Get the free Credit Application - Residential - Fuel - 30.doc

Show details

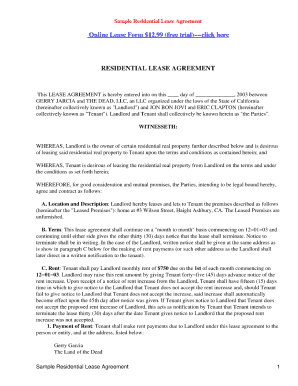

BOLTZMANN OIL CORPORATION Application for Credit Residential Fuel Card SECTION 1 APPLICANT NAME (first, middle, last) HOME TELEPHONE: CELL NUMBER: MAILING ADDRESS CITY STATE ZIP CODE PHYSICAL ADDRESS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit application - residential

Edit your credit application - residential form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit application - residential form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit application - residential online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit application - residential. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit application - residential

How to fill out credit application - residential:

01

Gather all necessary documents

1.1

Collect documents such as your identification (driver's license, passport), proof of income (pay stubs, tax returns), and proof of address (utility bills, lease agreement).

02

Provide personal information

2.1

Fill in your full name, date of birth, social security number, and contact information in the designated sections of the application. Ensure accuracy and double-check for any mistakes.

03

Fill in employment details

3.1

Provide your current employment status, such as whether you are employed, self-employed, or unemployed. If employed, include your employer's name, address, and contact information. Include any additional income sources if applicable.

04

Provide financial details

4.1

Disclose your current financial situation, including your monthly income, expenses, and assets. This may include details about your bank accounts, investments, and any outstanding debts or loans.

05

Fill in residential information

5.1

Include details about your current residence, such as the address, how long you have lived there, and whether you own or rent the property. Provide any previous addresses if you have moved within the past few years.

06

Include references

6.1

Provide references who can vouch for your character and reliability. This may include friends, family members, or professional contacts. Include their contact information and specify your relationship with them.

Who needs credit application - residential?

01

Individuals seeking to rent or purchase a residential property

1.1

Potential tenants or homebuyers may be required by landlords or lenders to fill out a credit application as part of the screening process. This ensures that the applicant's financial background and creditworthiness meet certain criteria.

02

Landlords and property management companies

2.1

Landlords and property managers rely on credit applications to assess the financial stability and reliability of potential tenants. By reviewing the application, they can determine whether the applicant is likely to pay rent on time and fulfill their financial obligations.

03

Mortgage lenders and banks

3.1

When individuals apply for a home mortgage or other forms of residential financing, lenders evaluate their creditworthiness through a credit application. This helps lenders make informed decisions regarding loan approval, interest rates, and loan terms based on the applicant's financial history and ability to repay the loan.

04

Real estate agents

4.1

Real estate agents may request that potential buyers fill out a credit application to assess their suitability for specific properties. This can help agents match clients with properties that fit their budget and financing options.

05

Property owners selling their homes

5.1

In some cases, individuals selling their residential properties may request potential buyers to complete a credit application to ensure they are financially capable of purchasing the property. This helps the seller evaluate the buyer's qualifications and minimize the risk of a failed transaction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit application - residential in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign credit application - residential and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I fill out credit application - residential using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign credit application - residential and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit credit application - residential on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share credit application - residential on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is credit application - residential?

Credit application - residential is a form used by individuals to apply for credit for residential purposes, such as a home loan or mortgage.

Who is required to file credit application - residential?

Individuals who are seeking credit for residential purposes are required to file a credit application - residential.

How to fill out credit application - residential?

To fill out a credit application - residential, individuals need to provide personal information, financial information, and details about the residential property they are seeking credit for.

What is the purpose of credit application - residential?

The purpose of a credit application - residential is to allow individuals to apply for credit for residential purposes in an organized and standardized manner.

What information must be reported on credit application - residential?

Information such as personal details, employment history, income, assets, liabilities, and details about the residential property must be reported on a credit application - residential.

Fill out your credit application - residential online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Application - Residential is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.