Get the free Cash and Liquidity Management

Show details

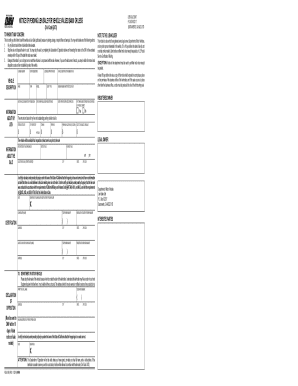

Fax your reply to 6224 2555 REPLY SLIP SEMINAR DETAILS Cash and Liquidity Management for Corporates Yes! Please register me for the seminar. (1109SAE) PAYMENT OPTIONS Date : 21 May 2009 Time : 09:00

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cash and liquidity management

Edit your cash and liquidity management form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash and liquidity management form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cash and liquidity management online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit cash and liquidity management. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cash and liquidity management

How to fill out cash and liquidity management:

01

Assess your current cash position: Start by evaluating your current cash inflows and outflows. This can involve analyzing your cash flow statements, bank statements, and financial records to determine your current cash position.

02

Identify potential cash flow issues: Look for any potential cash flow challenges or liquidity gaps that may arise in the future. Consider factors such as seasonality, business cycles, and any upcoming expenses or investments that could impact your cash reserves.

03

Forecast your future cash flows: Develop a cash flow forecast to project your future cash inflows and outflows. This can help you identify potential cash shortfalls or surpluses and make informed decisions about managing your cash and liquidity.

04

Optimize your cash inflows: Explore strategies to optimize your cash inflows. This could include negotiating favorable payment terms with customers or implementing efficient billing and collection processes to accelerate your cash receipts.

05

Analyze and control your cash outflows: Review your expenses and identify areas where you can reduce costs or improve efficiencies. This can involve renegotiating contracts with vendors, implementing cost-saving initiatives, or analyzing your inventory management practices to avoid tying up too much cash.

06

Maintain an appropriate cash reserve: Determine the optimal level of cash reserves you need to mitigate any unforeseen financial challenges or take advantage of potential opportunities. Strive to strike a balance between maintaining sufficient liquidity and maximizing the return on your excess cash.

07

Consider financing options: Evaluate different financing options such as lines of credit, short-term loans, or trade credit to address any temporary cash flow gaps or capitalize on growth opportunities. Compare the costs and benefits of each option to make an informed decision.

Who needs cash and liquidity management?

01

Small and medium-sized businesses: Cash and liquidity management is essential for small and medium-sized businesses that may have limited financial resources or face cash flow challenges. Effectively managing cash can help these businesses stay solvent and seize growth opportunities.

02

Startups and entrepreneurs: Startups and entrepreneurs often experience uncertain cash flows, especially during the early stages of business development. Adopting strong cash and liquidity management practices can ensure the survival and success of these ventures.

03

Large corporations: While large corporations may have more financial resources, they still need to manage their cash and liquidity effectively. By optimizing cash inflows and controlling cash outflows, these companies can enhance their financial stability and make strategic business decisions.

04

Not-for-profit organizations: Nonprofit organizations also require cash and liquidity management to ensure they can meet their financial obligations, fund their programs, and maintain their mission-driven activities.

In summary, effectively filling out cash and liquidity management involves assessing your current cash position, forecasting future cash flows, optimizing inflows and controlling outflows, maintaining adequate cash reserves, and considering financing options. This practice is relevant to small and medium-sized businesses, startups, large corporations, and nonprofit organizations alike.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cash and liquidity management directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign cash and liquidity management and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an eSignature for the cash and liquidity management in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your cash and liquidity management directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I edit cash and liquidity management on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing cash and liquidity management.

What is cash and liquidity management?

Cash and liquidity management refers to the process of monitoring, analyzing, and controlling the cash flows and liquid assets of an organization to ensure financial stability and meet short-term obligations.

Who is required to file cash and liquidity management?

Cash and liquidity management reports are typically required to be filed by financial institutions, large corporations, and organizations with significant cash holdings.

How to fill out cash and liquidity management?

Cash and liquidity management reports are filled out by compiling information on cash balances, cash flow projections, liquidity ratios, and any significant cash transactions.

What is the purpose of cash and liquidity management?

The purpose of cash and liquidity management is to optimize the use of cash resources, maintain financial stability, minimize the risk of insolvency, and ensure that the organization can meet its financial obligations.

What information must be reported on cash and liquidity management?

Information reported on cash and liquidity management typically includes cash balances, cash flow projections, liquidity ratios, and details of any significant cash transactions.

Fill out your cash and liquidity management online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cash And Liquidity Management is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.