Get the free EB SPURR - NZ Plant Protection Society Home Page - nzpps

Show details

Forest Weeds and Pests 401 FREEZEDRIED BAIT FOR WASP CONTROL E.B. SPUR Managed When Handcar Research, PO Box 69, Lincoln, New Zealand ABSTRACT An experimental freeze-dried sardine based bait and a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your eb spurr - nz form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your eb spurr - nz form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing eb spurr - nz online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit eb spurr - nz. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out eb spurr - nz

How to Fill Out EB Spurr - NZ:

01

Start by gathering all the necessary information and documents required to fill out the EB Spurr - NZ form. This may include personal details, employment information, and any other relevant information.

02

Carefully read through the instructions and guidelines provided with the form to ensure you understand the requirements and any specific instructions for filling it out.

03

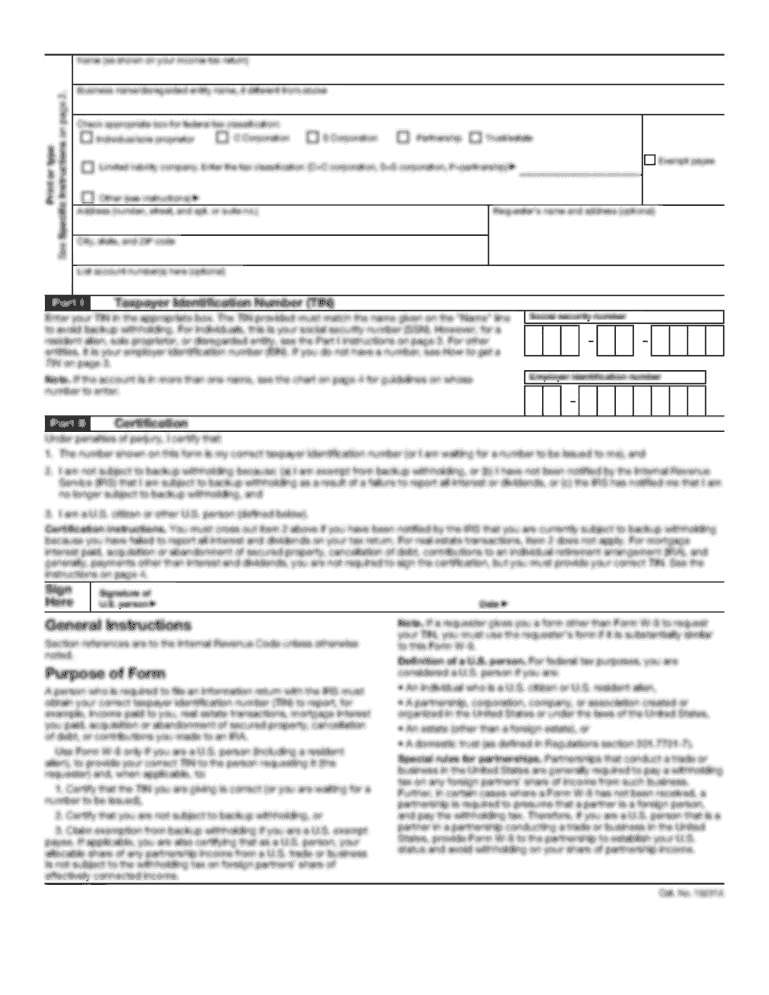

Begin filling out the form by entering your personal details, such as your full name, contact information, and residential address. Make sure to provide accurate and up-to-date information.

04

Move on to the employment section of the form where you will need to provide details about your current or previous employment. This may include your job title, company name, duration of employment, and your role or responsibilities.

05

Provide any additional information or supporting documents that are requested in the form. This may include financial statements, references, or any other relevant information required to complete the process.

06

Double-check all the information you've entered on the form to ensure its accuracy and completeness. Look out for any errors or missing information that may need to be corrected before submitting the form.

07

Once you've reviewed and verified all the information, sign and date the form as required. This confirms that the information provided is true and accurate to the best of your knowledge.

Who needs EB Spurr - NZ?

01

Individuals who are seeking employment opportunities in New Zealand may need to fill out the EB Spurr - NZ form. This form is often used as part of the application process for certain jobs or work permits in the country.

02

Employers or companies that are hiring foreign workers may also require applicants to fill out the EB Spurr - NZ form. This allows them to gather necessary information and assess an individual's suitability for the position and their eligibility to work in New Zealand.

03

Immigration authorities or government agencies may use the EB Spurr - NZ form to process work permit applications and evaluate an individual's eligibility to work in the country. This helps ensure compliance with immigration laws and regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is eb spurr - nz?

Eb Spurr - NZ is a tax form used in New Zealand to report income earned through self-employment or business activities.

Who is required to file eb spurr - nz?

Individuals who are self-employed or operating a business in New Zealand are required to file eb spurr - nz.

How to fill out eb spurr - nz?

Eb spurr - nz can be filled out online through the official website of the New Zealand Inland Revenue Department or by using paper forms available from their office.

What is the purpose of eb spurr - nz?

The purpose of eb spurr - nz is to report income and calculate taxes owed on self-employment or business activities.

What information must be reported on eb spurr - nz?

Information such as income earned, expenses incurred, and any tax deductions claimed must be reported on eb spurr - nz.

When is the deadline to file eb spurr - nz in 2023?

The deadline to file eb spurr - nz in 2023 is April 7th.

What is the penalty for the late filing of eb spurr - nz?

The penalty for the late filing of eb spurr - nz is a fine of $100 for each month the return is late, up to a maximum of $1,000.

How can I edit eb spurr - nz from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your eb spurr - nz into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete eb spurr - nz online?

Easy online eb spurr - nz completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit eb spurr - nz on an Android device?

The pdfFiller app for Android allows you to edit PDF files like eb spurr - nz. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your eb spurr - nz online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.