the lodging tax city of form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign lodging tax city of and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your lodging tax city of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.