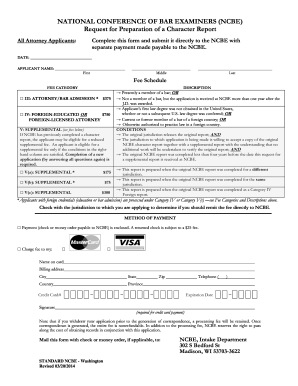

Get the free (Section 713

Show details

NOTICE OF CONTEST OF LIEN

(Section 713.22(2), F.S.)STATE OF FLORIDA

COUNTY OF SEMINOLE

TO:You are notified that the undersigned contests the claim of lien filed by you on,

Book, Page(year), and recorded

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign section 713

Edit your section 713 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your section 713 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit section 713 online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit section 713. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out section 713

How to fill out section 713:

01

Begin by carefully reading the instructions and requirements for section 713. Familiarize yourself with what information needs to be provided and any specific formatting or documentation requirements.

02

Fill out the required personal information accurately and completely. This may include your name, contact information, and any other details specifically requested in section 713.

03

Provide any necessary supporting documents or evidence. Section 713 may require you to submit additional documentation to support your claims or provide further information. Ensure that you gather all the necessary paperwork and attach it to your section 713 form.

04

Review your completed section 713 before submitting it. Take the time to double-check that all the information provided is correct and matches the requirements outlined in the instructions. Make any necessary corrections or additions.

Who needs section 713?

01

Individuals who are applying for a specific benefit or service may need to fill out section 713. This could include individuals applying for government assistance, grants, loans, or other forms of support.

02

Employers may also need to complete section 713 when filing certain types of documentation or forms related to their employees. This could include tax forms, benefits enrollment paperwork, or other HR-related documents.

03

Some organizations or institutions may require individuals or entities to fill out section 713 as part of their application or registration process. This could apply to educational institutions, licensing boards, or professional organizations.

Remember to always consult the specific instructions and requirements for section 713 in the context of the form or document you are working with, as it may vary depending on the situation or purpose.

Fill

form

: Try Risk Free

People Also Ask about

What is Texas franchise annual report?

The franchise tax report determines how much tax your Texas limited liability company (LLC) or corporation owes, as well as keeping your information up to date in state databases.

Does TX require annual report for LLC?

Information Reports: Corporations, LLCs, Limited Partnerships, Professional Associations and financial institutions must file the Public Information Report (PIR). All other entity types must file the Ownership Information Report (OIR).

Does Texas Secretary of State require an annual report for LLC?

Unlike most states, Texas does not require LLCs to file annual reports with the Secretary of State. However, LLCs must file annual franchise tax reports (see below).

What makes an annual report?

Annual reports typically include financial statements, such as balance sheets, income statements, and cash flow statements. In addition, there will often be graphs or charts included, helping break down the financials into easily readable information.

What is Texas Annual Report?

A Texas Annual Report is a yearly business report filed by companies conducting business in Texas.

What is annual report for LLC in Texas?

Your LLC annual report is an important document that details basic information to the state of Texas. The report requires collecting and reporting key information about the business, its structure, its directors and managers, and ownership interests. Filing this report is a mandated task within the state of Texas.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my section 713 directly from Gmail?

section 713 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Where do I find section 713?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the section 713 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make edits in section 713 without leaving Chrome?

section 713 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is section 713?

Section 713 refers to a specific section of a tax form or legal document.

Who is required to file section 713?

Individuals or entities who meet certain criteria set by the governing body.

How to fill out section 713?

Follow the instructions provided in the form or consult a professional for assistance.

What is the purpose of section 713?

The purpose of section 713 is to gather specific information for reporting or compliance purposes.

What information must be reported on section 713?

Information required on section 713 typically includes specific data relevant to the form or document.

Fill out your section 713 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Section 713 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.