IRS 1116 2012 free printable template

Show details

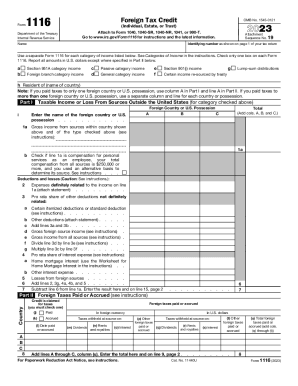

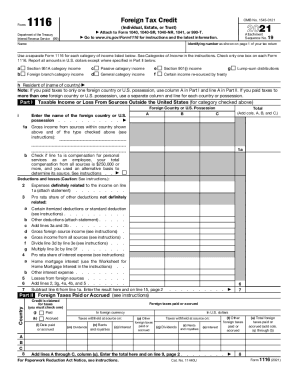

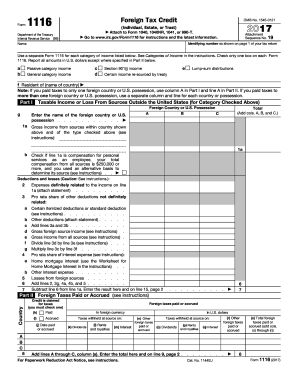

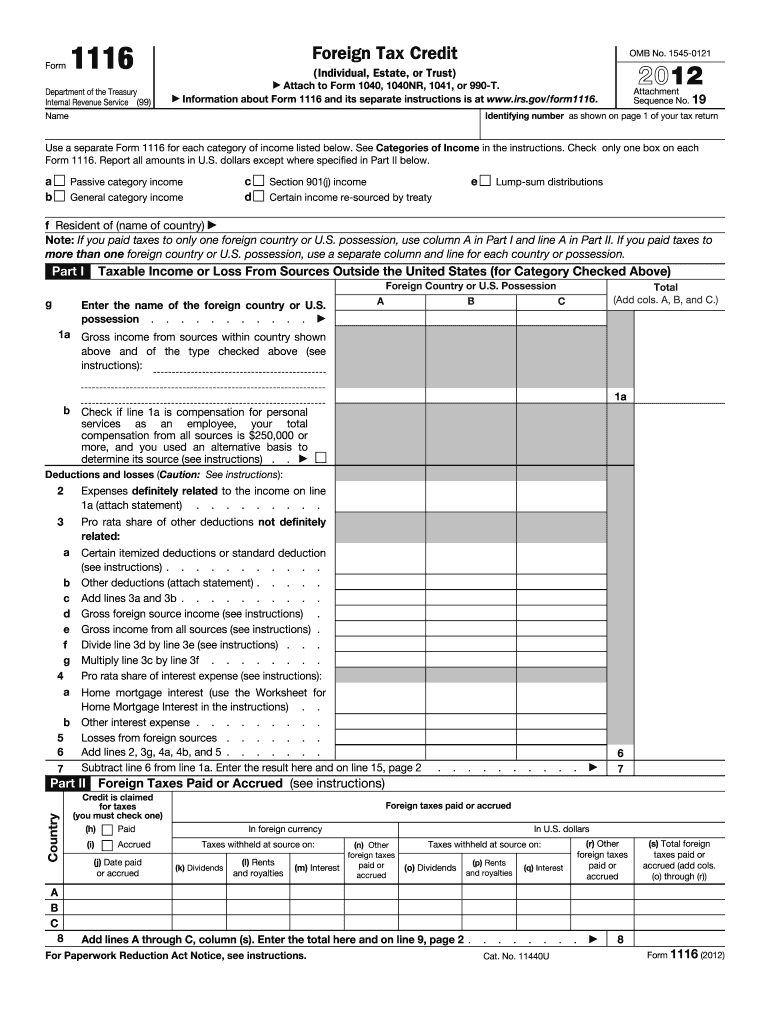

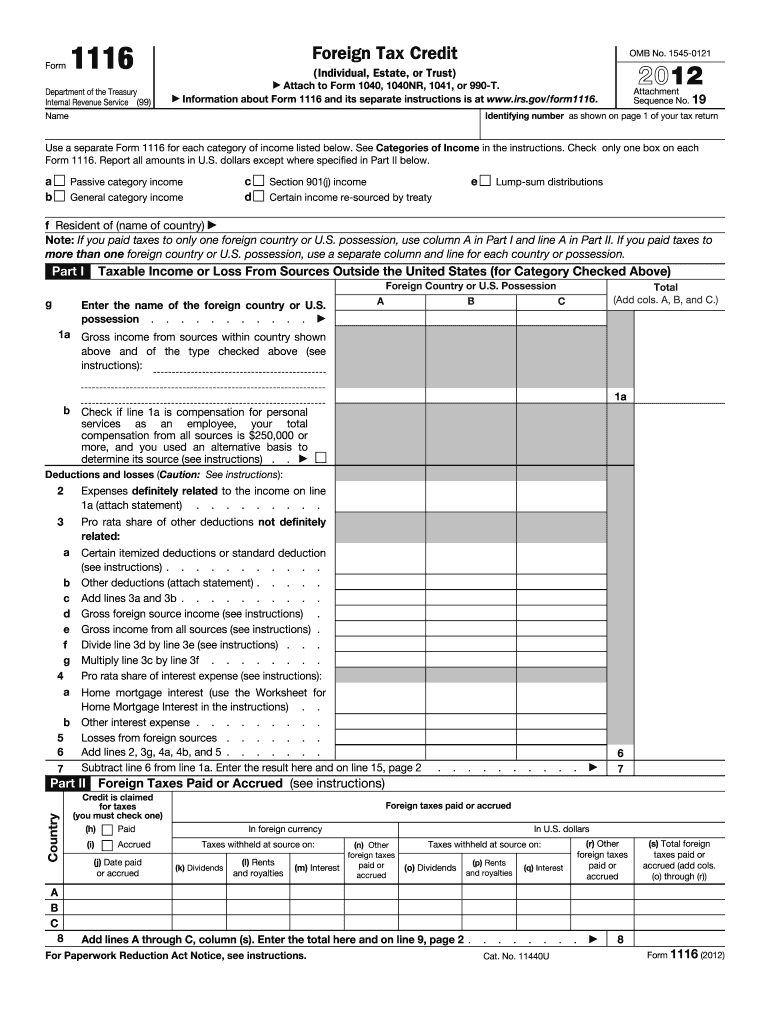

Information about Form 1116 and its separate instructions is at www.irs.gov/form1116. Attachment Sequence No. 19 Identifying number as shown on page 1 of your tax return Name Use a separate Form 1116 for each category of income listed below. If this is the only Form 1116 you are filing skip lines 23 through 27 and enter this amount on line 28. Skip lines 18 through 22. However if you are filing more than one Form 1116 you must complete line 20. O...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your form 1116 2012 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1116 2012 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 1116 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 1116. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

IRS 1116 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 1116 2012

How to fill out form 1116:

01

Begin by gathering all the necessary information and documents required to complete form 1116, such as your foreign tax credit information, income statements, and details about the foreign taxes paid.

02

Start filling out the form by providing your name, Social Security Number, and other personal information as requested.

03

Move on to Part I of the form, where you will need to enter the country or countries where you paid foreign taxes, along with the income earned and the amount of foreign taxes paid in each country.

04

In Part II, calculate the limitation on your foreign taxes by following the instructions provided on the form. This will help determine the maximum amount of foreign tax credits you can claim.

05

Use Part III to calculate your total foreign tax credit. This involves taking into account any carryover of unused foreign taxes from previous years, as well as any adjustments or modifications required.

06

Complete Part IV by providing additional information about your foreign tax credits, if necessary.

07

Finally, review your completed form 1116 for accuracy and make sure all required sections are filled out correctly. Attach any supporting documents as instructed and submit the form to the appropriate tax authorities.

Who needs form 1116:

01

Individuals who have earned income from foreign sources may need to file form 1116.

02

If you have paid taxes to a foreign country, form 1116 can be used to claim a foreign tax credit and avoid double taxation on that income.

03

