Get the free Credit Risk Grading Business Scorecard and Portfolio Management - hkib

Show details

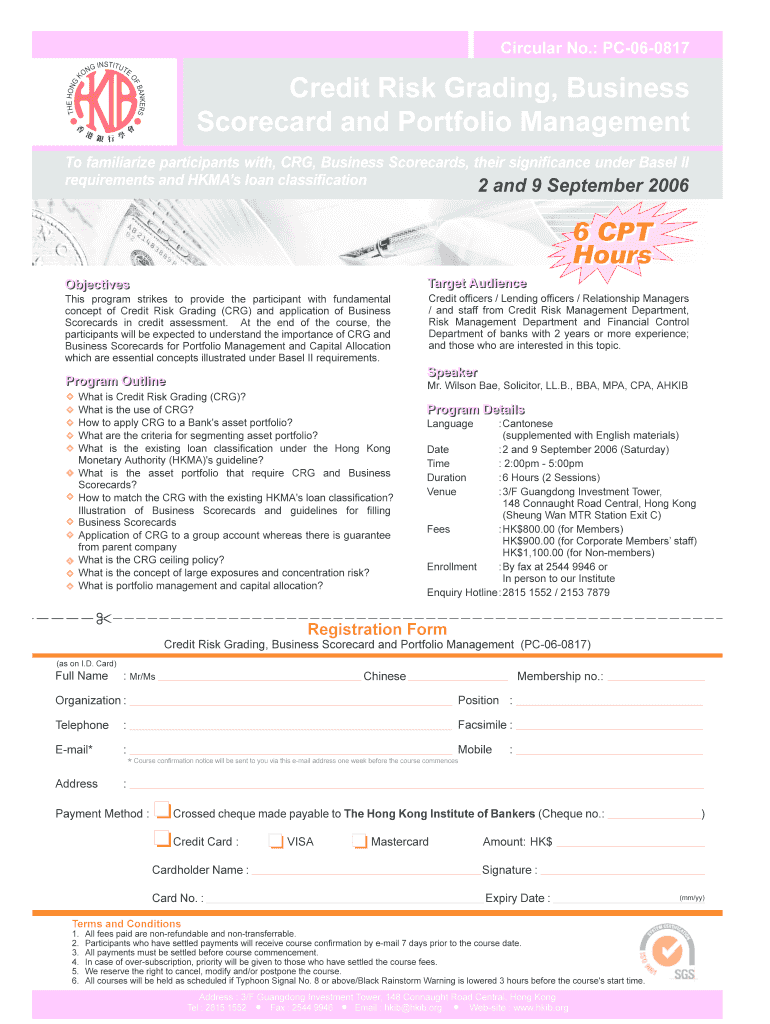

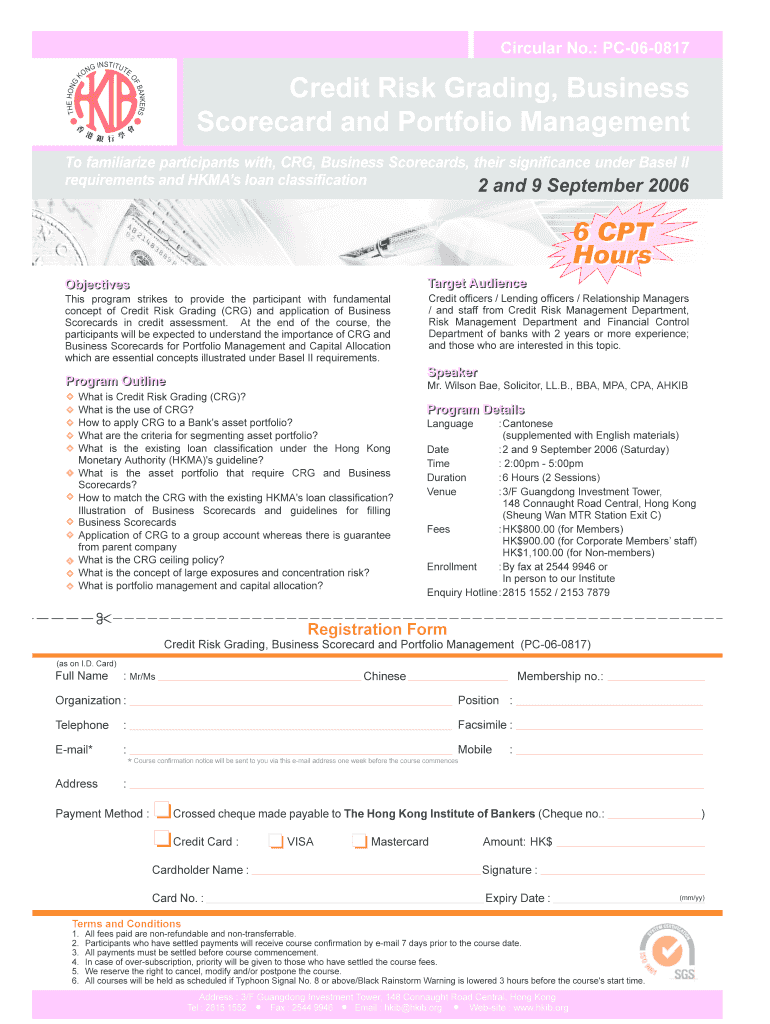

Circular No.: PC060817 Credit Risk Grading, Business Scorecard and Portfolio Management To familiarize participants with, CRG, Business Scorecards, their significance under Basel II requirements and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit risk grading business

Edit your credit risk grading business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit risk grading business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit risk grading business online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit risk grading business. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit risk grading business

To fill out credit risk grading for a business, follow these steps:

01

Begin by gathering all relevant financial information about the business, including its income statements, balance sheets, cash flow statements, and any other relevant financial documents.

02

Assess the business's creditworthiness by analyzing its financial ratios, such as its debt-to-equity ratio, current ratio, and profitability ratios. These ratios help determine the business's ability to repay its debts and manage financial risks.

03

Evaluate the business's industry and market conditions to understand any external factors that may impact its credit risk. Consider factors such as competition, regulatory environment, and economic trends.

04

Analyze the business's management team and their experience in managing credit risk. Assess their track record in meeting financial obligations and implementing risk management strategies.

05

Consider any collateral or guarantees available to secure the business's debts. Assess the value and quality of these assets to determine their effectiveness in mitigating credit risk.

06

Assign a credit risk grade to the business based on the analysis conducted. This grading system typically ranges from low risk to high risk, indicating the likelihood of default or late payment.

Now let's explore who needs credit risk grading for their business:

01

Financial institutions, such as banks and credit unions, need credit risk grading to assess the risk of default when providing loans or extending credit to businesses. It helps them make informed decisions and set appropriate interest rates and loan terms.

02

Investors and lenders who provide funds to businesses also need credit risk grading to evaluate the risk associated with their investments. It helps them determine the likelihood of receiving timely payments or recovering their investments.

