Get the free Annual Only $120

Show details

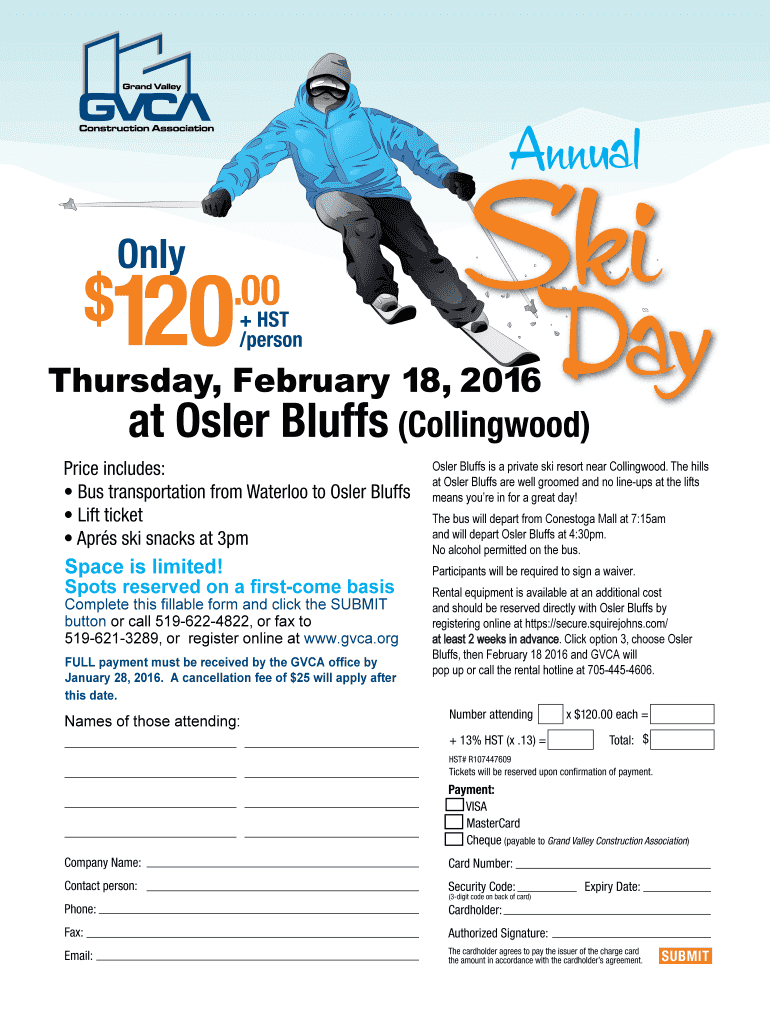

Annual Only $120.00 + HST /person Ski Day Thursday, February 18, 2016, at Osier Bluffs (Collingwood) Price includes: Bus transportation from Waterloo to Osier Bluffs Lift ticket Apr's ski snacks at

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your annual only 120 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual only 120 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annual only 120 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit annual only 120. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out annual only 120

How to fill out annual only 120:

01

Begin by gathering all the necessary information and documents for the annual form. This may include personal details, income information, deductions, and any other relevant financial information.

02

Start by entering your personal details accurately in the designated sections of the form. This usually includes your name, address, social security number, and contact information.

03

Move on to the income section and carefully report all sources of income for the year. This can include wages, commissions, dividends, rental income, or any other form of earnings. Be sure to enter the correct amounts and double-check for accuracy.

04

Deductions can help reduce your taxable income, so make sure to include any applicable deductions you are eligible for. These may include mortgage interest, student loan interest, medical expenses, or charitable contributions. Read the instructions carefully to ensure you include all the necessary details and properly calculate your deductions.

05

Next, review the form for any additional sections or schedules that need to be filled out. These can vary depending on your specific circumstances, such as self-employment income or investment gains/losses.

06

Once you have completed all the required sections of the form, review your answers and ensure everything is accurate. Mistakes or missing information can lead to processing delays or potential penalties.

07

Finally, sign and date the form before submitting it either electronically or by mail. Consider making a copy for your records before sending it off.

Who needs annual only 120?

01

Individuals with a relatively simple financial situation who do not require additional schedules or forms to report their income and deductions may opt for the annual only 120 form.

02

Those with a lower income threshold or few income sources may also find the annual only 120 form suitable for their needs.

03

Individuals who do not have significant deductions to claim or who utilize the standard deduction may find the simplified annual only 120 form more convenient to fill out.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is annual only 120?

Annual only 120 is a tax form used by individuals who earn income that is below a certain threshold and only need to file a simplified version of their taxes.

Who is required to file annual only 120?

Individuals who earn income below a certain threshold and do not have complex tax situations are required to file annual only 120.

How to fill out annual only 120?

To fill out annual only 120, individuals must report their income, deductions, and credits on the form as instructed by the tax authorities.

What is the purpose of annual only 120?

The purpose of annual only 120 is to simplify the tax filing process for individuals with low income and straightforward tax situations.

What information must be reported on annual only 120?

Information such as income, deductions, and credits must be reported on annual only 120 following the guidelines provided by the tax authorities.

When is the deadline to file annual only 120 in 2023?

The deadline to file annual only 120 in 2023 is typically April 15th, but this date may vary based on any extensions granted by the tax authorities.

What is the penalty for the late filing of annual only 120?

The penalty for late filing of annual only 120 may include fines or interest charges imposed by the tax authorities.

How can I send annual only 120 to be eSigned by others?

When you're ready to share your annual only 120, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I execute annual only 120 online?

With pdfFiller, you may easily complete and sign annual only 120 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I edit annual only 120 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign annual only 120 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your annual only 120 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.