AU Form 17 - Queensland 2007-2024 free printable template

Show details

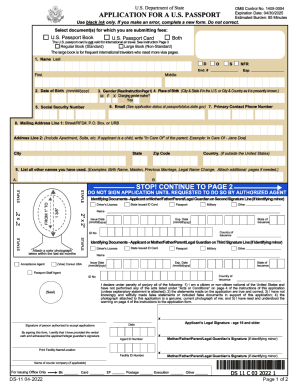

QUEENSLAND LAND REGISTRY Land Title Act 1994 and Land Act 1994 REQUEST TO DISPENSE WITH PRODUCTION OF INSTRUMENT / DOCUMENT FORM 17 Version 4 Page 1 of Lodger Name address E-mail phone number Dealing Number OFFICE USE ONLY Lodger Code Privacy Statement Collection of this information is authorised by the Land Title Act 1994 and the Land Act 1994 and is used to maintain the publicly searchable registers in the land registry and the water register. For more information about privacy in DNRM see...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your australia queensland document form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your australia queensland document form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing australia queensland document online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit land registry form 17. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

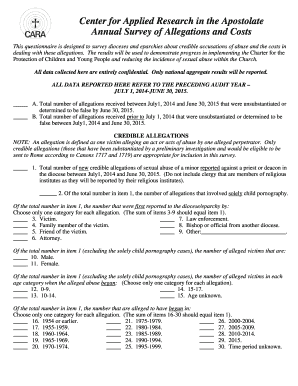

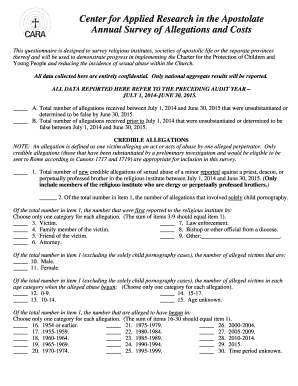

How to fill out australia queensland document form

How to fill out form 17 printable?

01

Start by gathering all the necessary information and documentation required to complete form 17. This may include personal details, such as name and contact information, as well as any relevant financial information.

02

Carefully read through the instructions provided with the form to ensure you understand the purpose and requirements of form 17.

03

Begin filling out the form by entering your personal information in the designated fields. This may include your full name, address, social security number, and other relevant details.

04

Proceed to the financial section of the form, where you will need to provide information about your income, assets, and liabilities. Be sure to carefully review and accurately enter all the necessary details to avoid any errors.

05

If applicable, answer any additional questions or provide supplementary information as requested on the form. This may include details about dependents, tax deductions, or any other relevant information required.

06

Double-check all the information you have provided to ensure accuracy and completeness. Pay special attention to numbers, names, and any other crucial details.

07

Sign and date the form where indicated, as failing to do so may invalidate your submission.

08

Make a copy of the completed form for your records before submitting it. If necessary, consult with a tax professional or advisor before submitting the form to ensure its accuracy.

Who needs form 17 printable?

01

Individuals who are required to file their taxes and have certain types of income or financial situations may need to use form 17 printable.

02

Businesses or self-employed individuals who need to report their income and financial details to the relevant authorities may also require form 17 printable.

03

Form 17 printable may also be necessary for individuals who have experienced specific life events, such as the birth of a child, marriage, divorce, or the purchase or sale of property, which may impact their tax obligations.

Note: While the above information provides a general overview of how to fill out form 17 printable and who may require it, it is always recommended to consult with a tax professional or advisor to ensure compliance with the latest regulations and guidelines.

Fill form 17 pdf download : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file form 17 printable?

Form 17 printable is required to be filed by all employers who are subject to the Florida Corporate Income/Franchise Tax. This includes C-Corporations, S-Corporations, LLCs, and other entities.

How to fill out form 17 printable?

1. Open the form 17 printable document.

2. Fill in the required information such as your name, address, and contact information.

3. Provide the details of the property you are transferring.

4. Enter the name of the person or entity you are transferring the property to.

5. Enter the details of the transaction and the amount you are transferring.

6. Provide the details of any restrictions or conditions attached to the transfer.

7. Sign and date the document.

8. Have the document witnessed and notarized if required.

9. Make two copies of the document and keep them in a safe place.

What is the purpose of form 17 printable?

Form 17 printable is a form used by the Internal Revenue Service (IRS) to report federal income tax withheld from an employee's wages. It is typically used when filing an annual income tax return. It is also used when making estimated tax payments.

What is form 17 printable?

Form 17 is a legal document that is typically used in real estate transactions. In the United States, it is known as the "Seller's Property Disclosure Statement" or "Seller's Disclosure." This form is filled out by sellers and includes details about the condition of the property, any known defects, renovations, or potential hazards. Its purpose is to inform potential buyers about the property's condition.

As for the term "printable," it suggests that Form 17 can be printed out and filled in manually, allowing sellers to provide the required disclosure information. However, it is important to note that real estate laws and forms can vary from state to state, so the specifics of Form 17 may differ depending on the location. It is recommended to consult with a local real estate professional or attorney to ensure compliance with relevant laws and regulations.

What information must be reported on form 17 printable?

Form 17 is a form used to report the sales of securities to the U.S. Securities and Exchange Commission (SEC). The specific information that must be reported on Form 17 includes:

1. Title and class of the security being sold.

2. Type of transaction (e.g., sale, gift, inheritance).

3. Date of transaction.

4. Name of the company whose securities are being sold.

5. Number of securities sold.

6. Price at which the securities were sold.

7. Whether the securities were sold on an exchange or in a private transaction.

8. Name and address of the person or entity selling the securities.

9. Relationship between the seller and the company (e.g., director, officer, affiliate).

10. Purpose of the sale (e.g., to raise funds, diversify investment portfolio).

11. Any additional information required by the SEC.

It is important to note that the specific requirements and instructions for filling out Form 17 may vary depending on the filing jurisdiction and the specific circumstances of the transaction. It is advisable to consult with a legal or financial professional familiar with SEC reporting requirements for accurate and complete reporting.

What is the penalty for the late filing of form 17 printable?

Form 17 is used to report changes in company details or addresses in the UK. If the form is submitted late, the penalty depends on the length of delay. Here are the current penalties for late filing of Form 17:

- Up to one month late: There is usually no penalty for late filing within this timeframe. However, it is still recommended to submit the form as soon as possible.

- One to three months late: A fixed penalty of £150 is usually imposed.

- Three to six months late: An increased fixed penalty of £375 is usually imposed.

- Six months or more late: The penalty increases further to £750, and it is also possible for the company's directors to be prosecuted for the late filing.

These penalties are subject to change, so it is advised to check the official websites or consult with professionals to get accurate and up-to-date information regarding penalties for late filing of Form 17.

How can I send australia queensland document for eSignature?

When you're ready to share your land registry form 17, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I sign the form 17 download electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your form 17 example in seconds.

How do I fill out the how to fill in form 17 land registry form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign form 17 printable and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your australia queensland document form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 17 Download is not the form you're looking for?Search for another form here.

Keywords relevant to form 17 land registry

Related to form 17

If you believe that this page should be taken down, please follow our DMCA take down process

here

.