Get the free Credit_Repair_Manual[1]

Show details

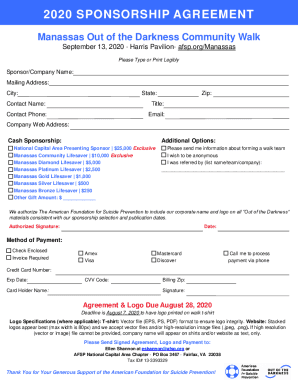

This document provides contact information for the three major credit reporting agencies—Experian, Trans Union, and Equifax—along with details on how to request credit reports and dispute any

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit_repair_manual1

Edit your credit_repair_manual1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit_repair_manual1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit_repair_manual1 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit_repair_manual1. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit_repair_manual1

How to fill out Credit_Repair_Manual[1]

01

Obtain a copy of your credit report from all three major credit bureaus.

02

Review the credit report for any errors or inaccuracies.

03

Gather supporting documents for any discrepancies found on your credit report.

04

Write dispute letters to the credit bureaus for any inaccuracies that need to be corrected.

05

Include necessary documentation with your dispute letters.

06

Monitor responses from the credit bureaus regarding your disputes.

07

Use the manual to learn about strategies for improving your credit score, such as paying bills on time and reducing credit card balances.

08

Follow the manual's guidance on building new credit responsibly.

Who needs Credit_Repair_Manual[1]?

01

Individuals looking to improve their credit score.

02

People who have been denied credit due to poor credit history.

03

Anyone wanting to dispute inaccuracies on their credit report.

04

Consumers who want to learn how to manage their credit wisely.

Fill

form

: Try Risk Free

People Also Ask about

What is the first step in repairing my credit?

How to repair your credit score in 6 steps Check your credit report often and look for errors. Focus on small, regular payments and control your spending. Reduce your high-balance accounts and use credit cards sparingly. Consider a debt consolidation loan. Work with a credit counseling agency.

How to charge for credit repair?

Monthly subscription model Some businesses opt to charge a recurring monthly fee. Rates can range widely, with many businesses charging anywhere from $59 to $179 per month. An initial “first work fee” may be charged after setup, followed by a monthly fee after each month's work is completed.

How to get a 700 credit score in 30 days?

Improving your credit in 30 days is possible. Ways to do so include paying off credit card debt, becoming an authorized user, paying your bills on time and disputing inaccurate credit report information.

Where to start with credit repair?

How Can I Repair Credit Myself? Request Credit Report. Review Reports Carefully. Dispute Any Incorrect Information. Pay Bills on Time. Pay Off Delinquent Balances. Decrease Your Credit Utilization, and Pay Down Your Debt. Open Different Types of Accounts. Keep Accounts Open.

What is the secret to credit repair?

To repair credit, it's important to consistently practice responsible credit habits. Using credit responsibly means doing things like paying statements on time every month. The better a person's credit is, the more attractive they may be to potential lenders.

How does credit repair actually work?

Credit repair works by reviewing credit reports for errors, disputing inaccuracies with credit bureaus, negotiating with creditors to remove negative items, providing guidance on building good credit habits, and monitoring progress over time. It's about correcting mistakes and improving your credit score.

What is the 15-3 rule for credit score?

What Is the 15/3 Rule? The 15/3 rule or hack has a few variations, but the basic premise is that you can improve your credit scores by making two credit card payments each month. The credit card hack gets its name because you're told to: Make a credit card payment 15 days before the bill's due date.

How can I start rebuilding my credit?

You can build credit by using your credit card and paying on time, every time. Pay off your balances in full each month to avoid paying finance charges. Paying off your balance each month can also build better credit than carrying a balance, because it helps keep you from getting too close to your credit limit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Credit_Repair_Manual[1]?

The Credit Repair Manual is a document or guide that outlines the processes, laws, and strategies involved in improving an individual's credit score and addressing inaccuracies on their credit report.

Who is required to file Credit_Repair_Manual[1]?

Individuals who are seeking to improve their credit score, particularly those who have negative items on their credit report that they believe are inaccurate or unjust, are encouraged to utilize the Credit Repair Manual.

How to fill out Credit_Repair_Manual[1]?

To fill out the Credit Repair Manual, individuals should gather their credit reports, identify errors or negative information, document details of any disputes, and follow the outlined procedures for correction and follow-up as prescribed in the manual.

What is the purpose of Credit_Repair_Manual[1]?

The purpose of the Credit Repair Manual is to provide individuals with a structured approach to dispute incorrect information on their credit reports and to educate them on rebuilding their credit history.

What information must be reported on Credit_Repair_Manual[1]?

The Credit Repair Manual must report details such as personal identification information, summary of credit history, specific inaccuracies being disputed, communications with credit bureaus, and outcomes of disputes or actions taken.

Fill out your credit_repair_manual1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit_Repair_Manual1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.