Get the free W Get the freeir Eyes On Your Brand NOA Partners in - nebraska aoa

Show details

NEW Sessions Unfocus Mini Get Their Eyes On Your Brand Mobile App Your company has the opportunity to engage Convention attendees in a 20minute presentation in the Unfocus seminar area in the middle

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your w ir eyes on form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w ir eyes on form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing w ir eyes on online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit w ir eyes on. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

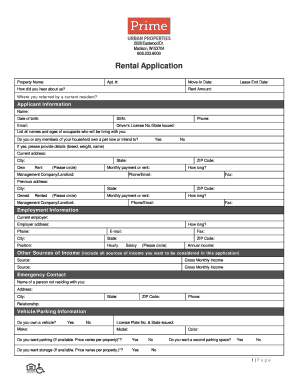

How to fill out w ir eyes on

01

To fill out w ir eyes on, start by gathering all the necessary information and documents pertaining to the subject. This may include personal details, identification numbers, financial statements, and any additional supporting materials.

02

Next, carefully read through the instructions provided on the w ir eyes on form. Make sure you understand each section and what information is required.

03

Begin filling out the form by entering your personal information accurately. This may include your name, address, social security number, and contact details. Double-check for any errors or missing information before proceeding.

04

Move on to the specific sections of the form that require you to provide details related to your income or expenses. This could involve reporting wages, dividends, interest, deductions, or credits. Refer to your financial records or consult with a tax professional if needed to ensure accurate reporting.

05

If the form requires any supplementary explanations or additional documentation, make sure to provide them as requested. This may be necessary for certain deductions or special circumstances.

06

Once you have completed all the necessary sections of the form, carefully review your entries for accuracy and completeness. Any mistakes or omissions could lead to delays or potential penalties.

07

If you are unsure about any specific section or question on the form, it's advisable to seek guidance from a tax expert or contact the relevant tax authority for clarification.

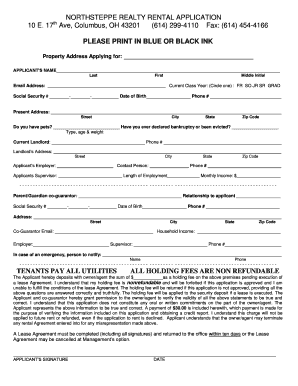

Who needs w ir eyes on?

01

Individuals who earn income from various sources such as employment, investments, or self-employment may need to fill out the w ir eyes on form. It helps determine the amount of taxes owed or the refund due to the taxpayer.

02

Small business owners or self-employed individuals who have to report their income and deductions to the tax authorities may also require the w ir eyes on form.

03

Individuals who have received income from rental properties, royalties, or foreign investments may need to fill out this form to accurately report their earnings.

04

Those who qualify for specific tax credits or deductions, such as the earned income tax credit or education-related deductions, may be required to provide the necessary information on the w ir eyes on form.

05

Married couples who choose to file jointly, as well as individuals with dependents, may also need to fill out the w ir eyes on form to ensure accurate reporting of their tax situation.

Remember, it is always recommended to seek professional advice or consult the IRS guidelines when in doubt about your tax obligations or how to properly fill out the w ir eyes on form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is w ir eyes on?

W ir eyes on is a form used to report certain financial accounts or foreign assets.

Who is required to file w ir eyes on?

US citizens, resident aliens, and certain non-resident aliens who have foreign financial accounts must file w ir eyes on.

How to fill out w ir eyes on?

W ir eyes on can be filled out online through the Financial Crimes Enforcement Network (FinCEN) website.

What is the purpose of w ir eyes on?

The purpose of w ir eyes on is to help prevent tax evasion by individuals with foreign accounts.

What information must be reported on w ir eyes on?

Information such as the account holder's name, account number, and maximum value of the account during the reporting period must be reported on w ir eyes on.

When is the deadline to file w ir eyes on in 2024?

The deadline to file w ir eyes on in 2024 is April 15th.

What is the penalty for the late filing of w ir eyes on?

The penalty for the late filing of w ir eyes on can be up to $10,000 per violation.

Where do I find w ir eyes on?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the w ir eyes on in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete w ir eyes on online?

With pdfFiller, you may easily complete and sign w ir eyes on online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit w ir eyes on online?

With pdfFiller, it's easy to make changes. Open your w ir eyes on in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Fill out your w ir eyes on online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.