Get the free 2210 - irs

Show details

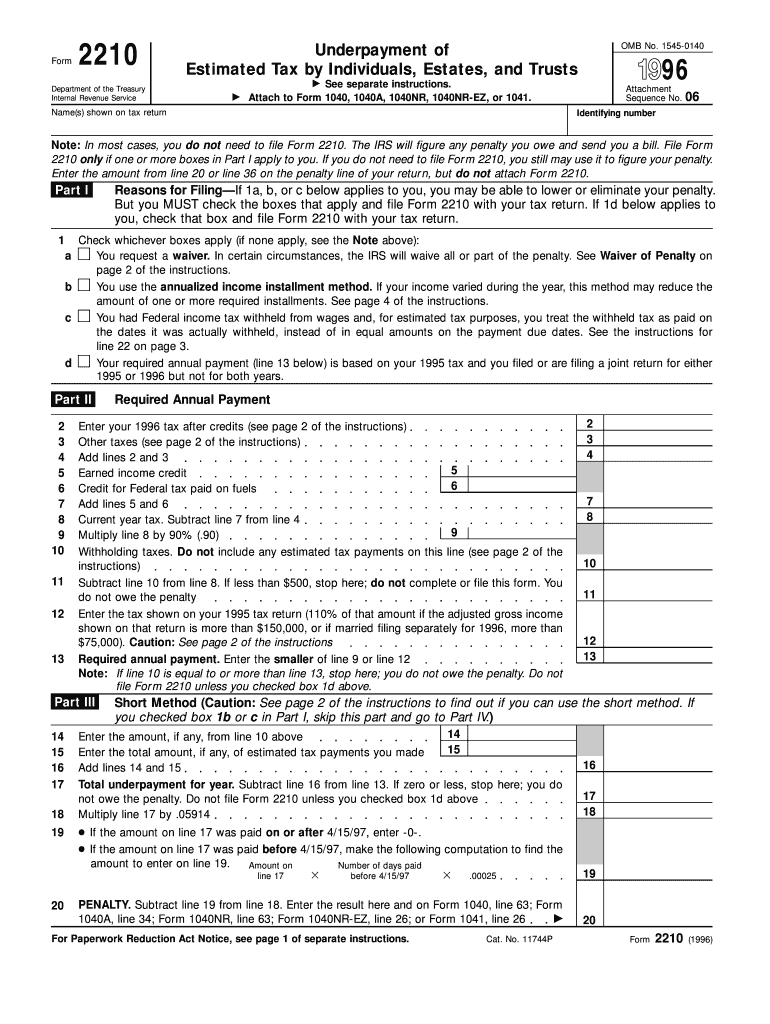

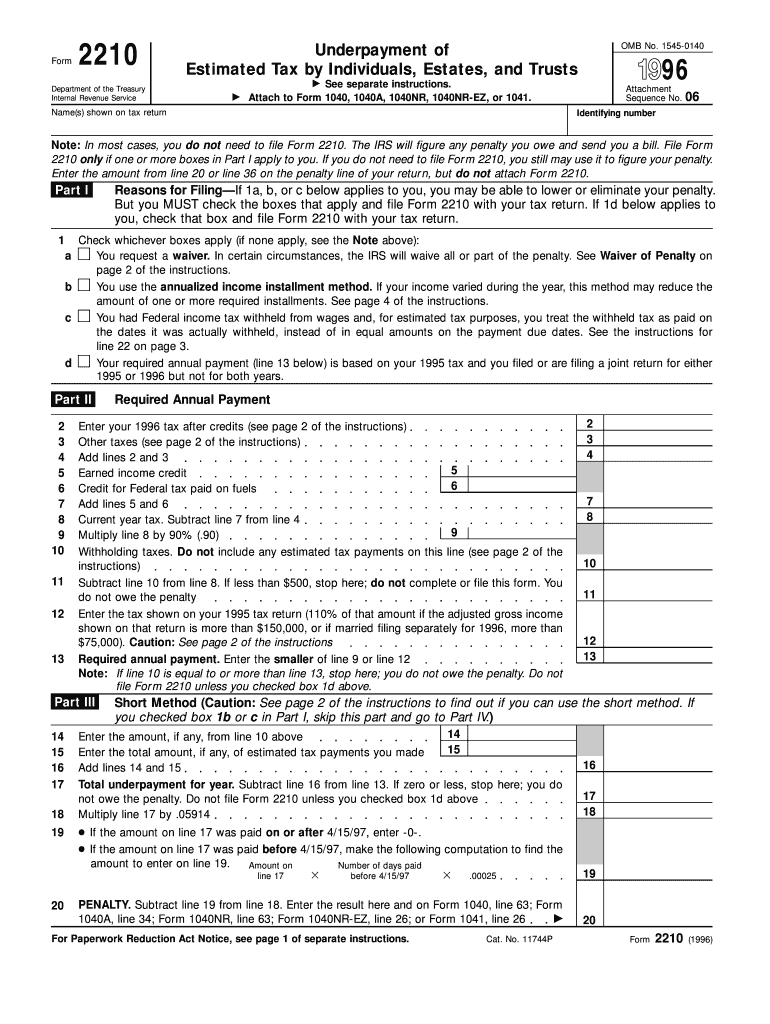

This form is used to calculate any penalties for the underpayment of estimated taxes by individuals, estates, and trusts as required by the IRS. It outlines the reasons for filing, calculations related

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2210 - irs

Edit your 2210 - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2210 - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2210 - irs online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2210 - irs. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2210 - irs

How to fill out 2210

01

Gather necessary documents: Collect your income statements, tax forms, and any other relevant financial information.

02

Determine if you need to file Form 2210: Check if you underpaid your taxes and might incur a penalty.

03

Fill out Part I: Complete the sections that calculate your total tax liability and any amount you owe.

04

Fill out Part II: Determine your underpayment amounts for each quarter based on your estimated tax payments.

05

Complete Part III: Calculate the penalty amount due for the underpayment.

06

Review instructions: Ensure that you have followed all guidelines and instructions provided for the form.

07

Sign and submit: Sign your completed Form 2210 and file it with your tax return or as a separate document.

Who needs 2210?

01

Individuals who have underpaid their estimated taxes during the year.

02

Taxpayers who incurred an underpayment penalty and need to explain or calculate it.

03

Those who did not withhold enough taxes from their income and wish to avoid future penalties.

Fill

form

: Try Risk Free

People Also Ask about

What is 22 numbers in English?

Hence, we can read the number 22 in English as “Twenty-Two”.

What does 10200 translate to in English?

10200 in words is written as Ten thousand two hundred.

What is twenty-two numbers in English?

Numbers in English NumberCardinalOrdinal 22 twenty-two twenty-second 23 twenty-three twenty-third 24 twenty-four twenty-fourth 25 twenty-five twenty-fifth39 more rows

