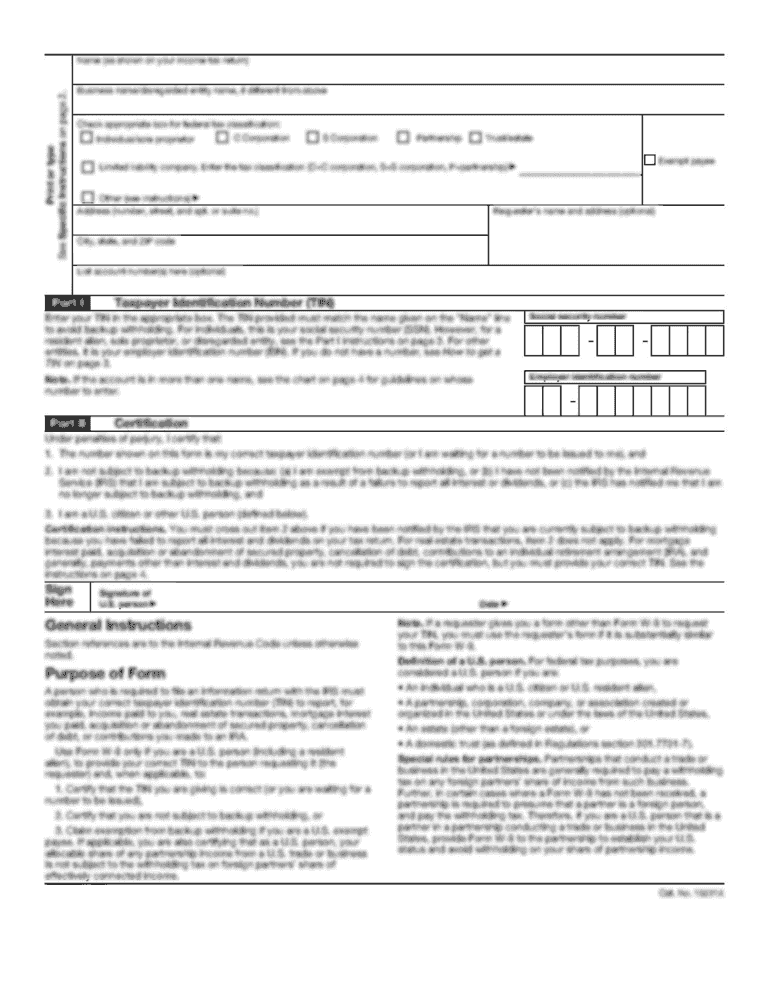

Get the free Stock Donation Brokerage Transfer Authorization Form (pdf) - allinahealth

Show details

? Stock? Donation? Brokerage? Transfer? Authorization? Form? (To?be?completed?by?the?donor)? ? ? Date:? ? ? To:? ? ? ? ?? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ???????????????(612)?863?4126? ? ? Donor’s?

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your stock donation brokerage transfer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your stock donation brokerage transfer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit stock donation brokerage transfer online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit stock donation brokerage transfer. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out stock donation brokerage transfer

How to fill out stock donation brokerage transfer:

01

Obtain the necessary forms: Contact your brokerage firm or financial advisor to request the relevant forms for stock donation brokerage transfer. These forms may vary depending on the institution, but typically include a stock transfer form and a donation acknowledgment form.

02

Provide personal information: Fill out your personal details, including your name, address, phone number, and email address. This information is required for record-keeping purposes and to ensure proper communication regarding the donation.

03

Specify the stock to be transferred: Clearly identify the stock you intend to donate by providing the name of the company, the number of shares, and the stock symbol. It is essential to accurately provide this information to avoid any errors in the transfer process.

04

Indicate the recipient organization: Write down the name and contact information of the nonprofit organization or charity that will receive the stock donation. Ensure that the organization is eligible to receive tax-deductible donations and that they accept stock donations.

05

Provide instructions for the transfer: Specify whether you would like to transfer the stocks in certificate form or electronically. If the stocks are held in certificate form, you will need to include the certificates with the filled-out forms. If the stocks are held electronically, indicate the account number or other relevant details required for the transfer.

06

Sign and date the forms: Read the instructions carefully and sign the relevant sections of the forms. Ensure that you date the forms accordingly to indicate the exact date of the transfer request.

07

Submit the forms: Once you have completed all the required sections and signed the forms, submit them to your brokerage firm or financial advisor. Some firms may allow you to submit the forms online, while others may require physical copies to be mailed or dropped off.

Who needs stock donation brokerage transfer?

01

Individuals looking to support charitable causes: Stock donation brokerage transfer is beneficial for individuals who wish to donate shares of stock to nonprofit organizations or charities. By donating appreciated stocks, individuals can potentially avoid capital gains taxes and claim a tax deduction based on the fair market value of the donated stocks.

02

Nonprofit organizations and charities: Nonprofit organizations and charities are the recipients of stock donation brokerage transfer. They rely on such donations to support their operations, fund projects, and make a positive impact in their respective causes. Accepting stock donations provides these organizations with another avenue for donors to contribute and support their missions.

03

Financial advisors and brokerage firms: Financial advisors and brokerage firms play a crucial role in facilitating stock donation brokerage transfers. They help individuals navigate the donation process, provide necessary forms, and ensure the smooth transfer of the donated stocks to the designated organizations. Financial advisors also offer guidance on the tax benefits and implications of stock donations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is stock donation brokerage transfer?

Stock donation brokerage transfer is the process of transferring stocks or securities from one brokerage account to another as a charitable donation.

Who is required to file stock donation brokerage transfer?

Individuals or organizations who want to donate stocks or securities as a charitable contribution are required to file stock donation brokerage transfer.

How to fill out stock donation brokerage transfer?

To fill out stock donation brokerage transfer, you need to provide details about the stocks or securities being donated, including their name, quantity, and value. You will also need to provide information about the receiving brokerage account.

What is the purpose of stock donation brokerage transfer?

The purpose of stock donation brokerage transfer is to enable individuals or organizations to donate stocks or securities to charitable causes.

What information must be reported on stock donation brokerage transfer?

The stock donation brokerage transfer should include information such as the name and contact information of the donor and the recipient, the details of the stocks or securities being donated, and any additional instructions or preferences.

When is the deadline to file stock donation brokerage transfer in 2023?

The deadline to file stock donation brokerage transfer in 2023 may vary depending on the jurisdiction and specific requirements. It is recommended to consult with tax authorities or a financial advisor to determine the exact deadline.

What is the penalty for the late filing of stock donation brokerage transfer?

The penalty for the late filing of stock donation brokerage transfer may vary depending on the jurisdiction and specific regulations. It is advisable to consult with tax authorities or a financial advisor to understand the potential penalties.

How can I get stock donation brokerage transfer?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific stock donation brokerage transfer and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How can I edit stock donation brokerage transfer on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing stock donation brokerage transfer right away.

How do I fill out the stock donation brokerage transfer form on my smartphone?

Use the pdfFiller mobile app to complete and sign stock donation brokerage transfer on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your stock donation brokerage transfer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.