Get the free GAB-2L - Government Accountability Board - gab wi

Show details

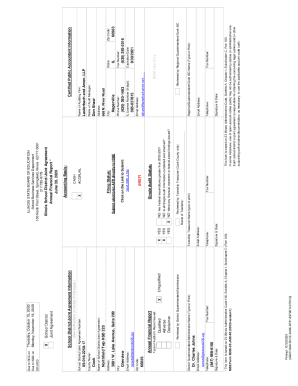

Filing dates and report names, refer to the CFS website https://cfis.wi.gov. . Summary of Receipts and Disbursements. Committees should complete the ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gab-2l - government accountability

Edit your gab-2l - government accountability form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gab-2l - government accountability form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gab-2l - government accountability online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit gab-2l - government accountability. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gab-2l - government accountability

How to fill out gab-2l - government accountability?

01

Start by gathering all the necessary information and documentation required to fill out the gab-2l form. This may include financial records, budget details, and any other relevant data related to government accountability.

02

Carefully read through the instructions provided with the gab-2l form. Familiarize yourself with the sections and fields that need to be completed. Pay close attention to any specific requirements or guidelines mentioned.

03

Begin filling out the gab-2l form by entering your personal or organizational information, such as your name, address, contact details, and identification numbers. Ensure that the information provided is accurate and up to date.

04

Move on to the financial section of the gab-2l form. Here, you will be required to provide details about your income, expenses, assets, liabilities, and any other financial information that is relevant to government accountability. Be thorough and precise in your responses.

05

If the gab-2l form includes sections for specific projects or programs, provide the necessary details, such as project goals, objectives, timelines, and budgets. Demonstrate how the resources allocated are being utilized effectively and efficiently.

06

Double-check all the information you have entered in the gab-2l form for any errors or omissions. Ensure that the form is complete and all sections have been properly filled out.

07

Review the guidelines for submitting the gab-2l form. Determine whether it needs to be submitted online, by mail, or in person. Make note of any supporting documents that need to accompany the form and gather them accordingly.

08

Once you have completed the gab-2l form and have organized all the necessary documents, submit them according to the provided instructions. Keep a copy of the filled-out form and supporting documents for your records.

Who needs gab-2l - government accountability?

01

Government agencies and departments: Government entities often require gab-2l forms to ensure transparency, accountability, and responsible handling of public funds. It allows them to evaluate and monitor the financial activities of various projects, programs, and organizations under their jurisdiction.

02

Non-profit organizations: Non-profits, particularly those that receive government funding or grants, may need to fill out gab-2l forms to demonstrate their proper utilization of funds and adherence to financial accountability standards.

03

Financial auditors and oversight bodies: Auditors and oversight entities utilize gab-2l forms to examine the financial practices and accountability of government agencies and organizations. It helps them ensure compliance with accounting principles and detect any potential mismanagement or irregularities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gab-2l - government accountability?

Gab-2l stands for Government Accountability Report and it is a report that helps ensure transparency and accountability in government spending.

Who is required to file gab-2l - government accountability?

Government agencies and departments are required to file gab-2l - government accountability.

How to fill out gab-2l - government accountability?

Gab-2l - government accountability can be filled out by providing detailed information on the expenditures and revenues of the government agency or department.

What is the purpose of gab-2l - government accountability?

The purpose of gab-2l - government accountability is to provide insight into how taxpayer money is being used by the government.

What information must be reported on gab-2l - government accountability?

Information such as budget allocations, actual spending, sources of revenue, and any discrepancies between budgeted and actual amounts must be reported on gab-2l - government accountability.

How can I manage my gab-2l - government accountability directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your gab-2l - government accountability and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I make edits in gab-2l - government accountability without leaving Chrome?

gab-2l - government accountability can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I sign the gab-2l - government accountability electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your gab-2l - government accountability in seconds.

Fill out your gab-2l - government accountability online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gab-2l - Government Accountability is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.