PR AS 2781.1 2015 free printable template

Show details

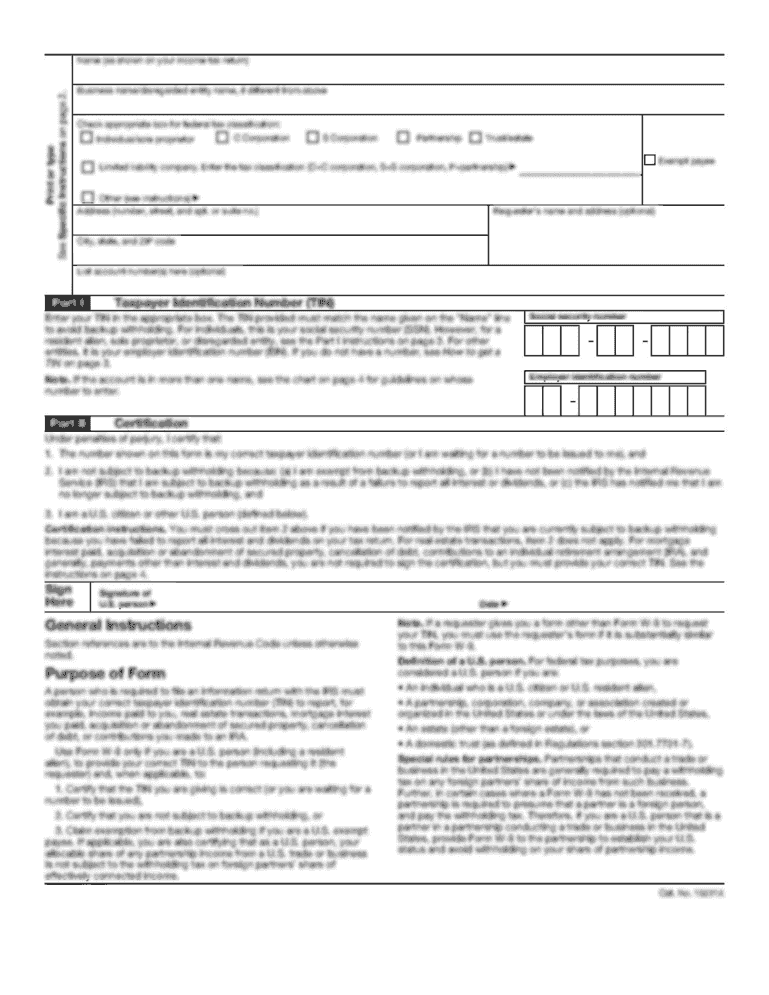

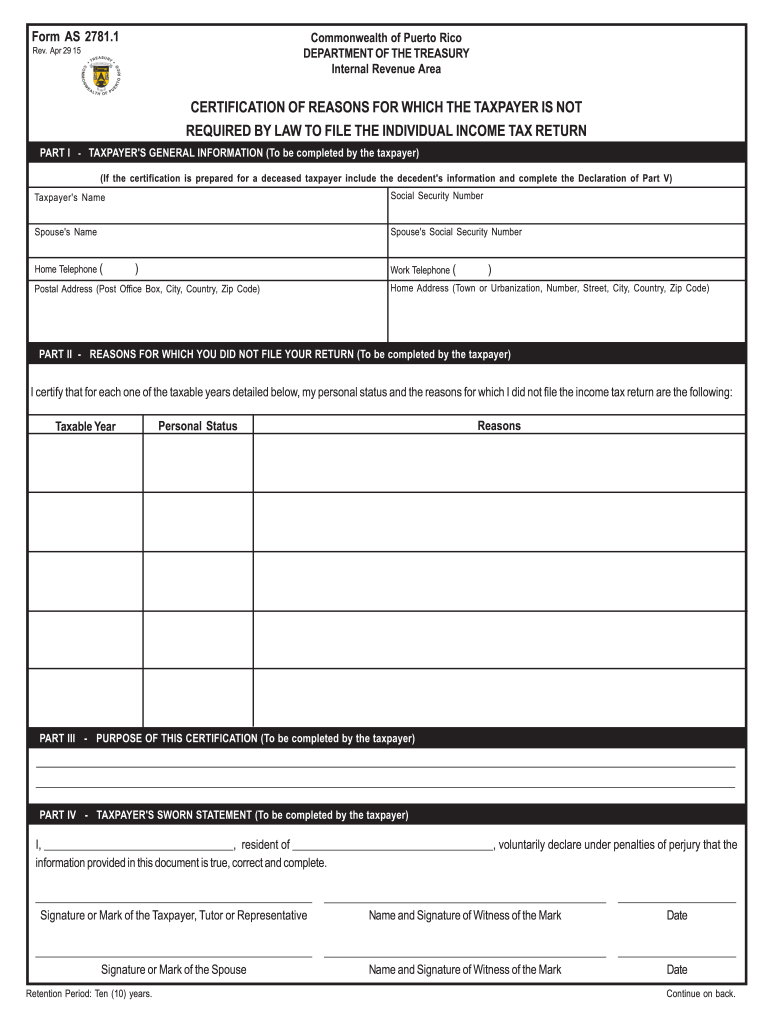

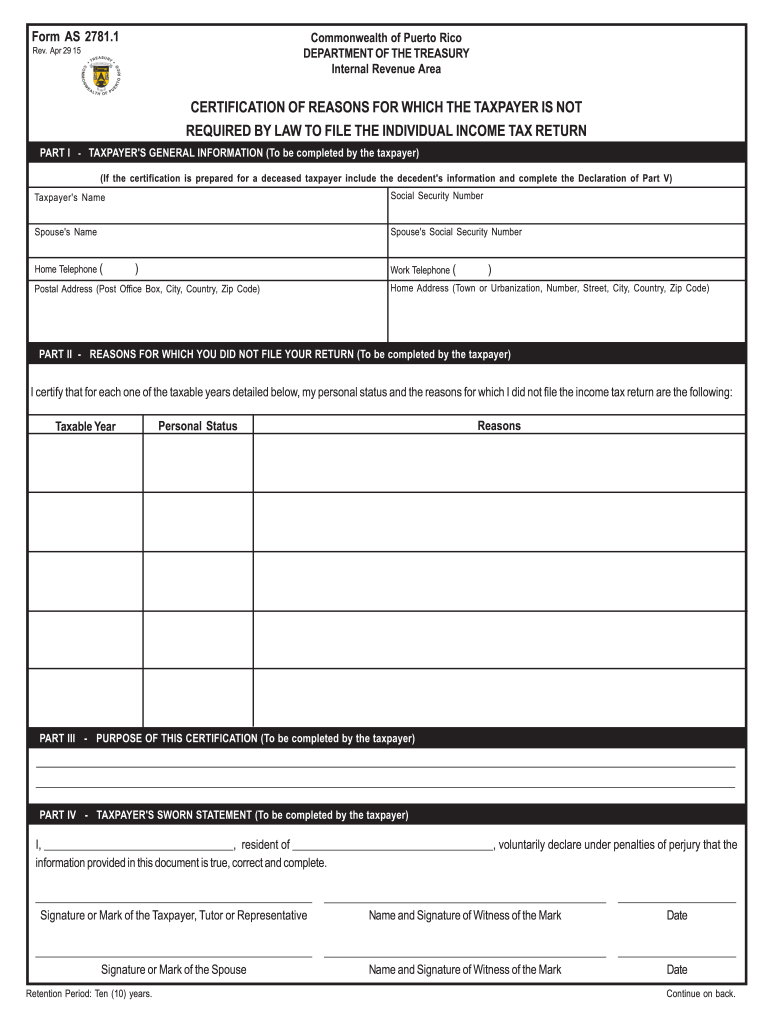

Form AS 2781.1 Commonwealth of Puerto Rico DEPARTMENT OF THE TREASURY Internal Revenue Area Rev. Apr 29 15 CERTIFICATION OF REASONS FOR WHICH THE TAXPAYER IS NOT REQUIRED BY LAW TO FILE THE INDIVIDUAL

