Get the free SATISFACTION OF MORTGAGE - titleguaranteecom

Show details

Prepared by and return to: SATISFACTION OF MORTGAGE KNOW ALL MEN BY THESE PRESENTS: That, I, the owner and holder of a certain mortgage deed executed by, a person, to, a person bearing date of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your satisfaction of mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your satisfaction of mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

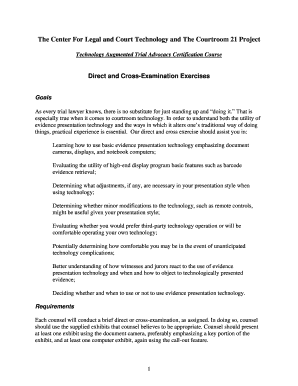

Editing satisfaction of mortgage online

To use the professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit satisfaction of mortgage. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

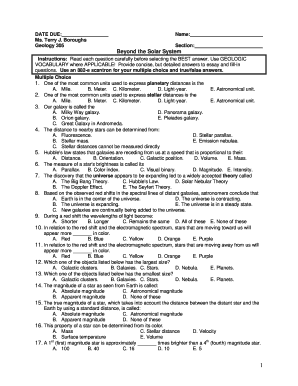

How to fill out satisfaction of mortgage

How to fill out satisfaction of mortgage:

01

Obtain the satisfaction of mortgage form from your mortgage lender, typically available on their website or by request.

02

Fill in your personal information accurately, including your full name, address, and contact details as requested in the form.

03

Provide the details of the mortgage, such as the mortgage account number, the original loan amount, and the date the mortgage was taken out.

04

Indicate the date of the final payment made towards the mortgage, and provide the exact amount paid.

05

If applicable, include any additional payments made towards the mortgage after the final payment and specify the dates and amounts.

06

Sign and date the satisfaction of mortgage form to acknowledge that the mortgage has been fully paid off.

07

Submit the completed form to the appropriate party as instructed by your mortgage lender.

08

Keep a copy of the filled-out satisfaction of mortgage form for your records.

Who needs satisfaction of mortgage:

01

Homeowners who have fully paid off their mortgage. A satisfaction of mortgage is a document that demonstrates that the homeowner has satisfied their financial obligation and that the mortgage is no longer valid.

02

Mortgage lenders or financial institutions require satisfaction of mortgage forms in order to release their claim on the property and confirm that the loan has been paid off in full.

03

Any future prospective buyers or title searchers may also request the satisfaction of mortgage to confirm the property's clear ownership and absence of any outstanding mortgage debt.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is satisfaction of mortgage?

Satisfaction of mortgage is a legal document issued by the lender when a mortgage loan has been fully paid off by the borrower.

Who is required to file satisfaction of mortgage?

The lender or their authorized agent is typically required to file satisfaction of mortgage with the appropriate government office.

How to fill out satisfaction of mortgage?

To fill out satisfaction of mortgage, you will need to include details such as the borrower's name, property address, loan amount, and date of final payment.

What is the purpose of satisfaction of mortgage?

The purpose of satisfaction of mortgage is to officially release the borrower from their mortgage obligation and to provide public record that the loan has been paid in full.

What information must be reported on satisfaction of mortgage?

The satisfaction of mortgage document must include details such as the names of the borrower and lender, property address, loan amount, recording information, and notarized signatures.

When is the deadline to file satisfaction of mortgage in 2023?

The deadline to file satisfaction of mortgage in 2023 would typically be within a certain number of days after the final payment is made, as specified by state laws.

What is the penalty for the late filing of satisfaction of mortgage?

The penalty for late filing of satisfaction of mortgage may vary by jurisdiction, but it could result in fines, penalties, or delays in transferring property ownership.

How do I make changes in satisfaction of mortgage?

The editing procedure is simple with pdfFiller. Open your satisfaction of mortgage in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my satisfaction of mortgage in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your satisfaction of mortgage right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit satisfaction of mortgage on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign satisfaction of mortgage. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your satisfaction of mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.