Get the free Administrators of Small APRA Funds (SAFs): 2006 Annual Return - apra gov

Show details

6 October 2006

Dear Trustee/ Administrator

APA ANNUAL RETURNS

APA’s records indicate that you are the trustee or administrator of a superannuation

entity that is due to submit the 2006 annual superannuation

We are not affiliated with any brand or entity on this form

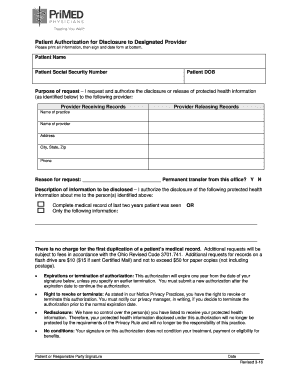

Get, Create, Make and Sign

Edit your administrators of small apra form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your administrators of small apra form via URL. You can also download, print, or export forms to your preferred cloud storage service.

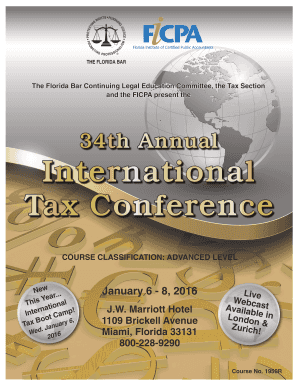

How to edit administrators of small apra online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit administrators of small apra. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

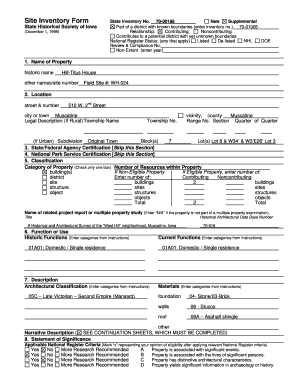

What is administrators of small apra?

Administrators of small apra refers to a regulatory filing that must be submitted by small APRA-regulated entities to the relevant regulatory authority. It is a reporting requirement that aims to gather information about the operations and financials of these entities.

Who is required to file administrators of small apra?

Small APRA-regulated entities are required to file administrators of small apra. These entities are typically non-bank financial institutions, such as insurance companies and superannuation funds, that are regulated by the Australian Prudential Regulation Authority (APRA).

How to fill out administrators of small apra?

The process to fill out administrators of small apra may vary depending on the specific requirements of the regulatory authority. Generally, it involves gathering relevant financial and operational data of the entity, completing the provided reporting forms, and submitting them electronically or through specified channels determined by APRA.

What is the purpose of administrators of small apra?

The purpose of administrators of small apra is to enable regulatory authorities, such as APRA, to monitor and assess the financial stability, risk exposures, and compliance of small APRA-regulated entities. This helps ensure the soundness of the financial system and protects the interests of consumers and stakeholders.

What information must be reported on administrators of small apra?

The specific information that must be reported on administrators of small apra may vary, but it commonly includes financial statements, risk management practices, capital adequacy, liquidity positions, business operations, and other relevant data that provide insights into the entity's financial soundness and compliance with regulatory requirements.

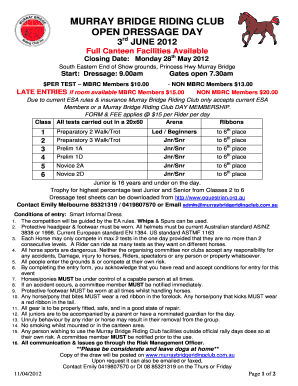

When is the deadline to file administrators of small apra in 2023?

The deadline to file administrators of small apra in 2023 may depend on the specific jurisdiction and regulatory requirements. It is recommended to refer to the official guidelines and announcements from the regulatory authority, such as APRA, for the accurate deadline information.

What is the penalty for the late filing of administrators of small apra?

The penalties for the late filing of administrators of small apra may be determined by the regulatory authority, such as APRA, and can vary depending on the severity and frequency of non-compliance. Common penalties may include monetary fines, sanctions, reputational damage, or increased regulatory scrutiny on the entity's operations.

How can I edit administrators of small apra from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your administrators of small apra into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Where do I find administrators of small apra?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific administrators of small apra and other forms. Find the template you want and tweak it with powerful editing tools.

How do I fill out administrators of small apra using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign administrators of small apra. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Fill out your administrators of small apra online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.