Get the free SCHEDULE A

Show details

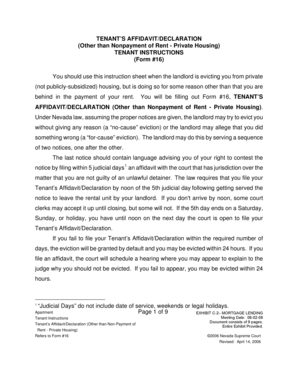

ALTA Commitment Number: MI-P70425 SCHEDULE A 1. Effective Date: July 15, 2011, at 08:00 AM Revision: 2. Policy or Policies to be issued: (a) X Owner's Policy Proposed Insured: Proposed Purchaser Loan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your schedule a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit schedule a online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit schedule a. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out schedule a

How to fill out schedule a:

01

Gather all necessary information and supporting documents for the schedule.

02

Start by providing your personal information, such as your name, address, and social security number.

03

Indicate the year or period for which you are filling out the schedule.

04

Include any deductions or credits that apply to you, such as medical expenses or mortgage interest.

05

Calculate the total amount for each category and enter the appropriate figures in the provided spaces.

06

Double-check all the information you have entered to ensure accuracy.

07

Sign and date the schedule before submitting it along with your tax return.

Who needs schedule a:

01

Individuals who itemize deductions instead of opting for the standard deduction may need to fill out schedule A.

02

Schedule A is used to report various deductible expenses, such as medical and dental expenses, real estate taxes, interest paid on mortgages, charitable contributions, and more.

03

Taxpayers who have significant expenses in these areas and think they will exceed the standard deduction amount should consider using schedule A to maximize their tax savings.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is schedule a?

Schedule A is a tax form used by individuals to report itemized deductions on their federal income tax return.

Who is required to file schedule a?

Individuals who choose to itemize their deductions rather than taking the standard deduction are required to file Schedule A.

How to fill out schedule a?

To fill out Schedule A, you need to gather all necessary receipts and documentation for eligible deductions and report them in the appropriate sections of the form.

What is the purpose of schedule a?

The purpose of Schedule A is to allow taxpayers to claim deductions for certain expenses, such as medical expenses, state and local taxes, mortgage interest, and charitable contributions.

What information must be reported on schedule a?

Schedule A requires taxpayers to report various information, including medical expenses, state and local taxes, mortgage interest, charitable contributions, and other eligible deductions.

When is the deadline to file schedule a in 2023?

The deadline to file Schedule A in 2023 is usually April 15th, unless it falls on a weekend or holiday, in which case it may be extended to the following business day.

What is the penalty for the late filing of schedule a?

The penalty for the late filing of Schedule A can vary depending on the specific circumstances, but it is generally a percentage of the unpaid tax amount. It's best to consult with a tax professional or the IRS for accurate penalty information.

How do I edit schedule a in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing schedule a and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I sign the schedule a electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your schedule a in seconds.

How do I fill out schedule a on an Android device?

On an Android device, use the pdfFiller mobile app to finish your schedule a. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your schedule a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.