Get the free STATE OF WEST VIRGINIA State Tax Department, Tax Account Administration Division 120...

Show details

STATE OF WEST VIRGINIA State Tax Department, Tax Account Administration Division 1206 Quarries St. Charleston, WV 25301 Earl Ray Tomlin, Governor Craig A. Griffith, Tax Commissioner Estate or Trust

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

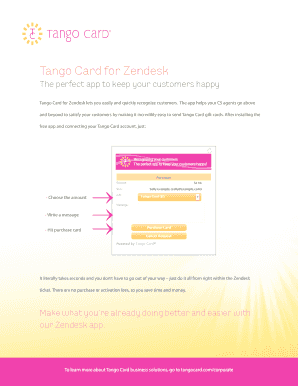

Edit your state of west virginia form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state of west virginia form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing state of west virginia online

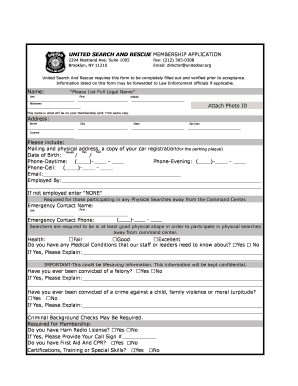

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit state of west virginia. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

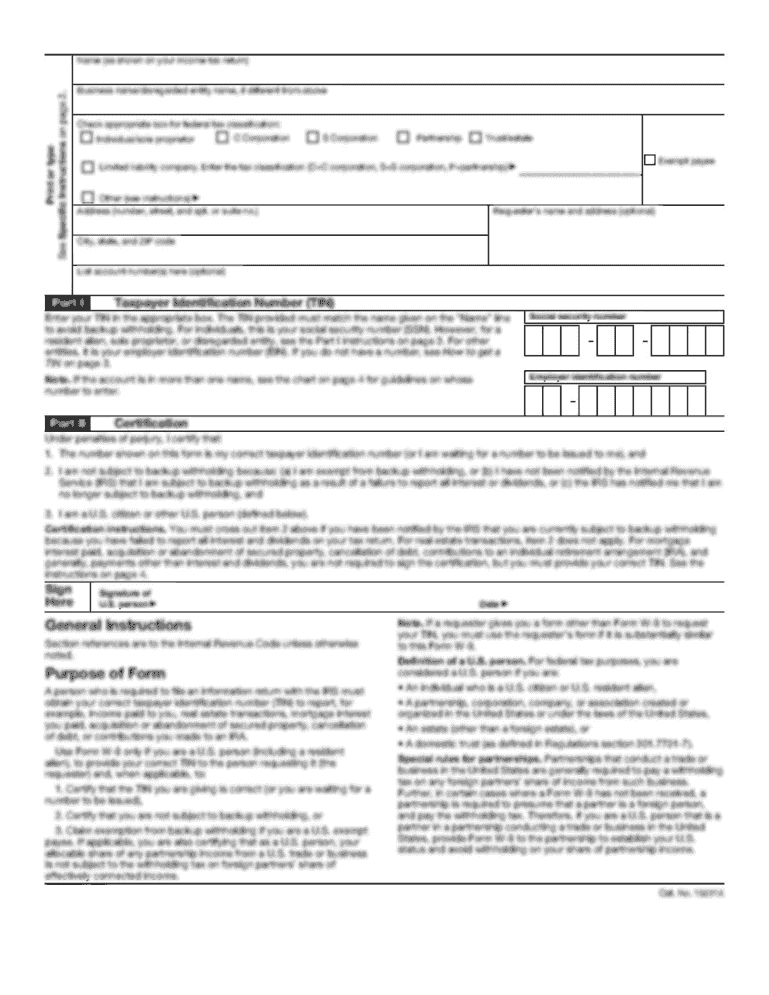

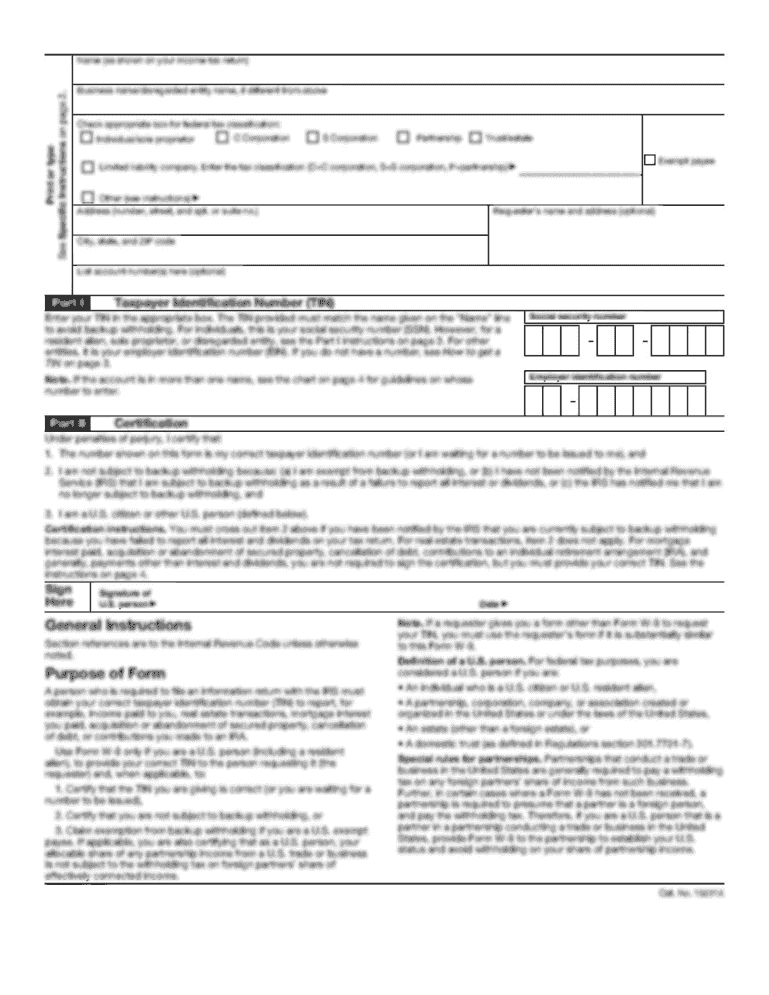

How to fill out state of west virginia

How to Fill Out State of West Virginia:

01

Obtain the necessary forms: Start by downloading or obtaining the required forms for filling out the state of West Virginia. These forms can usually be found on the official website of the West Virginia state government or by visiting a local government office.

02

Gather the required information: Before filling out the forms, gather all the necessary information you will need. This may include personal details such as your name, address, social security number, and employment information. Additionally, you may need to gather supporting documents such as identification, proof of residency, or income statements.

03

Complete the forms accurately: Carefully fill out each section of the forms, ensuring accuracy and providing all the requested information. Pay close attention to any specific instructions or guidelines provided with the forms to avoid any mistakes or omissions.

04

Attach required documents: Depending on the purpose of filling out the state of West Virginia, you may need to attach certain supporting documents. Make sure to review the instructions and include any necessary documentation, such as proof of income or identification, along with the completed forms.

05

Review and double-check: Once you have completed filling out the forms and attached any required documents, take the time to review everything. Double-check for any errors or missing information that needs to be corrected before submission. Accuracy is essential to avoid delays or complications in the process.

06

Submit the forms: After ensuring that everything is accurately completed and all necessary documents are attached, submit the forms. Follow the specified instructions for submission, whether it be online, via mail, or in person.

Who needs state of West Virginia?

01

Residents: Individuals who reside in the state of West Virginia need to ensure their state-related matters, such as taxes, voting registration, or driver's license, are appropriately addressed.

02

