PR Form 483.20 2016 free printable template

Show details

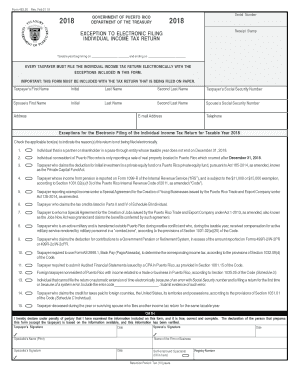

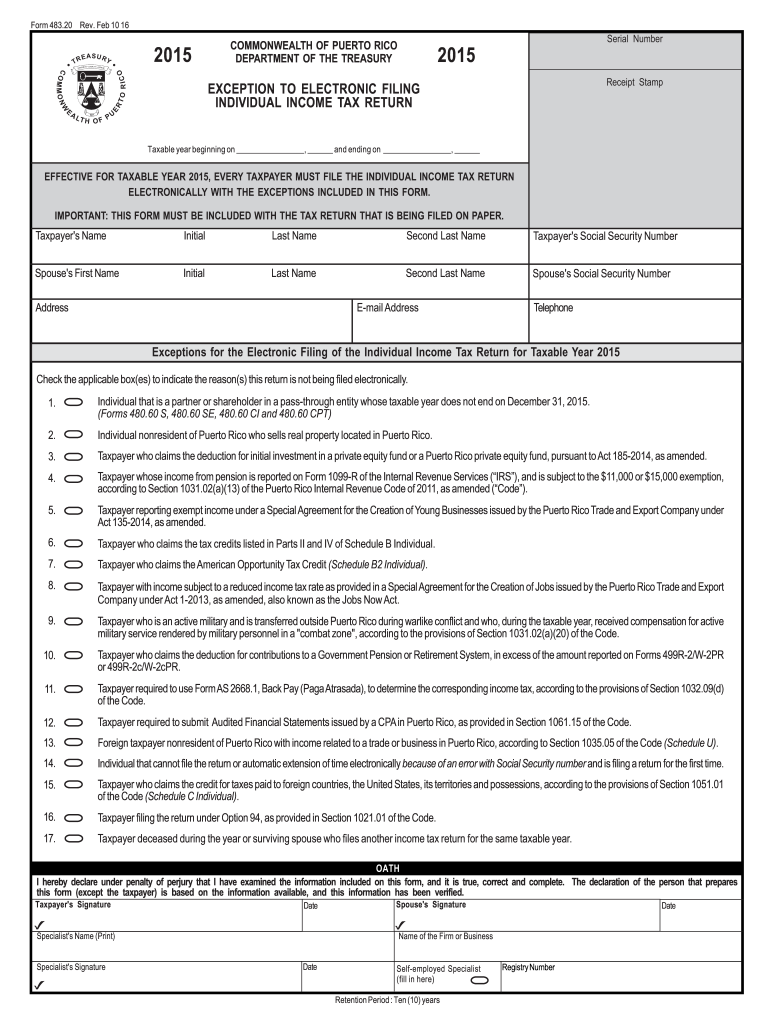

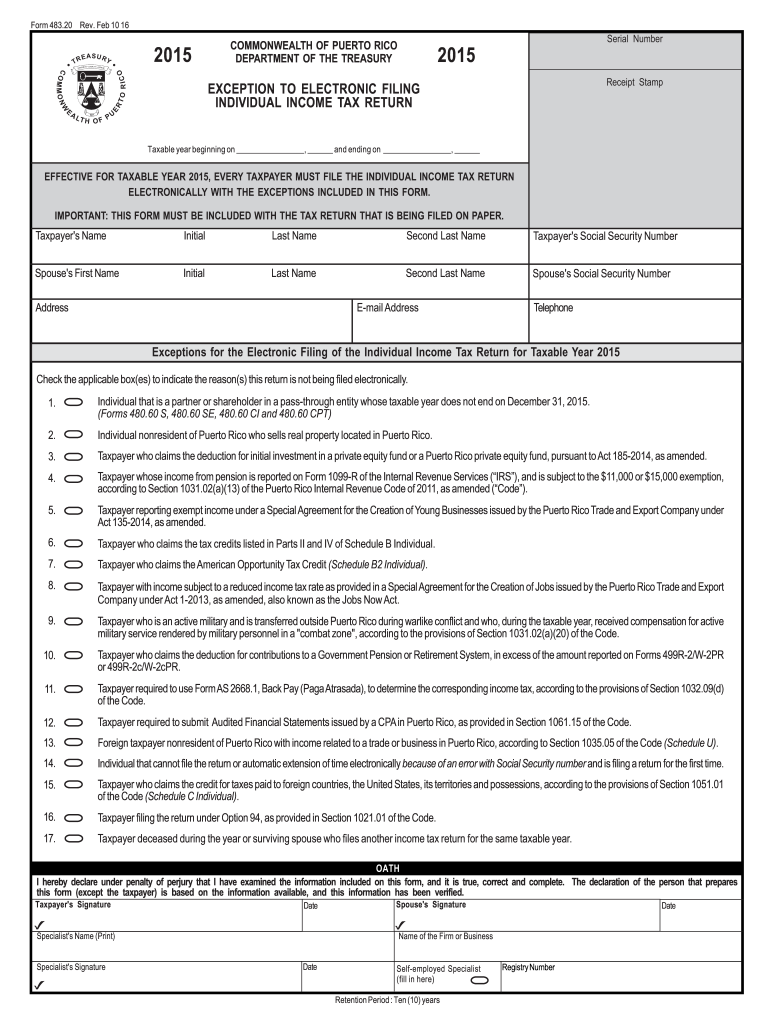

Form 483.20 Rev. Feb 10 16 2015 Rev. 4 Nov 15 COMMONWEALTH OF PUERTO RICO DEPARTMENT OF THE TREASURY Serial Number 2015 Receipt Stamp EXCEPTION TO ELECTRONIC FILING INDIVIDUAL INCOME TAX RETURN Taxable

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your puerto rico tax forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your puerto rico tax forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing puerto rico tax forms online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit puerto rico tax forms. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

PR Form 483.20 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out puerto rico tax forms

How to fill out Puerto Rico tax forms:

01

Gather all necessary documents such as W-2 forms, 1099 forms, and any other income documents.

02

Determine which Puerto Rico tax forms are applicable to your situation. Common forms include Form 480.6A for individuals and Form 480.6B for corporations.

03

Fill out the required fields on the form, including personal information, income details, deductions, and credits.

04

Double-check all information for accuracy and completeness.

05

Calculate your tax liability or refund using the provided instructions or an online tax calculator.

06

Sign and date the completed form.

07

Submit the form to the Puerto Rico Department of Treasury, either electronically or through mail, depending on the instructions provided.

08

Keep a copy of the completed form and all supporting documents for your records.

Who needs Puerto Rico tax forms:

01

Individuals who are residents of Puerto Rico and have income from Puerto Rican sources.

02

Individuals who are non-residents of Puerto Rico but have Puerto Rican source income that is effectively connected to a trade or business conducted in Puerto Rico.

03

Corporations that are organized under Puerto Rico law or conduct business activities in Puerto Rico and have Puerto Rican source income.

