Get the free Texas Comptroller’s Property Tax Rules - window state tx

Show details

This document outlines the rules and regulations regarding property tax administration in Texas as set forth by the Texas Comptroller. It includes details about property value studies, appraisal procedures,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign texas comptrollers property tax

Edit your texas comptrollers property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas comptrollers property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

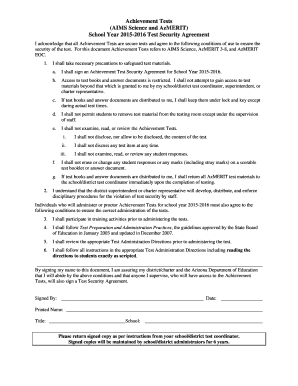

Editing texas comptrollers property tax online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit texas comptrollers property tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out texas comptrollers property tax

How to fill out Texas Comptroller’s Property Tax Rules

01

Gather all necessary property information including property address, ownership details, and any relevant tax documents.

02

Visit the Texas Comptroller's website to access the Property Tax Rules document.

03

Read through the provided rules and guidelines carefully to understand the application process.

04

Fill out the required forms, ensuring all information is accurate and complete.

05

Include any supporting documentation that may be required.

06

Submit the completed forms by the designated deadline, either electronically or by mail.

Who needs Texas Comptroller’s Property Tax Rules?

01

Property owners in Texas who are subject to property tax assessments and need to understand their rights and responsibilities.

02

Tax professionals and consultants who assist clients with property tax matters.

03

Local government officials and assessors who administer property taxes.

Fill

form

: Try Risk Free

People Also Ask about

At what age does Texas stop paying property taxes?

To qualify for the age 65 or older residence homestead exemption, the individual must be age 65 or older, have an ownership interest in the property and live in the home as his or her principal residence.

Who doesn't pay property tax in Texas?

Property Tax Exemptions (Texas Property Tax Code 11.13) If the county grants an optional exemption for homeowners age 65 or older or disabled, the owners will receive only the local-option exemption.

How much of your property taxes are tax deductible in Texas?

One of the key considerations when deducting property taxes is the SALT deduction limit. The SALT (State and Local Taxes) deduction allows taxpayers to deduct up to $10,000 ($5,000 if married filing separately) of their total state and local taxes, which include property taxes, state income taxes, and sales taxes.

At what age do seniors stop paying property taxes in Texas?

To qualify for the age 65 or older residence homestead exemption, the individual must be age 65 or older, have an ownership interest in the property and live in the home as his or her principal residence.

Who qualifies for tax exempt in Texas?

Some customers are exempt from paying sales tax under Texas law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

What is the 10% rule for property taxes in Texas?

The appraised value for a homeowner who qualifies his or her homestead for exemptions in the preceding and current year may not increase more than 10 percent per year.

How to get out of paying property taxes in Texas?

You may apply for homestead exemptions on your principal residence. Homestead exemptions remove part of your home's value from taxation so they lower taxes. For example, your home is appraised at $50,000, and you qualify for a $15,000 exemption, you will pay taxes on the home as if it was worth only $35,000.

Who is exempt from paying property taxes in Texas?

There are several partial and absolute exemptions available. Some of these exemptions include General Residential Homestead, Over 65, Over 55 Surviving Spouse, Disability Homestead, Disabled Veterans, Charitable, Religious, Freeport and Pollution Control.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Texas Comptroller’s Property Tax Rules?

Texas Comptroller’s Property Tax Rules are regulations governing the assessment and collection of property taxes in the state of Texas, providing guidelines for property owners and appraisal districts.

Who is required to file Texas Comptroller’s Property Tax Rules?

Property owners, including individuals and businesses, as well as appraisal districts and taxing units, are required to comply with the Texas Comptroller’s Property Tax Rules.

How to fill out Texas Comptroller’s Property Tax Rules?

To fill out Texas Comptroller’s Property Tax Rules, property owners must complete the appropriate forms provided by the Comptroller's office, ensuring all required information is accurately reported and submitted by the deadlines.

What is the purpose of Texas Comptroller’s Property Tax Rules?

The purpose of Texas Comptroller’s Property Tax Rules is to ensure fair and equitable property tax assessment and collection, providing clarity and consistency in the property tax process throughout the state.

What information must be reported on Texas Comptroller’s Property Tax Rules?

The information that must be reported includes property descriptions, ownership details, exemptions claimed, and the appraised value of the property, along with any other relevant financial information.

Fill out your texas comptrollers property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Comptrollers Property Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.