Get the free JOINT CREDIT APPLICATION - bmohavestbankcomb

Show details

JOINT CREDIT APPLICATION PLEASE TYPE OR PRINT This application is designed to be completed by the applicant(s) with the Lenders assistance. Applicants should complete this form as Borrower or Borrower,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your joint credit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your joint credit application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing joint credit application online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit joint credit application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out joint credit application

How to fill out joint credit application:

01

Gather all necessary information: Before starting the application, make sure you have all the required information at hand. This includes personal details such as names, social security numbers, addresses, employment information, and financial details.

02

Choose the right credit application: Depending on the lending institution, there may be multiple types of credit applications available. Look for a joint credit application specifically designed for applicants who want to apply together, rather than individual credit applications.

03

Complete the personal information section: Begin by filling out the personal information section of the joint credit application. This typically includes your full names, contact information, social security numbers, and dates of birth. Ensure that all the information provided is accurate and up to date.

04

Provide employment and income details: In this section, both applicants will need to provide their employment details, including the name and address of their employer, job titles, and length of employment. Additionally, include income information such as salary, bonuses, and any other sources of income.

05

List all existing debts and obligations: Disclose any existing debts or financial obligations that either applicant may have. This includes mortgages, car loans, student loans, credit card debts, or any other outstanding balances. Be sure to include the name of the lender, the outstanding balance, and the monthly payment amount for each debt.

06

Provide details about joint accounts: If you and your co-applicant already have joint accounts, make sure to include the details of those accounts on the application. This could include joint bank accounts, mortgages, or other shared financial responsibilities. Also, mention the purpose of opening the joint credit account.

07

Review and sign the application: Double-check all the information provided in the joint credit application for accuracy and completeness. Once you are satisfied, both applicants should sign the application form. By signing, you are confirming the accuracy of the information provided and your mutual agreement to apply for joint credit.

Who needs a joint credit application?

01

Married or legally recognized partners: Couples who are married or in a legally recognized partnership may need a joint credit application when they want to apply for a loan or credit together. This can be helpful when both individuals' incomes and credit histories are needed to evaluate creditworthiness.

02

Family members or relatives: Sometimes, family members or relatives may choose to apply for joint credit to access larger credit limits or better interest rates. It can be beneficial to combine their incomes and credit scores to qualify for credit options they might not be eligible for individually.

03

Business partners or co-owners: In cases where two or more individuals are co-owners of a business or jointly responsible for a financial obligation, they may need to apply for joint credit. This allows them to access credit resources for their shared business expenses or investments.

04

Co-applicants with shared expenses: When individuals share significant financial responsibilities, such as renting an apartment together or purchasing a vehicle, a joint credit application may be necessary. This helps create a shared financial picture for evaluating creditworthiness and can simplify the process.

Remember, it's essential to thoroughly understand the terms and conditions of joint credit before signing any application. Joint credit means both applicants are equally responsible for the debt, and any missed payments or default can impact both parties' credit scores.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