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PR AS 27811

Edit your PR AS 27811 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PR AS 27811 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PR AS 27811 online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PR AS 27811. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PR AS 2781.1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PR AS 27811

How to fill out PR AS 2781.1

01

Begin by obtaining a copy of the PR AS 2781.1 form.

02

Read the instructions provided at the beginning of the form carefully.

03

Fill in your personal details, including your name, address, and contact information.

04

Provide any necessary identification numbers or codes as specified.

05

Complete the sections relating to your qualifications, ensuring all information is accurate.

06

Include any required supporting documents as per the checklist in the form.

07

Review all entered information to avoid errors.

08

Sign and date the form at the designated area.

09

Submit the completed form and supporting documents to the relevant authority.

Who needs PR AS 2781.1?

01

Individuals or organizations seeking to apply for certification or registration related to Australian standards in a specific industry.

02

Professionals involved in quality assurance and conformity assessment processes.

03

Companies looking to comply with industry standards and regulations.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file Puerto Rico tax return?

Generally, if you are a Puerto Rico bona fide resident, you must file a Puerto Rico tax return. If you are not a bona fide resident of Puerto Rico, you must file both a Puerto Rico tax return and a U.S. tax return. If you are a member of the United States Armed Forces, special tax rules may be applied.

What is a 480 form used for?

Form 480 Rural Call Completion Data Filing This information concerned the delivery of calls to Rural Local Exchange Carriers and is used to identify possible areas for further inquiry. For purposes of these requirements, a covered provider may be: a local exchange carrier as defined in 47 C.F.R.

What is a Puerto Rico Form 480?

What is a 480 form? Form 480 is a document that summarizes payments that have not been subject to withholding, payments generated to a supplier for services, distributions, among others, to declare statements before the Department of the Treasury of Puerto Rico.

What is Form 2781.1 in Puerto Rico?

Form AS 2781.1 is used in those cases where Form SC 6088 shows that the taxpayer did not file some of the income tax returns corresponding to the last 5 or 10 taxable years, as applicable.

What is the non resident tax in Puerto Rico?

Puerto Rican employees who are non-residents are subject to a flat 29% withholding in the case of foreign nationals and to a 20% withholding in the case of US citizens.

What is form 480.6 C Puerto Rico withholding?

480.6C - Form 480.6C is intended for non-residents of Puerto Rico. It covers investment income that has been subject to Puerto Rico source withholding. 480.6D - Form 480.6D is intended for residents of Puerto Rico. It covers exempt income and income subject to the Puerto Rico Alternate Basic Tax (ABT).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my PR AS 27811 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your PR AS 27811 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I sign the PR AS 27811 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit PR AS 27811 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share PR AS 27811 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is PR AS 2781.1?

PR AS 2781.1 is a regulatory form used for the reporting of specific financial activities in accordance with established guidelines.

Who is required to file PR AS 2781.1?

Entities that engage in the specified financial activities or operations outlined by regulatory authorities are required to file PR AS 2781.1.

How to fill out PR AS 2781.1?

To fill out PR AS 2781.1, individuals or entities must provide required information accurately in designated fields, ensuring adherence to guidelines set forth by the governing body.

What is the purpose of PR AS 2781.1?

The purpose of PR AS 2781.1 is to ensure transparency and accountability in financial reporting and to provide regulatory authorities with necessary data for oversight.

What information must be reported on PR AS 2781.1?

The information that must be reported on PR AS 2781.1 includes financial activities, transactions, relevant dates, and identification details of the reporting entity.

Fill out your PR AS 27811 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PR AS 27811 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.