Get the free PDFb2008b Q2 13597400353958pdf - TV Station Profiles amp Public bb

Show details

FCC Form 398 Children's Television Programming Report Page 1 of 11 Federal Communications Commission Washington, DC 20554 Approved by OMB 30600754 FCC 398 Children's Television Programming Report

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your pdfb2008b q2 13597400353958pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdfb2008b q2 13597400353958pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pdfb2008b q2 13597400353958pdf online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pdfb2008b q2 13597400353958pdf. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

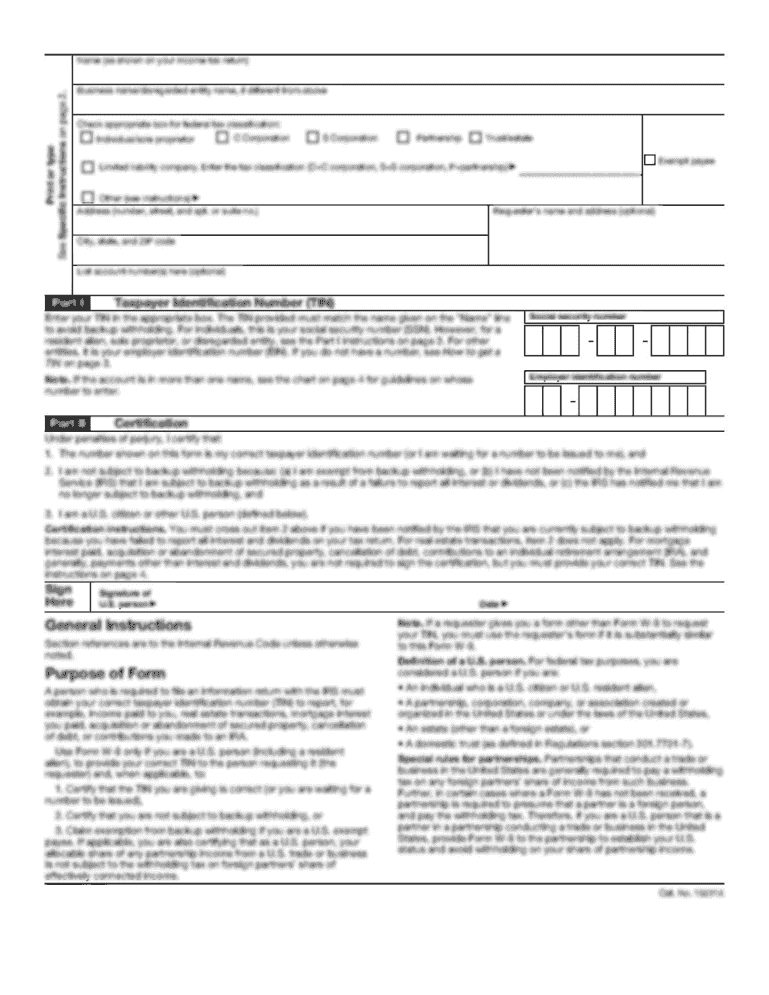

How to fill out pdfb2008b q2 13597400353958pdf

How to fill out pdfb2008b q2 13597400353958pdf:

01

Start by opening the PDF file on your computer or mobile device.

02

Carefully read the instructions provided in the form before proceeding.

03

Locate the first field or section that you need to fill out. This could be a text box, checkbox, or dropdown menu.

04

Click or tap on the field to activate it and enter the requested information. Make sure to type in the correct details accurately.

05

If you encounter any additional sections or fields, repeat step 4 until all required information is filled out.

06

Double-check your entries for any errors or missing information. It's essential to ensure the accuracy and completeness of the form.

07

Once you have filled out all the necessary sections, review the entire document to verify the accuracy of all your inputs.

08

Save the filled-out form to your device or print a hard copy if needed.

Who needs pdfb2008b q2 13597400353958pdf:

01

Individuals filing taxes: The pdfb2008b q2 13597400353958pdf form may be required for people who need to report their income and expenses for a specific period to the relevant tax authority.

02

Employers and business owners: Companies and employers might need to fill out this form to disclose financial information, employee salaries, or other business-related details.

03

Government agencies: Certain government agencies may utilize pdfb2008b q2 13597400353958pdf for data collection or regulatory purposes.

04

Financial institutions: Banks, credit unions, or other financial institutions may require this form to gather necessary information about their customers or clients.

05

Contractors and freelancers: Independent contractors or freelancers who need to report their income and expenses to clients or tax authorities might need this form.