Form 1116 is typically required if you are eligible for foreign tax credits and want to offset your U.S. tax liability with those credits.

Please note that it is always advisable to consult with a tax professional or refer to the IRS guidelines for specific instructions and requirements related to form 1116.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 1116?

Form 1116 is a tax form used by U.S. taxpayers to claim a foreign tax credit.

Who is required to file form 1116?

U.S. taxpayers who have paid foreign taxes on income earned outside the United States are required to file form 1116 if they want to claim a foreign tax credit.

How to fill out form 1116?

To fill out form 1116, you need to gather information about your foreign income, foreign taxes paid, and any foreign tax credits you are eligible to claim. You must then enter this information accurately and completely in the appropriate sections of the form.

What is the purpose of form 1116?

The purpose of form 1116 is to allow U.S. taxpayers to claim a credit for the foreign taxes they have paid on their foreign income. This helps to prevent double taxation and reduce the overall tax liability of the taxpayer.

What information must be reported on form 1116?

Form 1116 requires taxpayers to report their foreign income, foreign taxes paid, and any foreign tax credits they are eligible to claim. Additionally, taxpayers must provide details about the country or countries from which they earned the income and paid the taxes.

When is the deadline to file form 1116 in 2023?

The deadline to file form 1116 in 2023 is typically April 15th, or the following business day if April 15th falls on a weekend or holiday. However, it is always recommended to check with the IRS or a tax professional to confirm the exact deadline.

What is the penalty for the late filing of form 1116?

The penalty for late filing of form 1116 can vary depending on the specific circumstances. As of now, for individual taxpayers, the penalty is generally 5% of the unpaid tax per month, up to a maximum of 25% of the unpaid tax. However, it is important to consult with the IRS or a tax professional for the most accurate and up-to-date penalty information.

How can I modify form 1116 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including form 1116. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Where do I find form 1116?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the form 1116. Open it immediately and start altering it with sophisticated capabilities.

How can I fill out form 1116 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your form 1116, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your form 1116 2012 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.