Note: It is important to consult a tax professional or refer to the Puerto Rico Department of Treasury's guidelines for specific eligibility and requirements.

Fill form : Try Risk Free

People Also Ask about puerto rico tax forms

Can I download IRS tax forms?

What should I do with form 480.6 C?

What is a Puerto Rico form 480?

What is the form 480.6 C from Puerto Rico?

Can I download and print tax forms?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is puerto rico tax forms?

Puerto Rico tax forms refer to the documents that individuals and businesses in Puerto Rico must fill out and submit to the Puerto Rico Department of Treasury (Hacienda) to report their income, expenses, and calculate and pay their taxes. These forms are specific to Puerto Rico's tax laws and regulations and are separate from the tax forms used in the United States.

Some common Puerto Rico tax forms include:

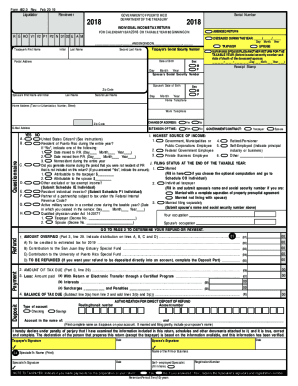

1. Form 480.7C - Individual Income Tax Return: This form is used by resident individuals to report their income, deductions, exemptions, and determine the amount of tax owed.

2. Form 480.7D - Nonresident Individual Income Tax Return: This form is used by nonresident individuals who have Puerto Rico-source income to report their income and calculate their tax liability.

3. Form 499R-4 - Annual Reconciliation Statement of Income Tax Withheld: This form is used by employers to report the total income tax withheld from employee wages and salaries throughout the year.

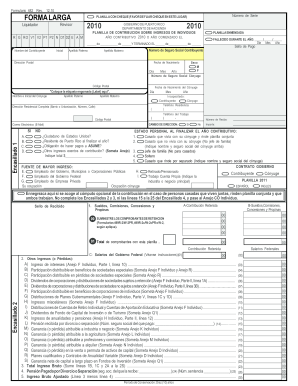

4. Form SC 2644 - Corporate Income Tax Return: This form is used by corporations to report their income, expenses, deductions, and calculate their tax liability.

5. Form 480.6D - Partnership Declaration of Income: This form is used by partnerships to report their income and expenses and determine their tax liability.

It is important to note that these forms may change over time, so it is advisable to consult the Puerto Rico Department of Treasury's website or seek professional assistance to ensure the use of the correct and most up-to-date tax forms.

Who is required to file puerto rico tax forms?