How to write 21100 in words in English?

21100 in words is written as Twenty One Thousand One Hundred. In 21100, 2 has a place value of ten thousand, 1 is in the place value of thousand and the second 1 is in the place value of hundred.

How do you write 22 in words in English?

Now, using 1 to 30 spelling chart, we know that 22 in words is written as twenty-two.

How to write 210 in English words?

210 in words is written as Two Hundred and Ten. 210 represents the count or value.

Why 22 is a special number?

Number 22 signifies that you have the strength to not only withstand life's adversities but also to transform them into opportunities for personal growth and spiritual development. By trusting your inner voice and following your spiritual path, you can increase your spiritual awareness and find inner peace.

What is 22 as a number?

22 (twenty-two) is a number. It comes between twenty-one and twenty-three, and is an even number. It is divisible by 1, 2, 11, and 22.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2210?

Form 2210 is a document used by taxpayers to calculate whether they owe a penalty for underpayment of estimated tax.

Who is required to file 2210?

Taxpayers who do not pay enough tax through withholding and estimated tax payments may be required to file Form 2210.

How to fill out 2210?

To fill out Form 2210, you need to gather information about your income, deductions, and the estimated taxes you've paid, then follow the instructions provided on the form to calculate any underpayment.

What is the purpose of 2210?

The purpose of Form 2210 is to determine if a taxpayer has underpaid their estimated taxes and to compute any penalties associated with that underpayment.

What information must be reported on 2210?

Form 2210 requires information on total tax liability, estimated tax payments made, and the amount of tax owed or overpaid at various points during the tax year.

Fill out your 2210 - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2210 - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.