Business Owners: Entrepreneurs or companies operating within West Virginia must comply with state regulations, which may involve filing tax returns, registering their business, or obtaining necessary licenses.

03

Job Applicants/Employees: Individuals seeking employment in West Virginia or already employed within the state may need to fill out specific state-related forms, such as W-4s for tax withholding purposes.

04

Students: Students looking to attend West Virginia universities or colleges may need to fill out state-related forms, such as applications for financial aid or residency verification.

05

Individuals Receiving State Benefits: Those who are eligible for state benefits such as healthcare, unemployment, or public assistance may need to complete specific forms to access these services.

Remember to refer to specific state guidelines and consult with appropriate authorities or professionals when filling out state-related forms in West Virginia.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is state of west virginia?

The state of West Virginia is a state located in the Appalachian region of the United States.

Who is required to file state of west virginia?

Individuals and businesses that meet certain income thresholds or have West Virginia source income are required to file the state of West Virginia.

How to fill out state of west virginia?

To fill out the state of West Virginia, individuals and businesses can use the official forms provided by the West Virginia Department of Revenue or utilize electronic filing methods.

What is the purpose of state of west virginia?

The purpose of the state of West Virginia is to report and pay taxes owed to the state government based on income earned or certain transactions conducted within the state.

What information must be reported on state of west virginia?

The state of West Virginia requires individuals and businesses to report various types of income, deductions, credits, and other relevant information depending on their specific tax situation.

When is the deadline to file state of west virginia in 2023?

The deadline to file the state of West Virginia in 2023 is typically April 17th, unless it falls on a weekend or holiday.

What is the penalty for the late filing of state of west virginia?

The penalty for the late filing of the state of West Virginia can vary depending on the amount of tax owed and the length of the delay. It is best to consult the official guidelines provided by the West Virginia Department of Revenue for specific details.

How can I send state of west virginia to be eSigned by others?

To distribute your state of west virginia, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for the state of west virginia in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your state of west virginia in minutes.

How do I edit state of west virginia straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing state of west virginia.

Fill out your state of west virginia online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.