03

Credit rating agencies play a crucial role in evaluating credit risk for businesses. They assign credit ratings based on their analysis, which is used by investors, lenders, and other stakeholders to assess the creditworthiness of a business.

04

Businesses themselves can benefit from credit risk grading by understanding their own creditworthiness and identifying areas for improvement. It allows them to manage their financial risks effectively and make informed decisions regarding borrowing and credit management.

In conclusion, filling out credit risk grading for a business involves a thorough analysis of its financial performance, industry conditions, management capabilities, and collateral availability. It helps financial institutions, investors, lenders, credit rating agencies, and businesses themselves make informed decisions regarding credit risks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit risk grading business for eSignature?

To distribute your credit risk grading business, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete credit risk grading business online?

pdfFiller has made it simple to fill out and eSign credit risk grading business. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I sign the credit risk grading business electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your credit risk grading business and you'll be done in minutes.

What is credit risk grading business?

Credit risk grading business is the process of evaluating the credit risk associated with a borrower or potential borrower.

Who is required to file credit risk grading business?

Financial institutions and lenders are required to file credit risk grading business.

How to fill out credit risk grading business?

Credit risk grading business can be filled out by assessing the borrower's financial information, credit history, and other relevant factors.

What is the purpose of credit risk grading business?

The purpose of credit risk grading business is to assess the likelihood of a borrower defaulting on a loan or other financial obligation.

What information must be reported on credit risk grading business?

Information such as borrower's credit score, income, debt-to-income ratio, and other financial indicators must be reported on credit risk grading business.

Fill out your credit risk grading business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Risk Grading Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.