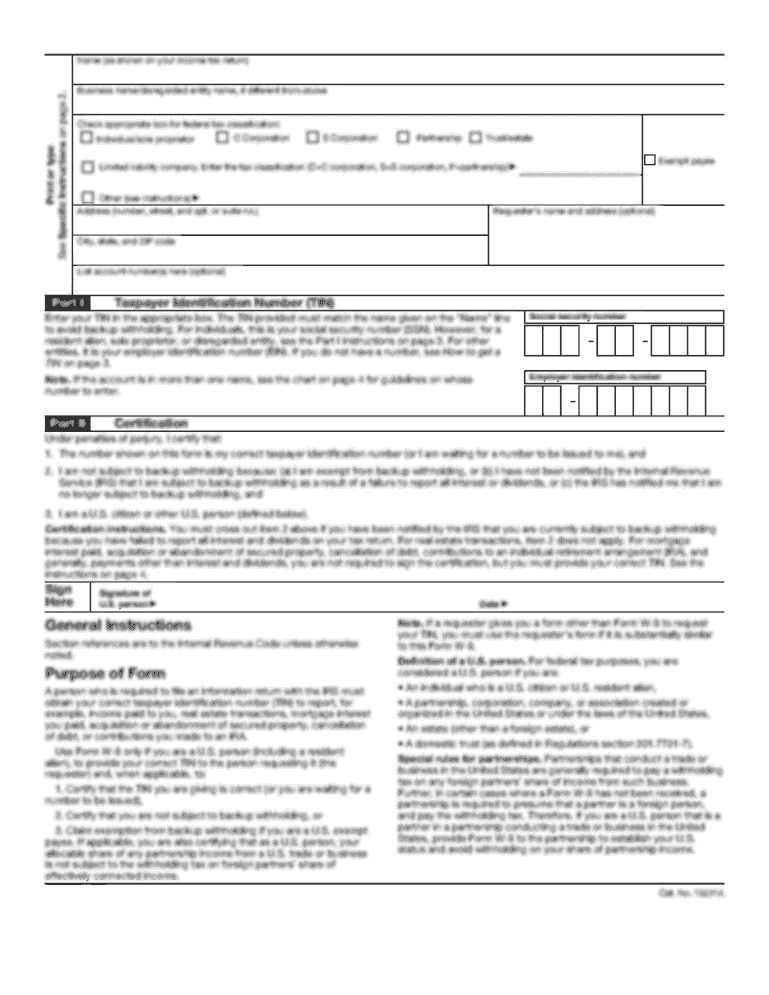

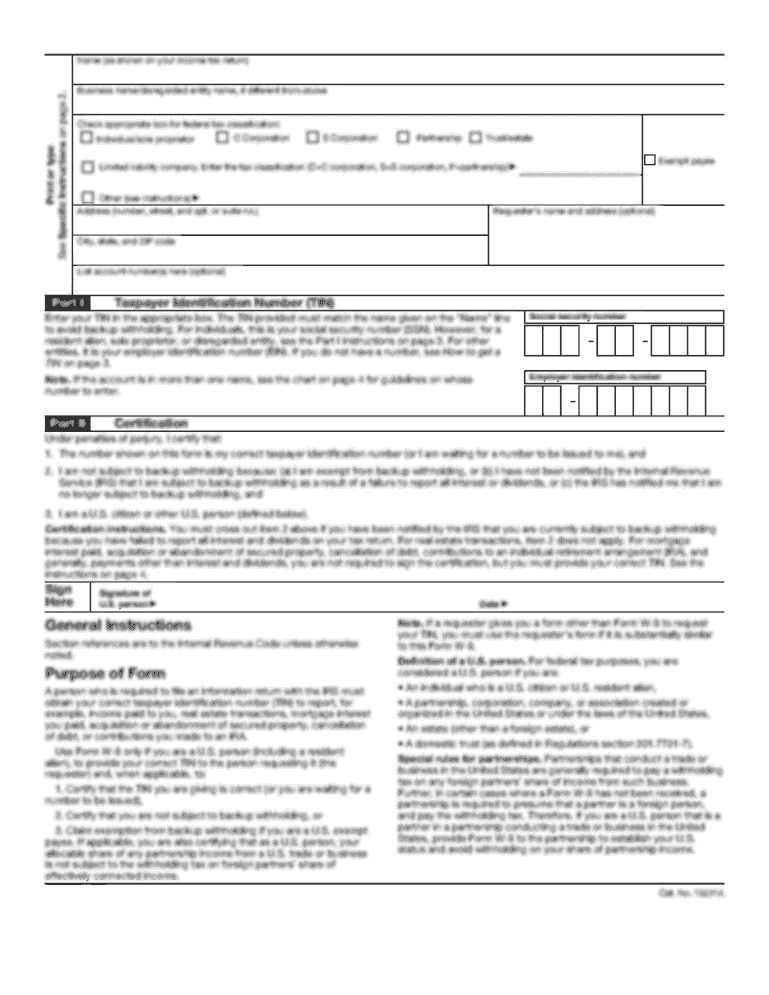

What is joint credit application?

A joint credit application is a credit application where two or more individuals apply for credit together, usually for a loan or credit card.

Who is required to file joint credit application?

Individuals who want to apply for credit together, such as spouses or business partners, are required to file a joint credit application.

How to fill out joint credit application?

To fill out a joint credit application, both parties must provide their personal information, financial details, and authorize a credit check.

What is the purpose of joint credit application?

The purpose of a joint credit application is to combine the financial strengths of multiple individuals to increase the likelihood of approval for credit.

What information must be reported on joint credit application?

Information such as names, addresses, employment details, income, debts, and assets of all parties involved must be reported on a joint credit application.

When is the deadline to file joint credit application in 2023?

The deadline to file a joint credit application in 2023 will depend on the specific lender or financial institution. It is recommended to check with the lender for their specific deadline.

What is the penalty for the late filing of joint credit application?

The penalty for the late filing of a joint credit application may result in delayed approval or denial of credit, depending on the lender's policies.

How can I manage my joint credit application directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your joint credit application and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I edit joint credit application from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your joint credit application into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit joint credit application straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing joint credit application, you can start right away.

Fill out your joint credit application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.