Get the free E-2201RC 01 cs3

Show details

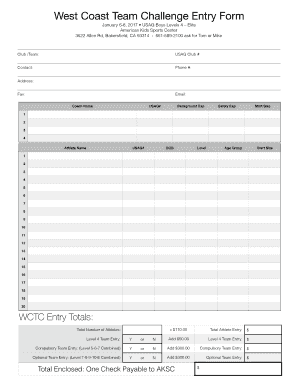

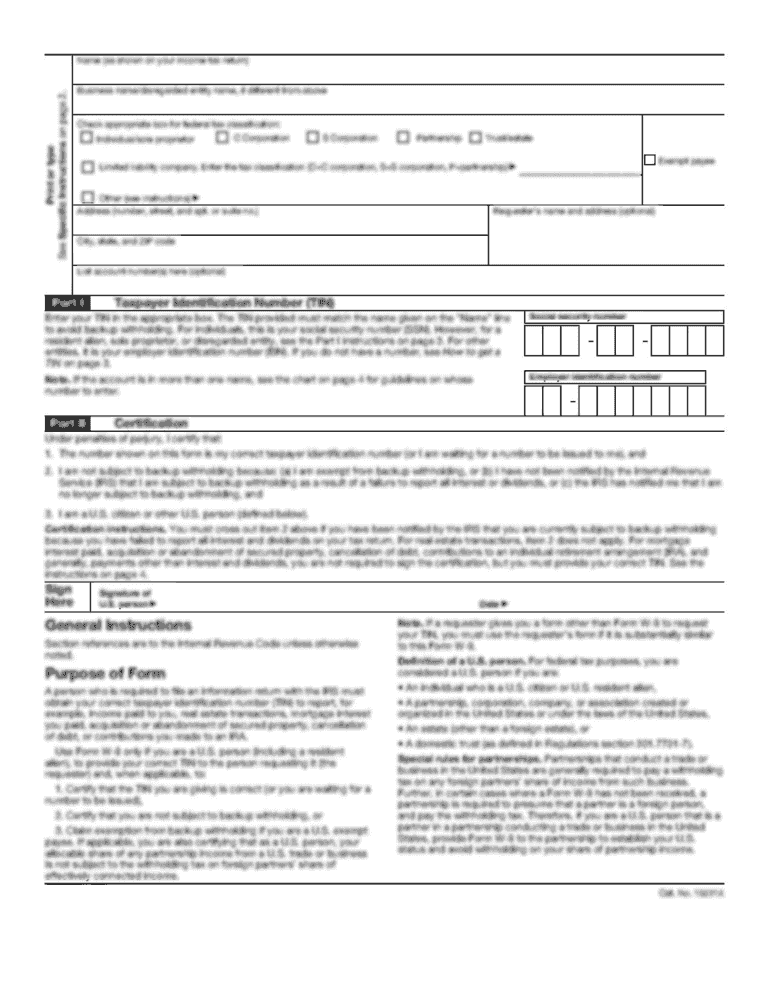

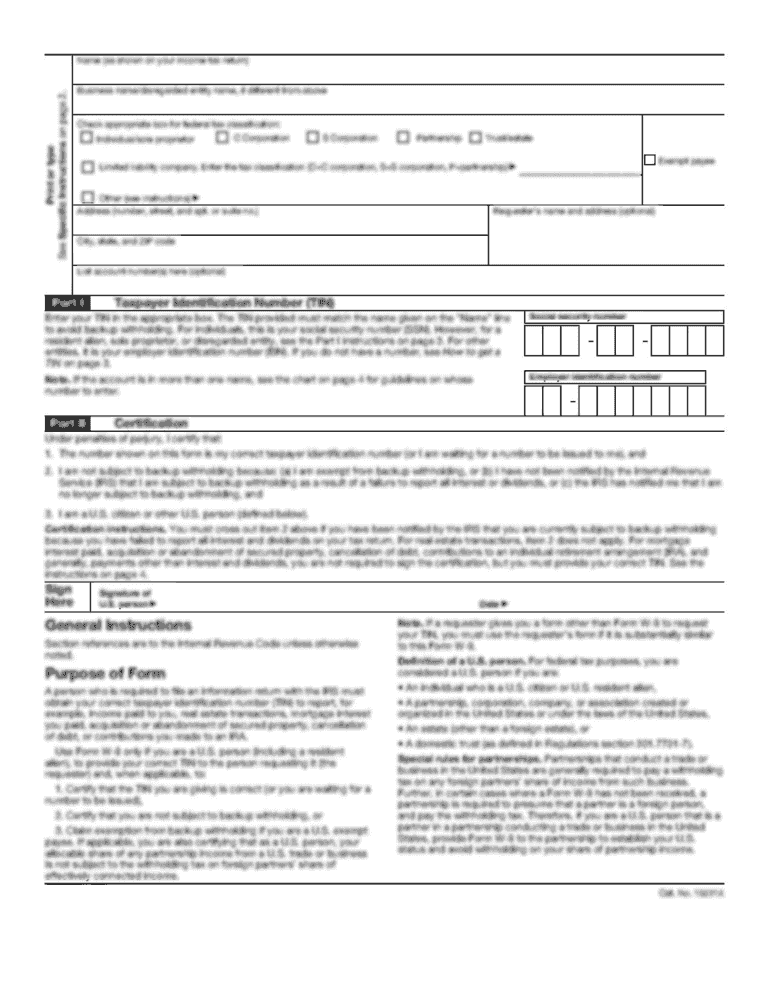

1/3 Technical data sheet 1/4/2013 1304130401 ID: 40VM22010 Features Printing materials for UV curable ink jet printers Transparent polyester film It is suitable for window display applications. It

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your e-2201rc 01 cs3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your e-2201rc 01 cs3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit e-2201rc 01 cs3 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit e-2201rc 01 cs3. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

How to fill out e-2201rc 01 cs3

How to fill out e-2201rc 01 cs3:

01

Start by gathering all the necessary information and documents required to complete the form. This may include personal information such as your name, address, and contact details, as well as any relevant identification numbers or tax information.

02

Carefully read the instructions provided with the form to ensure you understand the purpose and requirements of e-2201rc 01 cs3. This will help you accurately fill out the form and avoid any mistakes or confusion.

03

Begin by providing your personal details in the designated sections of the form. Make sure to double-check for accuracy to avoid any errors.

04

If the form requires any additional information or attachments, ensure that you have included them as instructed. This could include supporting documentation or written explanations for certain sections.

05

Review the completed form for any mistakes or missing information. It is important to ensure that all fields are properly filled out and all required information has been provided.

06

Once you are satisfied with the accuracy and completeness of the form, sign and date it as required.

07

Submit the filled-out form as instructed, either by mail, in person, or electronically, depending on the submission options provided.

Who needs e-2201rc 01 cs3:

01

