Get the free Sustaining Growth in Credit Card Business - The Hong Kong bb - hkib

Show details

The Hong Kong Bankers Club, 43 Floor, Gloucester Tower, The Landmark Sustaining Growth in Credit Card Business The economy is continuing to recover and growing at a healthy rate, many banks are seeing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your sustaining growth in credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sustaining growth in credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sustaining growth in credit online

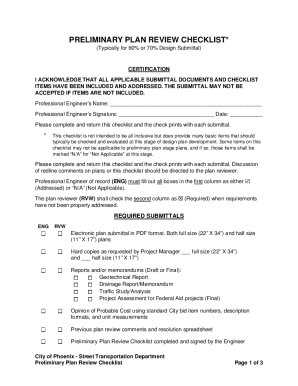

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sustaining growth in credit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

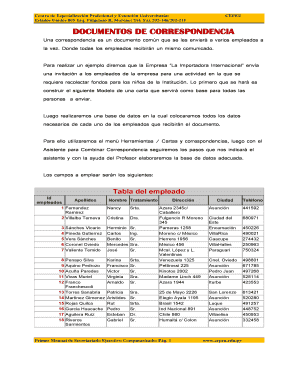

How to fill out sustaining growth in credit

How to fill out sustaining growth in credit:

01

Start by analyzing your current credit situation. Take a close look at your credit score, outstanding debts, and payment history. This will help you understand where you stand and identify areas for improvement.

02

Develop a strategic plan to increase your creditworthiness. Set specific goals and create a timeline to achieve them. This may involve paying off outstanding debts, making timely payments, and reducing your credit utilization ratio.

03

Build a strong credit history by establishing a pattern of responsible credit behavior. This includes paying bills on time, avoiding excessive credit applications, and maintaining low credit card balances.

04

Consider utilizing credit-building tools such as secured credit cards or credit builder loans. These financial products can help you establish or rebuild credit if you have a limited or damaged credit history.

05

Monitor your credit regularly to track your progress. Review your credit reports from the major credit bureaus and dispute any inaccuracies. Stay on top of your credit score to ensure you're heading in the right direction.

06

Seek guidance from financial professionals or credit counseling agencies if you're facing challenges or need expert advice. They can provide insights tailored to your specific situation and offer tailored strategies to improve your credit.

Who needs sustaining growth in credit:

01

Individuals who want to qualify for better interest rates and loan terms. This could include aspiring homeowners looking to secure a mortgage, entrepreneurs seeking business financing, or individuals planning to purchase a car.

02

People who desire financial stability and flexibility. Maintaining a good credit score can provide access to credit cards with favorable rewards, allow for easier qualification for rental applications, and can even impact employment opportunities in some industries.

03

Borrowers looking to expand their borrowing capacity. As your credit score grows, you'll have more options and flexibility in securing loans or lines of credit, allowing you to pursue new opportunities or investments.

In summary, sustaining growth in credit requires a proactive approach, strategic planning, and responsible credit behavior. It is crucial for individuals who want to enhance their financial well-being, access better borrowing options, and position themselves for future success.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sustaining growth in credit?

Sustaining growth in credit refers to the continuous increase in credit availability and usage within an economy.

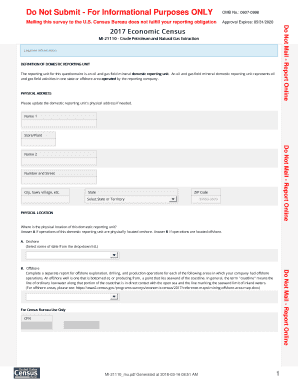

Who is required to file sustaining growth in credit?

Financial institutions and organizations involved in providing credit are required to file sustaining growth in credit.

How to fill out sustaining growth in credit?

Sustaining growth in credit can be filled out by providing accurate and up-to-date information on credit activities, trends, and projections.

What is the purpose of sustaining growth in credit?

The purpose of sustaining growth in credit is to monitor and analyze the credit market to ensure its stability and sustainability.

What information must be reported on sustaining growth in credit?

Information such as total credit outstanding, credit utilization rates, lending criteria, and credit quality must be reported on sustaining growth in credit.

When is the deadline to file sustaining growth in credit in 2023?

The deadline to file sustaining growth in credit in 2023 is typically set by regulatory authorities and may vary depending on the jurisdiction.

What is the penalty for the late filing of sustaining growth in credit?

The penalty for late filing of sustaining growth in credit may include fines, sanctions, and potential legal actions by regulatory authorities.

How do I make edits in sustaining growth in credit without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing sustaining growth in credit and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the sustaining growth in credit electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your sustaining growth in credit in minutes.

Can I create an eSignature for the sustaining growth in credit in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your sustaining growth in credit right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Fill out your sustaining growth in credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.