Get the free T-1678Corrigendum3

Show details

Maharashtra State Road Development Corporation Limited, Mumbai,

Near Priyadarshini Park, Repeat Sea Road, Mumbai 400 036, INDIA.

Tel: 022 26517931, Fax: 022 26417893

Email: toll.mumbai@gmail.com Website:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your t-1678corrigendum3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t-1678corrigendum3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing t-1678corrigendum3 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit t-1678corrigendum3. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out t-1678corrigendum3

How to fill out t-1678corrigendum3:

01

Start by obtaining a copy of the t-1678corrigendum3 form. This can usually be found on the relevant website or platform for submitting corrections or updates.

02

Read the instructions carefully to understand the purpose and requirements of the form. This will help you fill it out accurately.

03

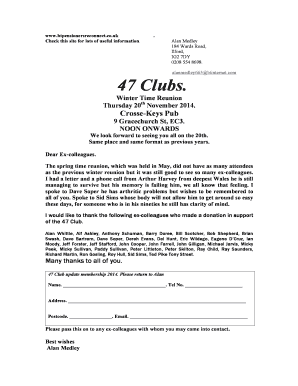

Begin filling out the form by providing your personal details or company information, depending on who the form is for. This may include your name, address, contact information, and any other relevant identification details.

04

Follow the instructions on the form to enter the necessary information or corrections. This could involve providing specific data, updating existing information, or amending any errors or inaccuracies.

05

Double-check all the information you have entered to ensure its accuracy. Mistakes on the form can cause delays or complications, so it's crucial to review everything thoroughly.

06

Once you are confident that all the required fields have been completed correctly, sign the form. You may also need to include the date of submission and any additional required signatures.

07

Keep a copy of the completed form for your records before submitting it through the designated channel or platform. It's always a good idea to have a copy in case any disputes or issues arise in the future.

Who needs t-1678corrigendum3:

01

Individuals or companies who have identified errors or inaccuracies in previous documents or submissions related to t-1678corrigendum3 may need to fill out this form. It is used to correct any mistakes or update information that was previously provided.

02

Those who require a revised version of a document or submission that was previously submitted and accepted may also need to fill out t-1678corrigendum3. This form allows for updates or amendments to be made where necessary.

03

Organizations or individuals who are responsible for maintaining accurate records and ensuring compliance with regulations may need to fill out t-1678corrigendum3 as part of their obligations. This helps to ensure that all information is kept up to date and accurately reflects the current situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

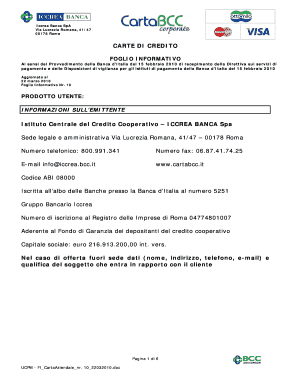

What is t-1678corrigendum3?

t-1678corrigendum3 is a form used for correcting errors in previously filed tax documents.

Who is required to file t-1678corrigendum3?

Any individual or entity that needs to correct errors in their previously filed tax documents.

How to fill out t-1678corrigendum3?

To fill out t-1678corrigendum3, you need to provide details of the errors that need to be corrected and the correct information.

What is the purpose of t-1678corrigendum3?

The purpose of t-1678corrigendum3 is to rectify mistakes in previously filed tax documents.

What information must be reported on t-1678corrigendum3?

t-1678corrigendum3 requires information on the errors that are being corrected and the correct information that should have been provided.

When is the deadline to file t-1678corrigendum3 in 2024?

The deadline to file t-1678corrigendum3 in 2024 is usually the same as the deadline for filing your tax return, but it is recommended to check with the relevant tax authority for specific dates.

What is the penalty for the late filing of t-1678corrigendum3?

The penalty for the late filing of t-1678corrigendum3 can vary depending on the tax authority, but it may include fines or interest charges on the corrected amount.

How can I manage my t-1678corrigendum3 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign t-1678corrigendum3 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send t-1678corrigendum3 to be eSigned by others?

Once you are ready to share your t-1678corrigendum3, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I get t-1678corrigendum3?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the t-1678corrigendum3 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Fill out your t-1678corrigendum3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.