Note: The specific circumstances or requirements for using pdfb2008b q2 13597400353958pdf may vary. It is advisable to consult the relevant authority or professional for accurate guidance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

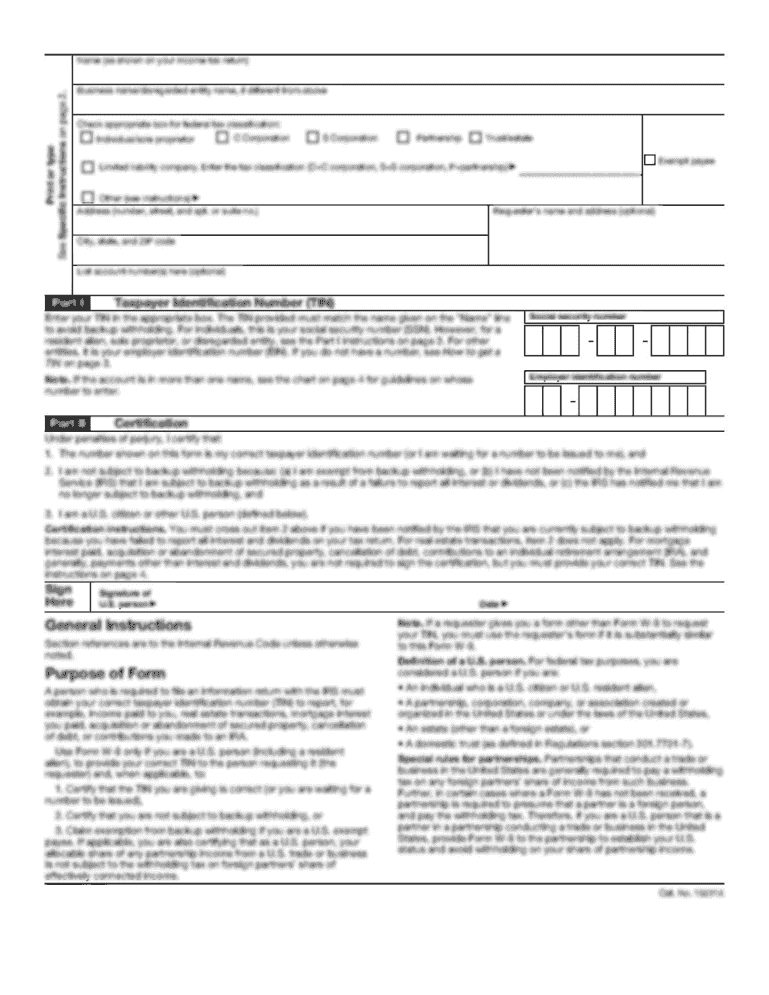

What is pdfb2008b q2 13597400353958pdf?

pdfb2008b q2 13597400353958pdf is a tax form used for reporting certain financial information.

Who is required to file pdfb2008b q2 13597400353958pdf?

Individuals or entities meeting specific criteria set by the tax authorities are required to file pdfb2008b q2 13597400353958pdf.

How to fill out pdfb2008b q2 13597400353958pdf?

pdfb2008b q2 13597400353958pdf can be filled out manually or electronically depending on the preference of the filer.

What is the purpose of pdfb2008b q2 13597400353958pdf?

The purpose of pdfb2008b q2 13597400353958pdf is to report relevant financial information to the tax authorities.

What information must be reported on pdfb2008b q2 13597400353958pdf?

pdfb2008b q2 13597400353958pdf requires reporting of income, expenses, and other financial details as mandated by the tax laws.

When is the deadline to file pdfb2008b q2 13597400353958pdf in 2024?

The deadline to file pdfb2008b q2 13597400353958pdf in 2024 is usually determined by the tax authorities and may vary based on the jurisdiction.

What is the penalty for the late filing of pdfb2008b q2 13597400353958pdf?

The penalty for the late filing of pdfb2008b q2 13597400353958pdf may include fines or interest charges imposed by the tax authorities.

How do I fill out the pdfb2008b q2 13597400353958pdf form on my smartphone?

Use the pdfFiller mobile app to complete and sign pdfb2008b q2 13597400353958pdf on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How can I fill out pdfb2008b q2 13597400353958pdf on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your pdfb2008b q2 13597400353958pdf. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit pdfb2008b q2 13597400353958pdf on an Android device?

You can make any changes to PDF files, like pdfb2008b q2 13597400353958pdf, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your pdfb2008b q2 13597400353958pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.