Individuals who are required to report certain tax information to the relevant authority may need to fill out e-2201rc 01 cs3. This could include self-employed individuals, business owners, or any taxpayer who is obligated to provide specific details as per the tax regulations.

02

Additionally, e-2201rc 01 cs3 might be required for individuals who are claiming certain deductions, credits, or exemptions on their tax returns.

03

The need for e-2201rc 01 cs3 may vary depending on the jurisdiction and specific tax laws applicable to each individual taxpayer. It is always recommended to consult with a tax professional or refer to the relevant tax guidelines to determine whether this form is applicable in your situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is e-2201rc 01 cs3?

e-2201rc 01 cs3 is a specific form or document used for tax reporting purposes.

Who is required to file e-2201rc 01 cs3?

Individuals or entities meeting certain criteria set by the tax authorities are required to file e-2201rc 01 cs3.

How to fill out e-2201rc 01 cs3?

To fill out e-2201rc 01 cs3, you need to provide accurate and complete information as requested on the form.

What is the purpose of e-2201rc 01 cs3?

The purpose of e-2201rc 01 cs3 is to report specific tax-related information to the authorities.

What information must be reported on e-2201rc 01 cs3?

Information such as income, expenses, deductions, and credits may need to be reported on e-2201rc 01 cs3.

When is the deadline to file e-2201rc 01 cs3 in 2024?

The deadline to file e-2201rc 01 cs3 in 2024 is usually determined by the tax authorities and may vary depending on the jurisdiction.

What is the penalty for the late filing of e-2201rc 01 cs3?

The penalty for the late filing of e-2201rc 01 cs3 may include fines or interest charges imposed by the tax authorities.

How can I manage my e-2201rc 01 cs3 directly from Gmail?

e-2201rc 01 cs3 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get e-2201rc 01 cs3?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific e-2201rc 01 cs3 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete e-2201rc 01 cs3 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your e-2201rc 01 cs3 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your e-2201rc 01 cs3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.