Puerto Rico tax forms are generally required to be filed by individuals and businesses that are residents of Puerto Rico or have income derived from Puerto Rico. Additionally, non-residents of Puerto Rico who have Puerto Rican source income may also be required to file tax forms. The specific tax forms and filing requirements may vary depending on the individual's or business's circumstances. It is recommended to consult with a tax professional or refer to the Puerto Rico Department of Treasury for accurate and up-to-date information on filing requirements.

How to fill out puerto rico tax forms?

Filling out tax forms in Puerto Rico follows a similar process to that in the United States. Here is a general step-by-step guide:

1. Determine your filing status: Puerto Rico tax forms have different sections for individual or corporate taxpayers. Identify whether you are a resident, non-resident, or corporation to choose the appropriate tax form.

2. Gather necessary documents: Collect all the required documents, such as W-2 forms, 1099 forms, investment statements, and any other income or expense records related to Puerto Rico.

3. Download the appropriate tax form: Visit the Puerto Rico Department of Treasury website (often called Hacienda) and download the tax form that corresponds to your filing status. The most commonly used individual tax form is the PR-1040.

4. Fill in personal information: Provide your name, Social Security number, address, and other personal identification details on the top portion of the form.

5. Determine your taxable income: Report your income from various sources based on the guidelines provided on the form. Include wages, self-employment earnings, interest, dividends, rental income, and any other taxable income.

6. Calculate tax deductions and credits: Deduct eligible expenses such as medical expenses, mortgage interest, education costs, and contributions to retirement plans. Review available tax credits and apply them accordingly.

7. Compute your tax liability: Follow the instructions on the form to calculate your tax liability. Puerto Rico has its own tax rates and brackets. Apply the appropriate tax rate to your taxable income to determine the amount owed or refundable.

8. Complete additional sections: Depending on your circumstances, there may be additional sections to complete. For example, there might be sections related to foreign income, capital gain/loss, or health insurance coverage.

9. Review and sign: Thoroughly review all the information entered on the tax form for accuracy and completeness before signing and dating it.

10. Submit the form: Mail the completed tax form along with any required attachments to the address provided on the form, usually indicated as the Puerto Rico Department of Treasury.

It's advisable to consult the specific form instructions and seek professional help, if needed, to ensure accurate completion of Puerto Rico tax forms, as requirements may change over time.

What is the purpose of puerto rico tax forms?

The purpose of Puerto Rico tax forms is to facilitate the collection of taxes from individuals and entities within Puerto Rico. These tax forms are used to report income, calculate tax liabilities, claim deductions and credits, and provide information to the Puerto Rico Department of the Treasury for the assessment and enforcement of taxes. The government uses the information provided on these forms to determine the tax liability of individuals and businesses and ensure compliance with the Puerto Rico tax laws.

What information must be reported on puerto rico tax forms?

The information that must be reported on Puerto Rico tax forms typically includes:

1. Personal Information: This includes the taxpayer's name, address, and Social Security Number (or Individual Taxpayer Identification Number).

2. Income: All sources of income earned by the taxpayer during the tax year, such as wages, salaries, self-employment income, rental income, dividends, interest, etc., must be reported.

3. Deductions: Taxpayers can claim deductions for eligible expenses or contributions, such as medical expenses, mortgage interest, charitable donations, etc.

4. Tax Credits: Any tax credits or exemptions for which the taxpayer may be eligible, such as the Earned Income Credit, Child Tax Credit, Education Credit, etc., should be reported.

5. Foreign Assets: If the taxpayer possesses foreign financial accounts or has interests in foreign entities, they may need to report these assets on specific forms (such as FBAR, Form 8938) if they meet certain threshold requirements.

6. Payments: The taxpayer should report any estimated tax payments, tax withheld from wages, or any other payments made towards their Puerto Rico taxes.

7. Filing Status: The taxpayer must indicate their correct filing status, such as single, married filing jointly, married filing separately, head of household, etc.

It is essential to consult with a qualified tax professional or refer to the official Puerto Rico Department of Treasury website for specific details and forms related to filing Puerto Rico taxes.

When is the deadline to file puerto rico tax forms in 2023?

The deadline to file Puerto Rico tax forms in 2023 is April 17, 2024.

What is the penalty for the late filing of puerto rico tax forms?

The penalty for late filing of Puerto Rico tax forms varies depending on the specific form and the duration of the delay. Generally, the penalty is a percentage of the tax due that is multiplied by the number of months the filing is late. However, it's important to note that these penalties can change over time and may also vary depending on the type of tax and specific circumstances of the late filing. It is recommended to consult the Puerto Rico Department of Treasury or a tax professional for the most accurate and up-to-date information regarding penalties for late filing.

How can I manage my puerto rico tax forms directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your puerto rico tax forms and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I make changes in puerto rico tax forms?

With pdfFiller, the editing process is straightforward. Open your puerto rico tax forms in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit puerto rico tax forms on an Android device?

You can edit, sign, and distribute puerto rico tax forms on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your puerto rico tax forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.